QUOTE(cindyKL @ Aug 25 2023, 02:52 PM)

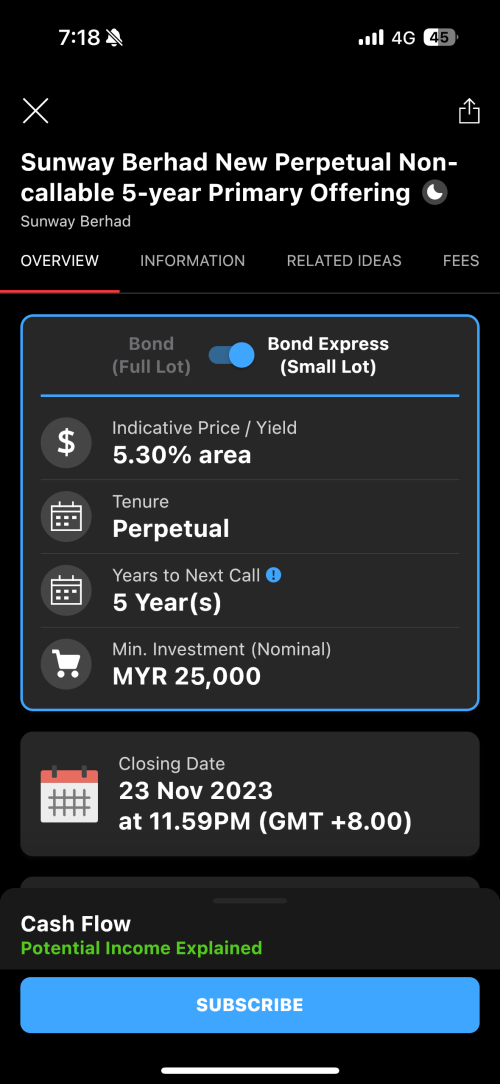

Buying from FSMOne better than but from bank? How about on fees? Processing fee 0.5%, platfrom fee 0.045% per quarter. If buy from bank got platform fee too?

FSM cheaper i paid RM251250 compared to RM255k fróm bankBank charge you once 2% fee that is all

FSM got continuous fees...multiply many yrs may be more than 2%

Buy and keep long term better from bank

Buy and sell fast better go FSM

already can make 0.6% in few days RM1500 profit

QUOTE(Wedchar2912 @ Aug 25 2023, 03:24 PM)

if you managed to get it at PAR value.... then yes of course.

Also don't know if the price indicated is a tradable price. Hopefully it is.

Also don't know if the price indicated is a tradable price. Hopefully it is.

QUOTE(hksgmy @ Aug 25 2023, 10:21 PM)

Usually there’ll be a spread as I’ve previously mentioned. No such thing as a fre lunch as far as the banks or bankers are concerned… FSM may be different though. Nevertheless I’m happy for guy3288 that he got it for a good price

i bought RM102 not cheap x3only got 1 cheap FSM RM100.50

buy high sell high

buy cheap sell cheap also

Redemption at CIMB RM103+

redemption at FSM only RM101+

kind of same amount of profit whether ´"buy high" or "buy low"

.

QUOTE(leo2010 @ Aug 25 2023, 11:40 PM)

cross-post my question from another thread ... https://forum.lowyat.net/topic/4193169/+30461

Anyone has experience buying/selling small lot bond through FSMOne Bond Express ? How's the spread vs. full lot size ?

no experienceAnyone has experience buying/selling small lot bond through FSMOne Bond Express ? How's the spread vs. full lot size ?

This post has been edited by guy3288: Aug 28 2023, 12:06 AM

Aug 28 2023, 12:04 AM

Aug 28 2023, 12:04 AM

Quote

Quote

0.0362sec

0.0362sec

0.75

0.75

6 queries

6 queries

GZIP Disabled

GZIP Disabled