QUOTE(contestchris @ Jan 31 2024, 07:54 PM)

Tq for your reply, means will have buy below 50k right?Can buy a few lots of say 30k each?

Sorry new to buying bonds from FSM, usually buy from bank with higher fees

Bond kaki lai, DRB HICOM bond coming

|

|

Jan 31 2024, 09:10 PM Jan 31 2024, 09:10 PM

Show posts by this member only | IPv6 | Post

#161

|

Junior Member

649 posts Joined: Jan 2003 From: KL |

|

|

|

|

|

|

Jan 31 2024, 09:13 PM Jan 31 2024, 09:13 PM

Show posts by this member only | IPv6 | Post

#162

|

Senior Member

5,581 posts Joined: Aug 2011 |

QUOTE(hedfi @ Jan 31 2024, 09:10 PM) Tq for your reply, means will have buy below 50k right? I believe you can buy as much as there's available for sale.Can buy a few lots of say 30k each? Sorry new to buying bonds from FSM, usually buy from bank with higher fees hedfi liked this post

|

|

|

Feb 1 2024, 10:04 PM Feb 1 2024, 10:04 PM

Show posts by this member only | IPv6 | Post

#163

|

Senior Member

5,924 posts Joined: Sep 2009 |

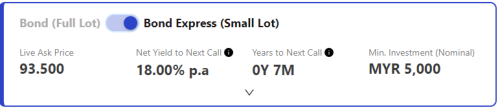

QUOTE(contestchris @ Jan 31 2024, 01:25 PM)  If anybody got bullets, go get this! Mispriced bonds with attractive risk-reward profile. Recently Tropicana has disposed of two investment assets, highly likely these will be redeemed at the call date in Sep 2024. Attached thumbnail(s)

nexona88 liked this post

|

|

|

Feb 1 2024, 10:26 PM Feb 1 2024, 10:26 PM

Show posts by this member only | IPv6 | Post

#164

|

Senior Member

5,581 posts Joined: Aug 2011 |

|

|

|

Feb 7 2024, 09:30 PM Feb 7 2024, 09:30 PM

Show posts by this member only | IPv6 | Post

#165

|

Senior Member

5,924 posts Joined: Sep 2009 |

|

|

|

Feb 8 2024, 09:28 AM Feb 8 2024, 09:28 AM

Show posts by this member only | IPv6 | Post

#166

|

Junior Member

895 posts Joined: Aug 2007 |

QUOTE(guy3288 @ Feb 7 2024, 09:30 PM) Wow 17% yield... did I read correctly? And it show 7m to next call... what does that mean and maturity date is perpetual? Not familiar with FSM BTW what the difference between bondsupermart and fsmone? They just platform to trade bonds? This post has been edited by gamenoob: Feb 8 2024, 09:39 AM |

|

|

|

|

|

Feb 13 2024, 04:26 PM Feb 13 2024, 04:26 PM

Show posts by this member only | IPv6 | Post

#167

|

Senior Member

8,510 posts Joined: Dec 2004 From: KayEL |

|

|

|

Feb 13 2024, 04:29 PM Feb 13 2024, 04:29 PM

Show posts by this member only | IPv6 | Post

#168

|

Senior Member

8,510 posts Joined: Dec 2004 From: KayEL |

|

|

|

Feb 13 2024, 07:07 PM Feb 13 2024, 07:07 PM

Show posts by this member only | IPv6 | Post

#169

|

Senior Member

3,684 posts Joined: Apr 2019 |

QUOTE(zamans98 @ Feb 13 2024, 04:29 PM) I think you meant bond price going downhill....Market is pricing increased risk on the bonds. On the callability I guess. zamans98 liked this post

|

|

|

Feb 13 2024, 10:20 PM Feb 13 2024, 10:20 PM

Show posts by this member only | IPv6 | Post

#170

|

Senior Member

5,581 posts Joined: Aug 2011 |

QUOTE(Wedchar2912 @ Feb 13 2024, 07:07 PM) I think you meant bond price going downhill.... Nah, it's FSM manipulating the Bond Express prices. It's a very opaque system. I might write in an official complaint to SC about this. Although it doesn't really impact me since I'll hold to whenever it is called.Market is pricing increased risk on the bonds. On the callability I guess. The yields on the real market have somewhat stablised and even recovered. |

