QUOTE(pub_yu @ Jan 5 2023, 02:12 PM)

Very excellent. Welcome to the club!

Ok. So there are 3 types of SG government securities for retail investors: SGS bond, SG T-bills, and SSB (Saving bonds). All 3 are exempted from tax in SG.

SGS bond are for those interested in holding for >2 years-20/30 years (mid-long term). They are like typical (government) bonds paying coupons semiannually. You can sell them in the secondary market via brokers if needed but the charges can be expensive for retail investors (especially CDP ones). Long-term bond prices are also more volatile as they are subject to greater uncertainty in interest rate movements.

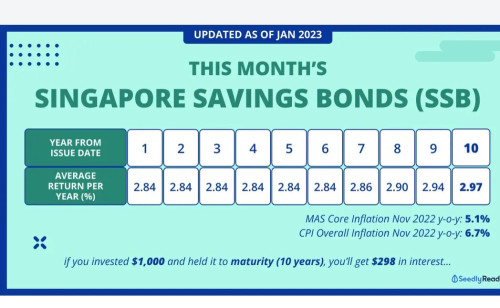

SSB are similar to SGS as a long-term investment vehicle but differ in a few ways. Firstly, the principal (your initial investment) is protected/guaranteed (SGS bond prices fluctuate) and the tenure is fixed at 10 years. The coupons are payable semiannually (similar to SGS bonds) and the rates known in advance. There is no secondary market for SSB, which means you can only sell your bonds back to MAS. You may do so on a monthly basis (2 SGD service charge). Take note that to encourage long-term investment, MAS will force the SSB yield curve to slope upwards regardless of the prevalent market conditions. So, even if the long-term rates are lower than short-term ones (like currently), you will still find SSB rates lower in near term than in long-term. SSBs are only available for retail investor subscription, no institutional subscriptions are available.

SSB and SGS bonds are for long-term investments. For short-term needs, you go for SG T-bills/treasury bills. 2 tenures are available: 6 months and 1 year. Everything is similar to SGS except the tenure is shorter.

-----------------------------

How to buy? and Allotment methods

All 3 types of securities can be purchased via DBS/UOB/OCBC for free except SSB, where 2 SGD charge is levied for each SSB purchase and redemption. Max limit is 200k SGD for SSB, no max limit for T-bills/SGS. Minimum bid is 1000 SGD for each T-bills/SGS and 500 SGD for SSB.

SSBs and SGS bonds are available on monthly basis, 6M SG T-bills are offered biweekly and 1Y bills are offered on a quarterly basis. You can check the auctions and issuances calendar published by MAS annually:

https://www.mas.gov.sg/bonds-and-bills/auct...suance-calendar SGS bonds and T-bills follow the "

uniform price auction" method (similar to US T-bills) whereas SSB follows the "

quantity ceiling"method.

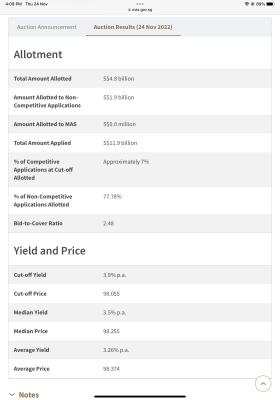

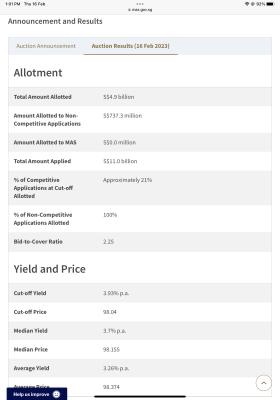

For uniform price auction, you can choose to either submit non-competitive bids or competitive bids.

QUOTE

In a non-competitive bid, you only specify the amount you want to invest, not the yield. Choose this if you wish to invest in the bond regardless of the return or are unsure of what yield to bid.

Non-competitive bids will be allotted first, up to 40% of the total issuance amount. If the amount of non-competitive bids exceeds 40%, the bond will be allocated to you on a pro-rated basis. The balance of the issue amount will be awarded to competitive bids from the lowest to highest yields.

You will get the bond at the cut-off yield, which is the highest accepted yield of successful competitive bids.

