is this a special deal ? 250k bond and 250k FD at 6% ?

Bond kaki lai, DRB HICOM bond coming

Bond kaki lai, DRB HICOM bond coming

|

|

Aug 10 2023, 11:06 AM Aug 10 2023, 11:06 AM

Show posts by this member only | IPv6 | Post

#101

|

Senior Member

1,630 posts Joined: Jun 2006 |

is this a special deal ? 250k bond and 250k FD at 6% ?

|

|

|

|

|

|

Aug 10 2023, 11:16 AM Aug 10 2023, 11:16 AM

Show posts by this member only | IPv6 | Post

#102

|

Junior Member

893 posts Joined: Aug 2007 |

QUOTE(ccschua @ Aug 10 2023, 11:06 AM) The bank offer 1:1 match for this resold bonds that was issued in 2017. The previous holder sold it back to bank recently. If you buy up 250k bond, you get 1:1 250k for the FD at 6.2% 12m only. Just the bank here offering such sweetener. Too bad my other funds only comes in Sept .. doubt the bonds still available by then. |

|

|

Aug 10 2023, 11:29 AM Aug 10 2023, 11:29 AM

Show posts by this member only | IPv6 | Post

#103

|

Senior Member

1,630 posts Joined: Jun 2006 |

this is really deal sweetener. if i have the excess, i wudnt mind investing it it.

|

|

|

Aug 10 2023, 11:51 AM Aug 10 2023, 11:51 AM

Show posts by this member only | IPv6 | Post

#104

|

Junior Member

147 posts Joined: Nov 2017 |

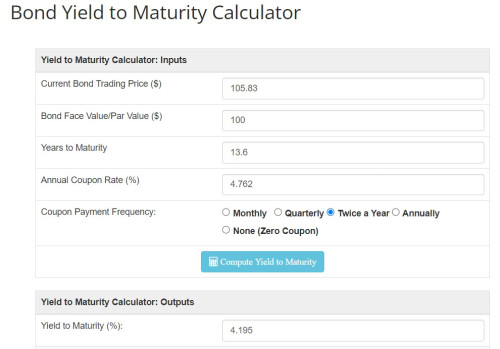

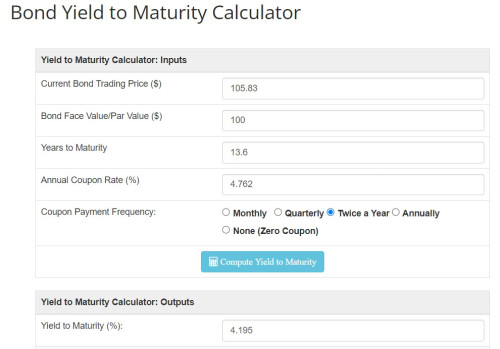

QUOTE(gamenoob @ Aug 8 2023, 05:14 PM) MY GOVT BOND Issued 2017 and matured 2037. It’s being resold by the bank from original owner. Coupon is 4.7% but yield to maturity is 4.01% Indicative ask price is MYR107.83 Payout semi annual Sukok code MX170003 Min 100k. QUOTE(gamenoob @ Aug 9 2023, 05:22 PM) FD at 6% 12m, one time offering of 1:1 if bought together with bondCurrent 12m FD promo is around >= 4% Indicative ask price of bond is MYR107.83 Taking into consideration of the promo FD extra of around 2%, this will lower the ask price of the bond. Not sure my understanding is correct here, can I take that the adjusted current price of bond is around MYR105.83 (107.83 -2)? Is so, this give YTM % of around 4.195% using the bond YTM calculator below. Hopefully someone can confirm whether my understanding is correct. Newbie here learning. Thanks https://dqydj.com/bond-yield-to-maturity-calculator/  |

