I'm thinking of increasing my Annual Limit on the Medical Card & adding Riders.

1. If I wish to increase my Death/TPD or CI coverage, would it cost less to upgrade my current Rider or to buy a standalone Term Life Online Policy (until 80yrs coverage) ?

2. Can I upgrade my current plan to the Smart Medic Million + Extender & upgrade my Riders, Without Underwriting again ?

3. Would it be better to collect my surrender value & change to Allianz Medisafe Infinite+, as it provides better additional benefits (20% NCB Discount & Traditional Medicine/2nd Opinion) OR should I just continue with Great Eastern because I've already paid the Agent's fee ?

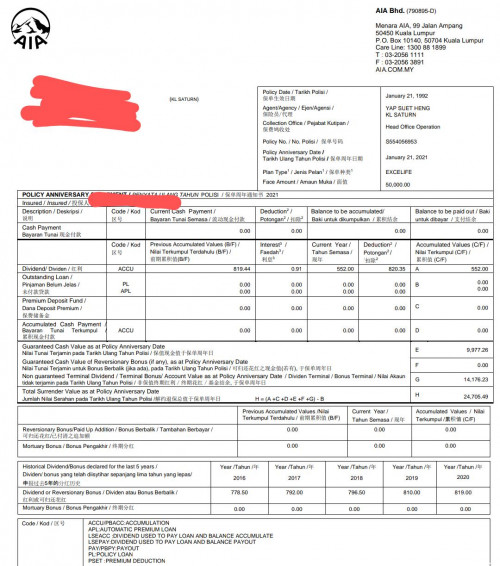

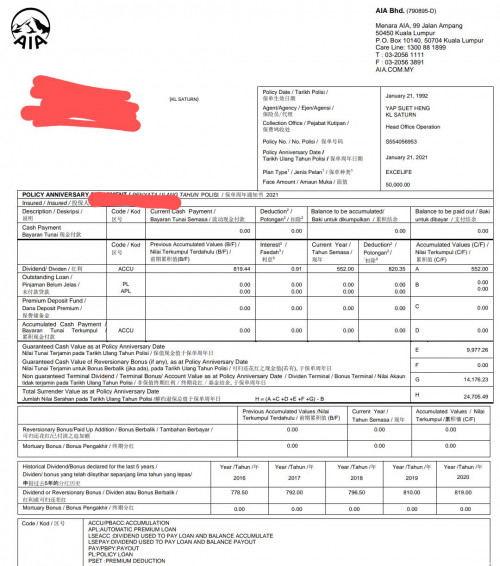

4. A relative of mine has an AIA Excelife Whole Life Policy.

Is it possible to Withdraw the Cash Value & still maintain coverage by paying the premium annually ?

All research so far says No, however, an Insurance Agent, said Yes. I'm wondering if he's confused Whole Life with ILP ?

Apologies for so many questions.

Thanks in advance, been researching Insurance for the past 3 days. I'm confident I can explain insurance policies better than 50% of Agents

https://pictr.com/images/2021/10/31/BVwdQ6.md.png

https://pictr.com/images/2021/10/31/BVwuDq.md.png

Attached thumbnail(s)

Oct 31 2021, 10:26 AM

Oct 31 2021, 10:26 AM

Quote

Quote

0.0279sec

0.0279sec

1.14

1.14

7 queries

7 queries

GZIP Disabled

GZIP Disabled