|

|

Feb 13 2024, 10:26 PM Feb 13 2024, 10:26 PM

|

Senior Member

3,684 posts Joined: Apr 2019 |

QUOTE(contestchris @ Feb 13 2024, 10:20 PM) Nah, it's FSM manipulating the Bond Express prices. It's a very opaque system. I might write in an official complaint to SC about this. Although it doesn't really impact me since I'll hold to whenever it is called. well, the only way to test whether the price is being manipulated (assuming too cheap) is to hit the price and see if they honor the deal. that's how price discovery work.The yields on the real market have somewhat stablised and even recovered. edit: btw, i don't mean to ask you buy more of the bond. that's not my intention. i am just describing the standard method to check if the price is real. This post has been edited by Wedchar2912: Feb 13 2024, 10:41 PM |

|

|

Feb 13 2024, 11:37 PM Feb 13 2024, 11:37 PM

Show posts by this member only | IPv6 | Post

#172

|

Senior Member

5,581 posts Joined: Aug 2011 |

QUOTE(Wedchar2912 @ Feb 13 2024, 10:26 PM) well, the only way to test whether the price is being manipulated (assuming too cheap) is to hit the price and see if they honor the deal. that's how price discovery work. As you can see, there are no bonds for sale at 93.5. edit: btw, i don't mean to ask you buy more of the bond. that's not my intention. i am just describing the standard method to check if the price is real. They are offering to buy 50k nominal at 92.0. Which is an absurd low price, and despite that, some who are desperate for cash flow still sell out. When they have inventory, they buy at 92.0 and sell at 93.5. So they're making easy money. But, the price is not reflective of the actual market valuation. They're profiting from the trading fees, platform fees, AND the bid-ask spread. Actual transaction: https://www.bixmalaysia.com/security-info-p...nformation-tab6 As you can see, other than the two trades at 91.0 on 29th Jan 2024, trades have been stable at around 96.0 - 98.0. I have a hunch that it is even possible that the 91.0 trades were purchased by FSM on the open market, hence they had quite a bit of inventory to sell at 93.5 over the past couple of weeks on Bond Express. The Bond Express platform should be like a stock exchange, allow market participants to bid the price, rather than FSM setting the prices via some opaque mechanism. This post has been edited by contestchris: Feb 13 2024, 11:39 PM boyboycute liked this post

|

|

|

Feb 13 2024, 11:46 PM Feb 13 2024, 11:46 PM

Show posts by this member only | IPv6 | Post

#173

|

Senior Member

5,924 posts Joined: Sep 2009 |

QUOTE(gamenoob @ Feb 8 2024, 09:28 AM) Wow 17% yield... did I read correctly? yes you would get 17% yield if call back done in sept, tropicana pay you rm100 And it show 7m to next call... what does that mean and maturity date is perpetual? Not familiar with FSM BTW what the difference between bondsupermart and fsmone? They just platform to trade bonds? when you bought only rm93.50 untung buta rm3250 per 50000 plus 2 dividends 7% of RM50000 PAR value = RM1750 x 2 if Tropicana dont call back in Sep 2024, no money or whatever..., never mind just continue pay me dividend at step up rate 9% so subsequently dividend = 9% x RM50k = RM2250 x2 a year QUOTE(zamans98 @ Feb 13 2024, 04:26 PM) when you buy bond 1st criteria is you have no cash flow problem, ie you dont need that money. this is perpetual bond bro. QUOTE(zamans98 @ Feb 13 2024, 04:29 PM) Yeah i can see you were looking at the lower yield there on the left, 5.95% and 4.9%that is becos you buy at price RM100.6 or 101.2 If you managed to buy cheaper at RM92, see right, yield is even higher 21%, 18%.. so is a case of you buy at high prices not a case of yield going down hill QUOTE(Wedchar2912 @ Feb 13 2024, 07:07 PM) I think you meant bond price going downhill.... Tropicana was tight in cash, so there is fear it may not have enough cash to call back.Market is pricing increased risk on the bonds. On the callability I guess. the question is Tropicana dare or not to let down its very first tranche of bond? with so many subsequent bonds queing up behind.. QUOTE(Wedchar2912 @ Feb 13 2024, 10:26 PM) well, the only way to test whether the price is being manipulated (assuming too cheap) is to hit the price and see if they honor the deal. that's how price discovery work. to me is demand- supplyedit: btw, i don't mean to ask you buy more of the bond. that's not my intention. i am just describing the standard method to check if the price is real. what you see is what you get. if it shows RM102 and the actual amount you have to pay.. and you go click buy, there is nothing to prove there other than buying at high prices the low prices odd lots no stock and you go buy full lot units prices . Attached thumbnail(s)

