QUOTE(TaiGoh @ Jan 31 2021, 11:12 PM)

Thanks lifebalance and lifebalance for your reply!

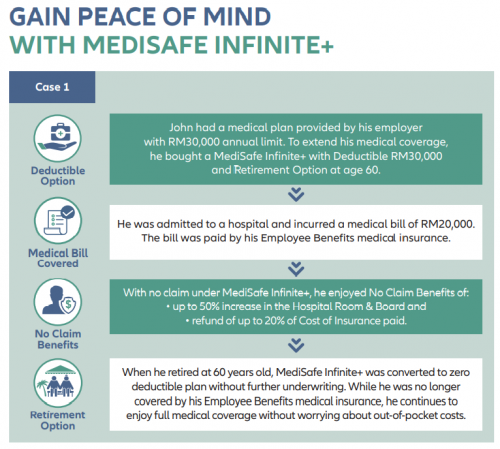

The reason I ask for a deductible plan is because I would assume that deductible plan premium will be a lot cheaper than non-deductible plan. So I just wondering is that a good idea to opt for a deductible plan since company already provided the benefits, then the premium saved can be utilized somewhere else. Or normally when hospitalization needed, it will be always advisable to use personal medical card first then followed by company medical card when over limit?

I am not so worried about I got laid off, but change of job could be possible. I not sure how the policy works but just wondering whether it is possible to adjust the deductible amount or even adjust to a non-deductible plan in the future. And whether worth it to do so? And I assume that there will be no waiting period and contestability period need to be served in this case if within the same company?

Thanks!

1. If you're using a deductible plan, you'll be forced to use your company card first otherwise you'll have to pay fork out to pay for the deductible before the deductible medical card can be used.The reason I ask for a deductible plan is because I would assume that deductible plan premium will be a lot cheaper than non-deductible plan. So I just wondering is that a good idea to opt for a deductible plan since company already provided the benefits, then the premium saved can be utilized somewhere else. Or normally when hospitalization needed, it will be always advisable to use personal medical card first then followed by company medical card when over limit?

I am not so worried about I got laid off, but change of job could be possible. I not sure how the policy works but just wondering whether it is possible to adjust the deductible amount or even adjust to a non-deductible plan in the future. And whether worth it to do so? And I assume that there will be no waiting period and contestability period need to be served in this case if within the same company?

Thanks!

As mentioned in the earlier post, as long as you're still healthy, you can make a request to change by re-declaring your health status at that point of time, if the insurance company finds it unfavorable then they'll reject your application to change the deductible to a non-deductible plan.

So if you have a 80k deductible plan for example then you'll be forced to pay the 80k upfront first before the balance is covered by the insurance company throughout your policy lifetime.

On the other side of the coin, you pay a low premium for your insurance but at the same time, will it be worth paying 80k upfront?

QUOTE(MUM @ Feb 1 2021, 08:46 AM)

Thanks for the inputs.

Btw, what is the variance In premium per year between a 80k deductible n a non deductible plan for his age?

That depends on what is offered by the insurance company for the 80k deductible. (Different company have different % of discount)Btw, what is the variance In premium per year between a 80k deductible n a non deductible plan for his age?

For example, the normal premium is RM1,000 monthly, but someone with an 80k deductible could be paying RM200 monthly.

Feb 1 2021, 08:56 AM

Feb 1 2021, 08:56 AM

Quote

Quote

0.0253sec

0.0253sec

0.32

0.32

6 queries

6 queries

GZIP Disabled

GZIP Disabled