QUOTE(CommodoreAmiga @ Nov 11 2023, 10:13 AM)

Currently best RHB 3.6% for 6/12 mthsAnyone know about foreign FD?

Anyone know about foreign FD?

|

|

Nov 13 2023, 03:40 AM Nov 13 2023, 03:40 AM

Show posts by this member only | IPv6 | Post

#961

|

Senior Member

2,543 posts Joined: Jan 2003 |

QUOTE(CommodoreAmiga @ Nov 11 2023, 10:13 AM) Currently best RHB 3.6% for 6/12 mths CommodoreAmiga liked this post

|

|

|

|

|

|

Nov 13 2023, 07:40 AM Nov 13 2023, 07:40 AM

|

Senior Member

3,496 posts Joined: Jan 2003 |

|

|

|

Nov 13 2023, 07:59 AM Nov 13 2023, 07:59 AM

|

Senior Member

3,864 posts Joined: Jun 2022 |

|

|

|

Nov 13 2023, 08:10 AM Nov 13 2023, 08:10 AM

|

Senior Member

3,496 posts Joined: Jan 2003 |

just need to switch region to singapore and register all over again (with your passport). give them your malaysian statements (bank accts, utility bill etc) as proof of malaysian residence

you'll need to get yourself a sg bank account separately also, which you probably already have by now |

|

|

Nov 13 2023, 09:07 AM Nov 13 2023, 09:07 AM

|

Senior Member

3,864 posts Joined: Jun 2022 |

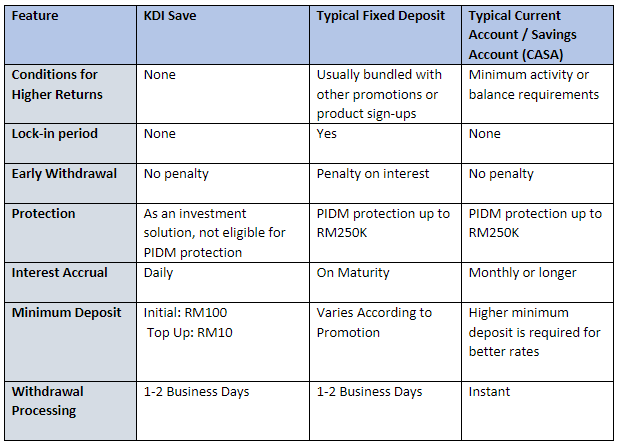

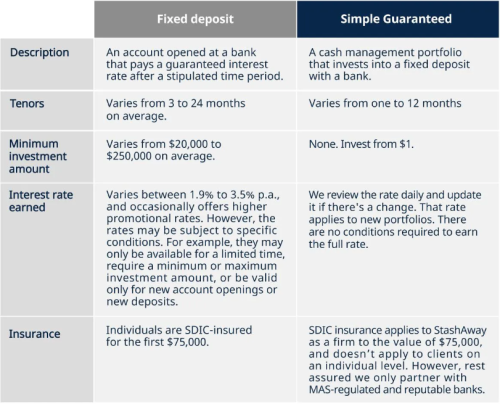

QUOTE(Medufsaid @ Nov 13 2023, 08:10 AM) just need to switch region to singapore and register all over again (with your passport). give them your malaysian statements (bank accts, utility bill etc) as proof of malaysian residence Thanks. Stashaway Simple Guaranteed is like KDI Save right? Not investment like Stashaway Simple?you'll need to get yourself a sg bank account separately also, which you probably already have by now |

|

|

Nov 13 2023, 09:40 AM Nov 13 2023, 09:40 AM

|

Senior Member

3,496 posts Joined: Jan 2003 |

kdi save is still considered investment  Stashaway simple guaranteed is SA investing in FD on your behalf  This post has been edited by Medufsaid: Nov 13 2023, 09:43 AM Takudan liked this post

|

|

|

|

|

|

Nov 22 2023, 03:38 PM Nov 22 2023, 03:38 PM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

BOC SG 3 month 3.50% Minimum 5000 SGD

https://www.bankofchina.com/sg/bocinfo/bi3/...0_24088022.html Source: bargin/HWZ |

|

|

Jan 24 2024, 08:48 PM Jan 24 2024, 08:48 PM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

BOC SG's latest FD rates: https://www.bankofchina.com/sg/bocinfo/bi3/...2_24463149.html

Good news! The minimum mobile banking FD placement is no longer 5000 SGD but just 500 SGD only. Source: lzydata and MastersIT/HWZ |

|

|

Jan 31 2024, 03:33 PM Jan 31 2024, 03:33 PM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

Syfe Guaranteed 3 month 4% is probably the most attractive package out there now. The declining 3 month MAS Bill risk-free rate means that you are increasingly being compensated for betting that Syfe won't go belly up in the next 3 months...

