QUOTE(owlinthenight @ Nov 16 2022, 04:34 PM)

Anyone here invest in Malaysia Bond?

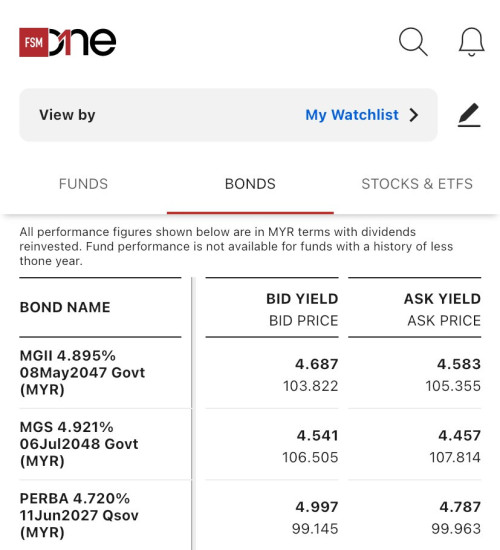

I saw FSM offer MGS 4.504% 30Apr2029 Govt (MYR), the interest rate is around 4.504% sound good to me.

but just not sure is it good to invest at this moment? since ringgit is depreciating asset.

and, is it better to invest in government bond rather than corporate bond?

bonds with only 4.5% now is too low

not worth it

FD can get around that or more.

MGS is very safe but very long tenure, wait for YTM going to 6% then buy

Some are reaching 5% as they are selling below PAR.

but in FSM you need to consider the platform fees and selling need to wait for willing buyers

buy from bank easy to sell back no platform annual fees.

Corporate bonds like Tropicana 7.5% why not, sure can buy but must check availability and price

if below PAR i sure will buy again.

QUOTE(xander2k8 @ Nov 17 2022, 07:36 AM)

Forget about MGS as you better off putting money in EPF instead 🤦♀️

Hello people buying bonds only got RM60k in 365days?

if they have more and you tell them put RM250k in EPF

Nov 16 2022, 04:34 PM, updated 4y ago

Nov 16 2022, 04:34 PM, updated 4y ago

Quote

Quote

0.0279sec

0.0279sec

0.70

0.70

6 queries

6 queries

GZIP Disabled

GZIP Disabled