|

|

|

|

|

|

Feb 14 2024, 12:08 AM Feb 14 2024, 12:08 AM

|

Senior Member

3,684 posts Joined: Apr 2019 |

QUOTE(contestchris @ Feb 13 2024, 11:37 PM) As you can see, there are no bonds for sale at 93.5. This is what illiquidity means, and that bonds are traded in the OTC market. As much as Bond Express is trying to make itself like a exchange, it is not. It is just a platform. The other "platform" the retail banks and buy via your fav RM. They are offering to buy 50k nominal at 92.0. Which is an absurd low price, and despite that, some who are desperate for cash flow still sell out. When they have inventory, they buy at 92.0 and sell at 93.5. So they're making easy money. But, the price is not reflective of the actual market valuation. They're profiting from the trading fees, platform fees, AND the bid-ask spread. Actual transaction: https://www.bixmalaysia.com/security-info-p...nformation-tab6 As you can see, other than the two trades at 91.0 on 29th Jan 2024, trades have been stable at around 96.0 - 98.0. I have a hunch that it is even possible that the 91.0 trades were purchased by FSM on the open market, hence they had quite a bit of inventory to sell at 93.5 over the past couple of weeks on Bond Express. The Bond Express platform should be like a stock exchange, allow market participants to bid the price, rather than FSM setting the prices via some opaque mechanism. Prices presented as 92.0/93.5 is the bid/offer price on the platform. No transactions at these levels indicate illiquidity, and in some sense, is the market price on this platform. If a investor feel it is good value, then he should just hit the 93.5 price and get his bond. In fact, if this investor have enough money and risk appetite, he can keep on buying the bonds until FSM platform runs out or until the price shifts higher. Conversely, if a existing investor is desperate and willing to sell his bonds at 92, he should just throw. The other part is a market structure issue, which maybe you would know. Similar to Brk-A convertible to Brk-B (and then to -C) but in reverse, would you know if the small lot size can be grouped together to form the standard lot size of 250K rm? I suspect it is not possible and hence this creates a weird dual pricing. (like you said, there were transaction of 250K rm at 91, which suggested someone can break the standard lot to small lot and try to earn the 2 bucks. It is just a guess and no way to find out except to ask some insider in FSM). Nonetheless, looking the transactions, even the full lots are traded below par, with 6 months away for the callability. Investors are not fully convinced that the issuer will call back the bonds. I also think this bond don't have cumulative deferral feature. Just my guess. This post has been edited by Wedchar2912: Feb 14 2024, 12:19 AM guy3288 liked this post

|

|

|

Feb 14 2024, 12:12 AM Feb 14 2024, 12:12 AM

|

Senior Member

3,684 posts Joined: Apr 2019 |

QUOTE(guy3288 @ Feb 13 2024, 11:46 PM) .... what you see is what you get. if it shows RM102 and the actual amount you have to pay.. and you go click buy, there is nothing to prove there other than buying at high prices the low prices odd lots no stock and you go buy full lot units prices . |