QUOTE

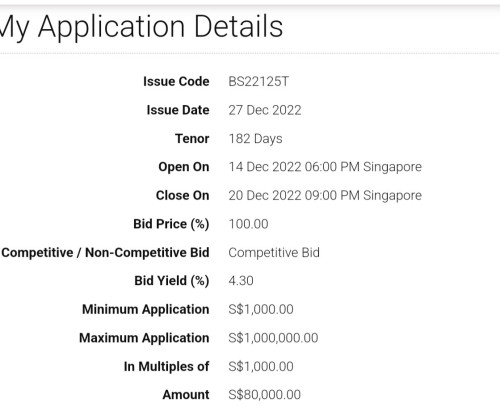

If you wish to invest in the bond only if it yields above a certain level, submit a competitive bid. You can specify the yield you are willing to accept in percentage terms, up to 2 decimal places.

Note that you may not get the full amount that you applied for, depending on how your bid compares to the cut-off yield.

Tip: A lower yield represents a more competitive bid, as you are indicating that you will accept a lower interest rate. You can submit multiple competitive bids.

Allotment limits are detailed here:

https://www.mas.gov.sg/bonds-and-bills/inve...s-are-conductedFor quantity ceiling format, kindly refer to the illustration here:

https://www.mas.gov.sg/bonds-and-bills/inve...bscribed-issues-----------------------

How to sell?

SSB, as mentioned earlier, can only be sold to MAS on a monthly basis. You will received accrued interests up to the day you sell your bonds.

https://www.mas.gov.sg/bonds-and-bills/inve...s/how-to-redeem. The proceeds will be credited to your CDP-linked bank account at the beginning of the next month.

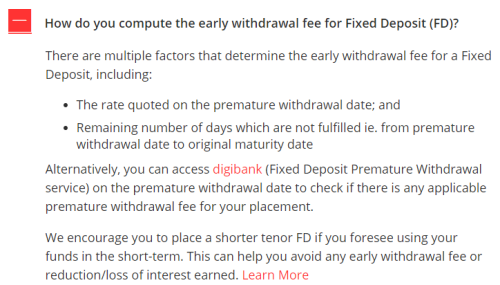

SGS and T-bills can be sold in secondary market but the fees are rather high as you can only sell to the primary dealers, i.e. DBS, UOB and OCBC. Bid/ask spreads are usually to the tune of 2%. (So, for a 4% 6-month bill, you get back your principal only).

---------------------

Resources

Do follow HWZ's thread on SSB and T-bills. They are pretty active.

SSB:

https://forums.hardwarezone.com.sg/threads/...006693/page-548T-bills:

https://forums.hardwarezone.com.sg/threads/...-bills.6769601/ The SGS thread is less active however:

https://forums.hardwarezone.com.sg/threads/...s-bond.6773131/IloveSSB is a recent website set up to forecast SSB rates:

https://www.ilovessb.com/ You may use it to decide whether to swap an earlier SSB to a newer ones.

MAS official resources are easy-to-read and quite retail investor-friendly:

https://www.mas.gov.sg/bonds-and-billsSG yields follow US yields closely. So you may want to look up US yield curves regularly to estimate the bids to be submitted for upcoming auctions. The HWZ forum threads also provide a wealth of resources and allow you to see what others are bidding and learn the dynamics of money flowing to and away from T-bills/SSB/SGS bonds (e.g. influence from CPF).

For short term T-bills, you can also rely on institutional money to estimate your bid levels. The 12-week MAS bill, which is available for institutions only, will have a weekly auction and the result is published 1 day or on the same day before the 6 month T-bills auction closes. The 12-week (3M) and 6M rates shouldn't differ too much.

Still another way is to look at FD levels in SG. The 6M and 1Y SG T-bill rate level should be similar prevalent 6 months/1 year FD rates in SG.

Other more advanced indicators include FX spread on SGD/USD rates in the coming months (to decide how close the SGS/T-bills rates are with respect to US rates), SORA rates etc.

Hope that helps.

This post has been edited by TOS: Jan 5 2023, 03:20 PM

Jun 1 2022, 07:12 PM, updated 10 months ago

Jun 1 2022, 07:12 PM, updated 10 months ago

Quote

Quote

0.5221sec

0.5221sec

0.71

0.71

6 queries

6 queries

GZIP Disabled

GZIP Disabled