|

|

Aug 10 2023, 12:22 PM Aug 10 2023, 12:22 PM

Show posts by this member only | IPv6 | Post

#105

|

Senior Member

4,689 posts Joined: Jan 2003 |

QUOTE(gamenoob @ Aug 10 2023, 09:42 AM) Caveat on my comments, apology for not being clear.I was referring specifically to MY sovereign funds that if it’s collapsed, we as a country would have a more serious problem by then. Defaulting the payment or delayed redemption surely its still a risk but it’s a whole lot lesser than other instruments. Lack of better word, wanted to say if MY totally failed in honour the sovereign bonds, then we are really in deeper end. Wasn’t referring to just any bonds.. Yes even if with everything your sovereign bonds still loses value 🤦♀️ because MYR depreciation 🤦♀️ as you can go look at the examples of sovereign bonds that loses more on the value when currency depreciatedWe have many trumpeting that they should withdrawal all their EPF at 55/60 citing the MYR is useless, country down the drain etc. If EPF indeed collapse, MY by then would have been in severe pits. Sure we have a lot of issues and those that have holding in MYR will always have such challenges etc. sure one can diversify too but they are also many factors that allow or prohibit such, so it’s not single dimension. My thinking along this when making the previous comment above. Hope it clarify. I stand corrected in my interpretation… Since 1998 MYR is already depreciated by almost by double so it’s 25 years already while coupon payments loses half its value 🤦♀️ not to mention inflation biting the coupon payment so do you think holding sovereign RM bonds are prudent move It won’t collapse but your money is loses half the value 🤦♀️ that is even before inflation biting you |

|

|

Aug 10 2023, 12:33 PM Aug 10 2023, 12:33 PM

Show posts by this member only | IPv6 | Post

#106

|

Junior Member

893 posts Joined: Aug 2007 |

QUOTE(xander2k8 @ Aug 10 2023, 12:22 PM) Yes even if with everything your sovereign bonds still loses value 🤦♀️ because MYR depreciation 🤦♀️ as you can go look at the examples of sovereign bonds that loses more on the value when currency depreciated Tell us something we didn’t know about inflation etc. Since 1998 MYR is already depreciated by almost by double so it’s 25 years already while coupon payments loses half its value 🤦♀️ not to mention inflation biting the coupon payment so do you think holding sovereign RM bonds are prudent move It won’t collapse but your money is loses half the value 🤦♀️ that is even before inflation biting you Since you seems to be well informed financially, do share what is your investment portfolio and instruments like so we can all learn from. LoTek liked this post

|

|

|

|

|

|

Aug 10 2023, 02:47 PM Aug 10 2023, 02:47 PM

|

Senior Member

3,683 posts Joined: Apr 2019 |

QUOTE(sirius2017 @ Aug 10 2023, 11:51 AM) FD at 6% 12m, one time offering of 1:1 if bought together with bond great analysis and dissection. Current 12m FD promo is around >= 4% Indicative ask price of bond is MYR107.83 Taking into consideration of the promo FD extra of around 2%, this will lower the ask price of the bond. Not sure my understanding is correct here, can I take that the adjusted current price of bond is around MYR105.83 (107.83 -2)? Is so, this give YTM % of around 4.195% using the bond YTM calculator below. Hopefully someone can confirm whether my understanding is correct. Newbie here learning. Thanks https://dqydj.com/bond-yield-to-maturity-calculator/  the yield does look rather low, even though it is for ringgit risk free. May as well throw extra money into EPF... similar risk if one has the means to take the money out after 14 years. |

|

|

Aug 10 2023, 03:15 PM Aug 10 2023, 03:15 PM

Show posts by this member only | IPv6 | Post

#108

|

Junior Member

893 posts Joined: Aug 2007 |

QUOTE(Wedchar2912 @ Aug 10 2023, 02:47 PM) great analysis and dissection. Ya the yield is rather low which is expected for MYR sovereign funds I guess. Me just started to read after you all started this bond thread…the yield does look rather low, even though it is for ringgit risk free. May as well throw extra money into EPF... similar risk if one has the means to take the money out after 14 years. As for epf Sudah max quota EPF liao. Next year bah… Benefits for older fart, we can treat epf self contribution almost like bank super FD… we can withdraw every year..or as and when TT to our acct 😅 Would be great if they increase the limit many X more … This post has been edited by gamenoob: Aug 10 2023, 03:16 PM Wedchar2912 liked this post

