SG Savings Bond (SSB) & Treasury Bills (T-bills), Guaranteed by Singapore Government

SG Savings Bond (SSB) & Treasury Bills (T-bills), Guaranteed by Singapore Government

|

|

Dec 20 2022, 07:56 PM Dec 20 2022, 07:56 PM

Return to original view | Post

#1

|

Senior Member

1,232 posts Joined: Mar 2019 |

TOS liked this post

|

|

|

Dec 21 2022, 03:19 PM Dec 21 2022, 03:19 PM

Return to original view | IPv6 | Post

#2

|

Senior Member

1,232 posts Joined: Mar 2019 |

QUOTE(Hansel @ Dec 21 2022, 02:40 PM) yes bro,... a few points in my mind to share :- Aiyoh Bro, next month pls share your thoughts earlier...I don't mind belanja kopi-0 no sugar.1) Riskfree rates are dropping everywhere. 2) This Monday, I noticed the longer-term USD FD rate (1-year) is higher than the shorter-term (6-mth) one, but this was not so last two weeks. So,.. I maxed out to 1-year tenure for my USD FD. 3) When riskfree rates start to drop,... REIT yields will have 'an easier opportunity' to maintain the spread with riskfree yields,... hence,... REITs will benefit,.... 4) I visiteds Japan recently and have held-on to my JPY not spent in my MCA. Time to hold-on now,... was waiting for the BOJ to pivot,... glad to be right,.... |

|

|

Jan 15 2023, 07:34 PM Jan 15 2023, 07:34 PM

Return to original view | Post

#3

|

Senior Member

1,232 posts Joined: Mar 2019 |

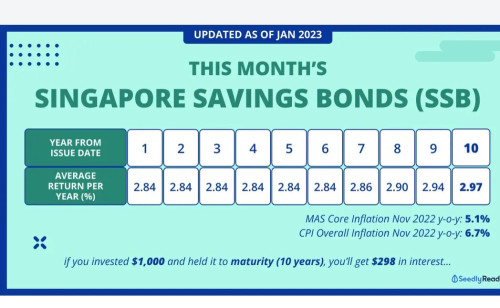

QUOTE(TOS @ Jan 15 2023, 03:12 PM) Bro TOS, pls shout out if you find rates increasing, add 1 buy...I no syiok, Jan 2023 yield low, man. But just hold lah, better than 0%. Kamsiah. Happy New Year. This post has been edited by Unkerpanjang: Jan 15 2023, 07:34 PM TOS liked this post

|

| Change to: |  0.0456sec 0.0456sec

0.46 0.46

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 12th December 2025 - 03:26 AM |