Looking at yesterday's 12-week MAS bill COY of 3.95%, the counterparty risk premium is around 0.05% p.a. Is that attractive for you guys? If I don't get the 6M T-bill auctioned tomorrow, I will probably start to take bets on Syfe's financial health in the next 3 months... |

|

|

Feb 14 2024, 09:46 AM Feb 14 2024, 09:46 AM

Show posts by this member only | IPv6 | Post

#970

|

Junior Member

500 posts Joined: Aug 2014 |

What is the best conversion rate u guys get for sgd? Mine offered at 3.5875

This post has been edited by mavistan89: Feb 14 2024, 09:46 AM |

|

|

Feb 14 2024, 09:52 AM Feb 14 2024, 09:52 AM

|

Senior Member

3,496 posts Joined: Jan 2003 |

|

|

|

Feb 15 2024, 09:17 PM Feb 15 2024, 09:17 PM

Show posts by this member only | IPv6 | Post

#972

|

Senior Member

9,361 posts Joined: Aug 2010 |

|

|

|

Feb 16 2024, 12:38 AM Feb 16 2024, 12:38 AM

Show posts by this member only | IPv6 | Post

#973

|

Junior Member

500 posts Joined: Aug 2014 |

|

|

|

|

|

|

Feb 16 2024, 04:45 PM Feb 16 2024, 04:45 PM

|

Senior Member

9,361 posts Joined: Aug 2010 |

QUOTE(mavistan89 @ Feb 16 2024, 12:38 AM) I think,... your rate is for changing MYR into SGD, becos the best rate I have been getting for changing SGD to MYR is the last few weeks was 3.54++, and this rate was from CIMB Singapore...Again,... I'll emphasize here : your rate of 3.58 is for changing MYR into SGD. Not SGD into MYR. Pls cfm, Mavis,.... |

|

|

Feb 19 2024, 12:08 AM Feb 19 2024, 12:08 AM

Show posts by this member only | IPv6 | Post

#975

|

Junior Member

500 posts Joined: Aug 2014 |

QUOTE(Hansel @ Feb 16 2024, 04:45 PM) I think,... your rate is for changing MYR into SGD, becos the best rate I have been getting for changing SGD to MYR is the last few weeks was 3.54++, and this rate was from CIMB Singapore... See wrongly. Yes for myr to sgd. Yours 3.54 is sgd to myr.Again,... I'll emphasize here : your rate of 3.58 is for changing MYR into SGD. Not SGD into MYR. Pls cfm, Mavis,.... |

|

|

Feb 20 2024, 10:28 AM Feb 20 2024, 10:28 AM

|

Newbie

20 posts Joined: Dec 2017 |

Do we need to pay tax for interest earned on foreign currency FD with Malaysian banks?

|

|

|

Feb 20 2024, 11:39 AM Feb 20 2024, 11:39 AM

|

Senior Member

9,361 posts Joined: Aug 2010 |

QUOTE(mavistan89 @ Feb 19 2024, 12:08 AM) QUOTE(Kenon70 @ Feb 20 2024, 10:28 AM) Thank you, Mavis,... I was really surprised with your earlier rate. Apologies for chasing so rapidly !Kenon,... no need to pay tax for your statement. But if you keep in foreign banks, and you remit the interest back to Msia, then there are plans by LHDN to apply tax. This is said to start in another two years' time. But things can chg,... it is not so easy to implement this. |

|

|

Feb 20 2024, 11:40 AM Feb 20 2024, 11:40 AM

|

Senior Member

4,082 posts Joined: Apr 2006 |

Hi, i am thinking of moving some money to SG and keeping it in FD. I have a CIMB SG account but is it better to keep in stashaway SG (or Versa) or CIMB SG?

I'm also looking to open a US bank account for the same reason. I only have IBKR and eTrade accounts. What's my best option for US account? The plan is to save some amount monthly and when it's enough, i will put it under FD. This post has been edited by silverwave: Feb 20 2024, 11:42 AM |

|

|

Feb 20 2024, 12:40 PM Feb 20 2024, 12:40 PM

|

Newbie

20 posts Joined: Dec 2017 |

QUOTE(Hansel @ Feb 20 2024, 11:39 AM) Thank you, Mavis,... I was really surprised with your earlier rate. Apologies for chasing so rapidly ! Thanks Hansel.Kenon,... no need to pay tax for your statement. But if you keep in foreign banks, and you remit the interest back to Msia, then there are plans by LHDN to apply tax. This is said to start in another two years' time. But things can chg,... it is not so easy to implement this. But the FD foreign currency accounts that I want to open are with banks in Malaysia eg CIMB, RHB. No need to pay tax on interest? |

|

|

Feb 20 2024, 12:45 PM Feb 20 2024, 12:45 PM

|

Newbie

20 posts Joined: Dec 2017 |

QUOTE(silverwave @ Feb 20 2024, 11:40 AM) Hi, i am thinking of moving some money to SG and keeping it in FD. I have a CIMB SG account but is it better to keep in stashaway SG (or Versa) or CIMB SG? For SGD FD, CIMB Malaysia interest rate is 3.7% for 2, 3 or 4 months. CMB SG 3.55% for 6 monthsI'm also looking to open a US bank account for the same reason. I only have IBKR and eTrade accounts. What's my best option for US account? The plan is to save some amount monthly and when it's enough, i will put it under FD. |

| Change to: |  0.0245sec 0.0245sec

0.48 0.48

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 15th December 2025 - 12:51 AM |