|

|

|

Aug 10 2023, 03:43 PM Aug 10 2023, 03:43 PM

Show posts by this member only | IPv6 | Post

#109

|

Senior Member

4,689 posts Joined: Jan 2003 |

QUOTE(gamenoob @ Aug 10 2023, 12:33 PM) Tell us something we didn’t know about inflation etc. My portfolio is mostly in stocks 🤦♀️ which you know and heard and use in your life so no need to share as you already know the names Since you seems to be well informed financially, do share what is your investment portfolio and instruments like so we can all learn from. There is so many to invest upon but I will tell you only invest in what you believe and use and rely and finally understand upon other than just blindly put in just because the bankers said so |

|

|

Aug 11 2023, 01:52 PM Aug 11 2023, 01:52 PM

Show posts by this member only | IPv6 | Post

#110

|

Senior Member

5,922 posts Joined: Sep 2009 |

QUOTE(ccschua @ Aug 10 2023, 11:06 AM) first time i hear buy MGS bond can get FD above board rate 2% and for 12 months some more!! QUOTE(gamenoob @ Aug 10 2023, 11:16 AM) The bank offer 1:1 match for this resold bonds that was issued in 2017. The previous holder sold it back to bank recently. Bro this sounds too good to be true with real sovereign MGS papers.If you buy up 250k bond, you get 1:1 250k for the FD at 6.2% 12m only. Just the bank here offering such sweetener. Too bad my other funds only comes in Sept .. doubt the bonds still available by then. MX170003 at the price bank selling you is normal market price so, giving you a sweetener 1:1 12 month FD at 6.2% rate is really fishy. You better double confirm with your RM you are not getting some bundle bank own repackaged product and not that MX17003 MGS papers itself. i knew of a case of "PTPTN Bond" when in actual fact it was bank structured product and not a bond issued by PTPTN itself. |

|

|

Aug 11 2023, 06:35 PM Aug 11 2023, 06:35 PM

Show posts by this member only | IPv6 | Post

#111

|

Junior Member

893 posts Joined: Aug 2007 |

QUOTE(guy3288 @ Aug 11 2023, 01:52 PM) first time i hear buy MGS bond can get FD above board rate 2% It's 2 separate product, not bundle. The bank offering sweetener for taking up the bonds.and for 12 months some more!! Bro this sounds too good to be true with real sovereign MGS papers. MX170003 at the price bank selling you is normal market price so, giving you a sweetener 1:1 12 month FD at 6.2% rate is really fishy. You better double confirm with your RM you are not getting some bundle bank own repackaged product and not that MX17003 MGS papers itself. i knew of a case of "PTPTN Bond" when in actual fact it was bank structured product and not a bond issued by PTPTN itself. I had same experience previous round TNB bonds, also 15 years with coupon at 5.23% at RM103.5k/100k in 2022 They also offer FD at 3.45% when that period most FD was 3%. They not willing to do 1:1 but 1:0.5 ie 100k bonds, 50k FD. FD already matured and uplift too. Bonds still running with semi annual payout as expected. Too bad my funds only come in next month. I'm sure those offer is gone by then. This post has been edited by gamenoob: Aug 11 2023, 09:11 PM hksgmy liked this post

|

|

|

Aug 11 2023, 10:05 PM Aug 11 2023, 10:05 PM

|

Senior Member

7,847 posts Joined: Sep 2019 |

QUOTE(gamenoob @ Aug 11 2023, 06:35 PM) It's 2 separate product, not bundle. The bank offering sweetener for taking up the bonds. Wow. Malaysian bankers are really going all out for your business, my friend! The more I read about it, the better the deal sounds!I had same experience previous round TNB bonds, also 15 years with coupon at 5.23% at RM103.5k/100k in 2022 They also offer FD at 3.45% when that period most FD was 3%. They not willing to do 1:1 but 1:0.5 ie 100k bonds, 50k FD. FD already matured and uplift too. Bonds still running with semi annual payout as expected. Too bad my funds only come in next month. I'm sure those offer is gone by then. |