|

|

Feb 14 2024, 12:20 AM Feb 14 2024, 12:20 AM

Show posts by this member only | IPv6 | Post

#176

|

Senior Member

5,581 posts Joined: Aug 2011 |

QUOTE(Wedchar2912 @ Feb 14 2024, 12:08 AM) This is what illiquidity means, and that bonds are traded in the OTC market. As much as Bond Express is trying to make itself like a exchange, it is not. It is just a platform. The other "platform" the retail banks and buy via your fav RM. There is NO WAY for you to buy at 93.50 at the moment. FSM is not selling at that price. Prices presented as 92.0/93.5 is the bid/offer price on the platform. No transactions at these levels indicate illiquidity, and in some sense, is the market price on this platform. If a investor feel it is good value, then he should just hit the 93.5 price and get his bond. In fact, if this investor have enough money and risk appetite, he can keep on buying the bonds until FSM platform runs out or until the price shifts higher. Conversely, if a existing investor is desperate and willing to sell his bonds at 92, he should just throw. The other part is a market structure issue, which maybe you would know. Similar to Brk-A convertible to Brk-B (and then to -C) but in reverse, would you know if the small lot size can be grouped together to form the standard lot size of 250K rm? I suspect it is not possible and hence this creates a weird dual pricing. (like you said, there were transaction of 250K rm at 91, which suggested someone can break the standard lot to small lot and try to earn the 2 bucks. It is just a guess and no way to find out except to ask some insider in FSM). Nonetheless, looking the transactions, even the full lots are traded below par, with 6 months away for the callability. Investors are not fully convinced that the issuer will call back the bonds. I also think this bond don't have cumulative deferral feature. Just my guess. You can however sell at 92.00. Up to RM50k nominal. At the moment, FSM is only buying at 92.00 and that's why I say, there is some level of manipulation here. Wedchar2912 and guy3288 liked this post

|

|

|

Feb 14 2024, 12:24 AM Feb 14 2024, 12:24 AM

|

Senior Member

3,684 posts Joined: Apr 2019 |

QUOTE(contestchris @ Feb 14 2024, 12:20 AM) There is NO WAY for you to buy at 93.50 at the moment. FSM is not selling at that price. ah ok, then I agree with you... definitely got cause to complain to SC... cos terang terang display 93.5 as live price. that is outright lying.You can however sell at 92.00. Up to RM50k nominal. At the moment, FSM is only buying at 92.00 and that's why I say, there is some level of manipulation here.   edit: only after you mentioned, did I realize that even the website is not truthful... i thought 93.5 price is live ask price, but with zero volume... can only see the zero volume after clicking. This post has been edited by Wedchar2912: Feb 14 2024, 12:28 AM |

|

|

Feb 14 2024, 12:54 AM Feb 14 2024, 12:54 AM

Show posts by this member only | IPv6 | Post

#178

|

Senior Member

5,924 posts Joined: Sep 2009 |

QUOTE(Wedchar2912 @ Feb 14 2024, 12:08 AM) This is what illiquidity means, and that bonds are traded in the OTC market. As much as Bond Express is trying to make itself like a exchange, it is not. It is just a platform. The other "platform" the retail banks and buy via your fav RM. try to bid is a waste of time., if you want just take what is the price in asked.Prices presented as 92.0/93.5 is the bid/offer price on the platform. No transactions at these levels indicate illiquidity, and in some sense, is the market price on this platform. If a investor feel it is good value, then he should just hit the 93.5 price and get his bond. In fact, if this investor have enough money and risk appetite, he can keep on buying the bonds until FSM platform runs out or until the price shifts higher. Conversely, if a existing investor is desperate and willing to sell his bonds at 92, he should just throw. The other part is a market structure issue, which maybe you would know. Similar to Brk-A convertible to Brk-B (and then to -C) but in reverse, would you know if the small lot size can be grouped together to form the standard lot size of 250K rm? I suspect it is not possible and hence this creates a weird dual pricing. (like you said, there were transaction of 250K rm at 91, which suggested someone can break the standard lot to small lot and try to earn the 2 bucks. It is just a guess and no way to find out except to ask some insider in FSM). Nonetheless, looking the transactions, even the full lots are traded below par, with 6 months away for the callability. Investors are not fully convinced that the issuer will call back the bonds. I also think this bond don't have cumulative deferral feature. Just my guess. you got to pay first and 4 days or more later FSM will return your money.. we are at the losing end. in stock exchange you can queue yes, and you may get the cheaper prices as it is live. QUOTE(Wedchar2912 @ Feb 14 2024, 12:12 AM) contestchris was referring to the small lot prices, which is 92/93.5. the full lot prices do look normal in the sense that it is above par... Full lots also at get at below PAR., i nearly bought full lot at RM96 from CIMB RM.Buy/sell at CIMB . follow CIMB' prices Buy/sell at FSM,follow FSM's prices Example in hand is my DRB Hicom bond bought at CIMB RM 102 could could sell at RM103+ 1 week or so later same bond same time , buy at RM100.50 from FSM ,FSM would only buy back at RM101+ 1 week later i doubt there is a case for complaints there on the price differences unless the spread displayed is too much eg wanna buy RM91 wanna sell RM102. QUOTE(contestchris @ Feb 14 2024, 12:20 AM) There is NO WAY for you to buy at 93.50 at the moment. FSM is not selling at that price. FSm buy at RM92 or even lower if sell to us at RM93.50 i dont see how we can complain.You can however sell at 92.00. Up to RM50k nominal. At the moment, FSM is only buying at 92.00 and that's why I say, there is some level of manipulation here. QUOTE(Wedchar2912 @ Feb 14 2024, 12:24 AM) ah ok, then I agree with you... definitely got cause to complain to SC... cos terang terang display 93.5 as live price. that is outright lying. i dont understand the basis for complaints,at RM93.50 stocks sold out. i managed to buy 2x 50k the other day.(but this is after i called my FSM RM , since there was no stocks and he called HQ and managed to put up some 150k units in FSM, after i bought i saw balance was 50k left and left there quite few hours, but next day checkde, sold. no more left) This post has been edited by guy3288: Feb 14 2024, 12:59 AM |

