QUOTE(EDD-ed @ Oct 31 2021, 10:26 AM)

Hi, this is my current ILP plan. (Pic Attached)

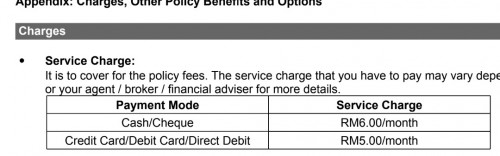

I'm thinking of increasing my Annual Limit on the Medical Card & adding Riders.

1. If I wish to increase my Death/TPD or CI coverage, would it cost less to upgrade my current Rider or to buy a standalone Term Life Online Policy (until 80yrs coverage) ?

2. Can I upgrade my current plan to the Smart Medic Million + Extender & upgrade my Riders, Without Underwriting again ?

3. Would it be better to collect my surrender value & change to Allianz Medisafe Infinite+, as it provides better additional benefits (20% NCB Discount & Traditional Medicine/2nd Opinion) OR should I just continue with Great Eastern because I've already paid the Agent's fee ?

4. A relative of mine has an AIA Excelife Whole Life Policy.

Is it possible to Withdraw the Cash Value & still maintain coverage by paying the premium annually ?

All research so far says No, however, an Insurance Agent, said Yes. I'm wondering if he's confused Whole Life with ILP ?

Apologies for so many questions.

Thanks in advance, been researching Insurance for the past 3 days. I'm confident I can explain insurance policies better than 50% of Agents

<a href='https://pictr.com/images/2021/10/31/BVwdQ6.md.png' target='_blank'>https://pictr.com/images/2021/10/31/BVwdQ6.md.png

<a href='https://pictr.com/images/2021/10/31/BVwdQ6.md.png' target='_blank'>https://pictr.com/images/2021/10/31/BVwdQ6.md.png </a>

<a href='https://pictr.com/images/2021/10/31/BVwuDq.md.png' target='_blank'>https://pictr.com/images/2021/10/31/BVwuDq.md.png </a>

From your overall post, it seems you're looking to upgrade your medical benefits to cover better/higher amount but not sure whether to stick with your existing insurer or to pick another insurer.

There is no right or wrong answer, different insurers have their own special perks to benefit their policyholder. It depends whether those perks suit your lifestyle as you've pointed out like NCB's or other benefits that entails.

You may say that starting a whole policy would mean paying a distribution/commission fee to the new agent but that's pretty much the cycle of the insurance industry. Say if it doesn't happen now, down the road 10 years later, you'd still face the same scenario on paying commissions. The question is, is the agent you're engaging is able to provide you good service & advise that would make you want to shift your portfolio to him/her?

2. You'll have to do a health declaration for underwriting as this is an upgrade.

3. Answer above

4. it's best for you to refer back to the policy contract on the matter of withdrawal as this is a really old policy.

Things to determine.

Oct 27 2021, 02:54 AM

Oct 27 2021, 02:54 AM

Quote

Quote

0.0215sec

0.0215sec

0.51

0.51

6 queries

6 queries

GZIP Disabled

GZIP Disabled