|

|

Aug 11 2023, 10:52 PM Aug 11 2023, 10:52 PM

|

Junior Member

893 posts Joined: Aug 2007 |

QUOTE(hksgmy @ Aug 11 2023, 10:05 PM) Wow. Malaysian bankers are really going all out for your business, my friend! The more I read about it, the better the deal sounds! Bro, your recent sharing on FIRE n net worth have triggered much interests on bonds...Good to see many here that willingly shared their knowledge n know how... This post has been edited by gamenoob: Aug 12 2023, 07:56 AM hksgmy liked this post

|

|

|

|

|

|

Aug 15 2023, 02:41 PM Aug 15 2023, 02:41 PM

Show posts by this member only | IPv6 | Post

#114

|

Senior Member

5,922 posts Joined: Sep 2009 |

QUOTE(joeblow @ Aug 5 2023, 02:09 PM) Congrats, it seems my RM is useless. Anyway Monday I will just park my money in FD. FSM one you got too? You really going all in... haha. received FSM email last night.......Nowadays can buy from FSM is much better...... Bankers ask for money 15.8.23 FSM can wait till 21.8.23 3pm! Attached thumbnail(s)

Cubalagi liked this post

|

|

|

Aug 15 2023, 03:10 PM Aug 15 2023, 03:10 PM

|

Senior Member

7,847 posts Joined: Sep 2019 |

QUOTE(guy3288 @ Aug 15 2023, 02:41 PM) received FSM email last night....... Congratulations bro!Nowadays can buy from FSM is much better...... Bankers ask for money 15.8.23 FSM can wait till 21.8.23 3pm! guy3288 liked this post

|

|

|

Aug 25 2023, 01:50 PM Aug 25 2023, 01:50 PM

Show posts by this member only | IPv6 | Post

#116

|

Senior Member

5,922 posts Joined: Sep 2009 |

|

|

|

Aug 25 2023, 02:52 PM Aug 25 2023, 02:52 PM

Show posts by this member only | IPv6 | Post

#117

|

Junior Member

23 posts Joined: Nov 2022 |

QUOTE(guy3288 @ Aug 25 2023, 01:50 PM) Thanks bro Buying from FSMOne better than but from bank? How about on fees? Processing fee 0.5%, platfrom fee 0.045% per quarter. If buy from bank got platform fee too?This bond really in demand Surprisingly price up so fast RM103.21. just 2 days after issue Buy 10 lots and redeem now can make money oredi.. |

|

|

Aug 25 2023, 03:24 PM Aug 25 2023, 03:24 PM

|

Senior Member

3,683 posts Joined: Apr 2019 |

QUOTE(cindyKL @ Aug 25 2023, 02:52 PM) Buying from FSMOne better than but from bank? How about on fees? Processing fee 0.5%, platfrom fee 0.045% per quarter. If buy from bank got platform fee too? if you managed to get it at PAR value.... then yes of course. Also don't know if the price indicated is a tradable price. Hopefully it is. cindyKL liked this post

|

|

|

Aug 25 2023, 10:21 PM Aug 25 2023, 10:21 PM

|

Senior Member

7,847 posts Joined: Sep 2019 |

QUOTE(Wedchar2912 @ Aug 25 2023, 03:24 PM) if you managed to get it at PAR value.... then yes of course. Usually there’ll be a spread as I’ve previously mentioned. No such thing as a fre lunch as far as the banks or bankers are concerned… FSM may be different though. Nevertheless I’m happy for guy3288 that he got it for a good price Also don't know if the price indicated is a tradable price. Hopefully it is. guy3288 liked this post

|

|

|

Aug 25 2023, 11:40 PM Aug 25 2023, 11:40 PM

|

Junior Member

76 posts Joined: May 2010 |

cross-post my question from another thread ... https://forum.lowyat.net/topic/4193169/+30461

Anyone has experience buying/selling small lot bond through FSMOne Bond Express ? How's the spread vs. full lot size ? |

| Change to: |  0.0247sec 0.0247sec

0.89 0.89

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 18th December 2025 - 07:27 PM |