|

|

Feb 14 2024, 08:38 AM Feb 14 2024, 08:38 AM

Show posts by this member only | IPv6 | Post

#179

|

Junior Member

895 posts Joined: Aug 2007 |

QUOTE(guy3288 @ Feb 13 2024, 11:46 PM) yes you would get 17% yield if call back done in sept, tropicana pay you rm100 Thanks for the learning. Interesting to see how all these works etc. Surely rewarding for you to have taken the risk for it. Will take me a while to understand all these...when you bought only rm93.50 untung buta rm3250 per 50000 plus 2 dividends 7% of RM50000 PAR value = RM1750 x 2 if Tropicana dont call back in Sep 2024, no money or whatever..., never mind just continue pay me dividend at step up rate 9% so subsequently dividend = 9% x RM50k = RM2250 x2 a year when you buy bond 1st criteria is you have no cash flow problem, ie you dont need that money. this is perpetual bond bro. Yeah i can see you were looking at the lower yield there on the left, 5.95% and 4.9% that is becos you buy at price RM100.6 or 101.2 If you managed to buy cheaper at RM92, see right, yield is even higher 21%, 18%.. so is a case of you buy at high prices not a case of yield going down hill Tropicana was tight in cash, so there is fear it may not have enough cash to call back. the question is Tropicana dare or not to let down its very first tranche of bond? with so many subsequent bonds queing up behind.. to me is demand- supply what you see is what you get. if it shows RM102 and the actual amount you have to pay.. and you go click buy, there is nothing to prove there other than buying at high prices the low prices odd lots no stock and you go buy full lot units prices . This post has been edited by gamenoob: Feb 14 2024, 08:39 AM |

|

|

Feb 15 2024, 08:34 PM Feb 15 2024, 08:34 PM

Show posts by this member only | IPv6 | Post

#180

|

Senior Member

8,510 posts Joined: Dec 2004 From: KayEL |

QUOTE(guy3288 @ Feb 14 2024, 12:54 AM) try to bid is a waste of time., if you want just take what is the price in asked. Wow, I have more to learn. Thanks sifu.you got to pay first and 4 days or more later FSM will return your money.. we are at the losing end. in stock exchange you can queue yes, and you may get the cheaper prices as it is live. Full lots also at get at below PAR., i nearly bought full lot at RM96 from CIMB RM. Buy/sell at CIMB . follow CIMB' prices Buy/sell at FSM,follow FSM's prices Example in hand is my DRB Hicom bond bought at CIMB RM 102 could could sell at RM103+ 1 week or so later same bond same time , buy at RM100.50 from FSM ,FSM would only buy back at RM101+ 1 week later i doubt there is a case for complaints there on the price differences unless the spread displayed is too much eg wanna buy RM91 wanna sell RM102. FSm buy at RM92 or even lower if sell to us at RM93.50 i dont see how we can complain. i dont understand the basis for complaints, at RM93.50 stocks sold out. i managed to buy 2x 50k the other day.(but this is after i called my FSM RM , since there was no stocks and he called HQ and managed to put up some 150k units in FSM, after i bought i saw balance was 50k left and left there quite few hours, but next day checkde, sold. no more left) |

| Change to: |  0.0297sec 0.0297sec

0.94 0.94

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 19th December 2025 - 04:54 PM |