QUOTE(adele123 @ Mar 20 2024, 07:11 PM)

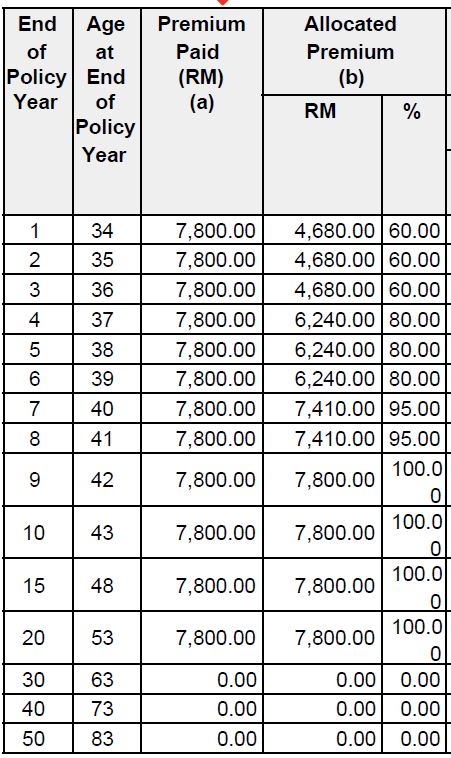

Part of the reason your 1mil life portion is expensive because you only pay for 20 years. It is coverage for very long i suppose. Probably up to 100 based on what you have shared. I would usually prefer something to pay yearly. After all, at some point, once i stop working i wont need the 1mil coverage.

The more you prepay upfront, you just putting more money into the investment fund. As ramjade rightly complaint most of the time, the fund performance are pretty bad across all the insurance companies. So you are just prepaying for GE to earn more fund management charge every year and give you lousy return.

For life protection, it's more simple to compare. How much you pay vs how much coverage you intend to have. It's really difficult to say if traditional plan is better. You have to ask agent send you both to compare.

Market trend wise, ILP is more popular. Does not mean traditional plan is bad. Gotta see the price and if it fits your need.

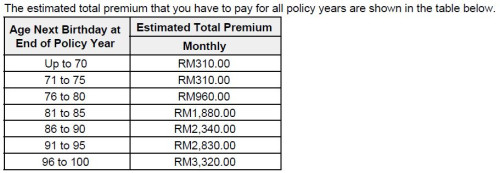

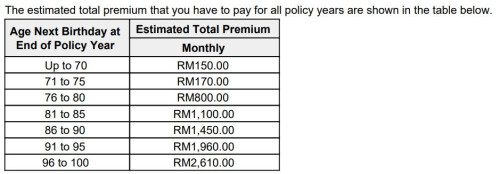

As for your medical plan, just fyi, it's just projections based on current cost of insurance. Based on current trend, every 2 to 3 years, insurance company will reprice. It's a matter of when not if. The 310 wont stay until age 70. I can guarantee this.

As for the price for the CI or medical plan, there is no context on what is being covered and what is not. But seriously, best way is just get a quote from another company and compare apple to apple.

I understand all insurance companies will reprice after some years.

If we put it this way,

(a) Premium reprice every 2 to 3 years

vs

(b) Premium reprice every 8 to 9 years

in continuous 30-50 years length (from year 2023 to year 2053 / 2073).

which reprice period is most likely happen? if premium must die die reprice every 2 to 3 years in continuous 30-50 years length, then I will be shocked lar.

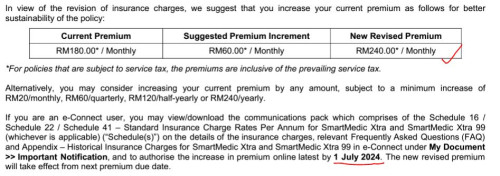

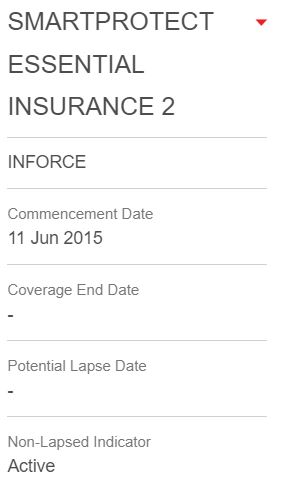

I used to have one medical ILP, RM 990k annual limit with RM 180 per month, bought in year 2015. never receive notification to increase, until last year 2023 then only received such notification. Meaning this reprice period has 8 years gap to me.

I think sometimes buying insurance need to see luck.

Mar 20 2024, 08:13 AM

Mar 20 2024, 08:13 AM

Quote

Quote

0.0417sec

0.0417sec

0.50

0.50

6 queries

6 queries

GZIP Disabled

GZIP Disabled