QUOTE(infernape772 @ Apr 15 2021, 09:29 AM)

Bruh Frank debit card annual fee is only RM8.

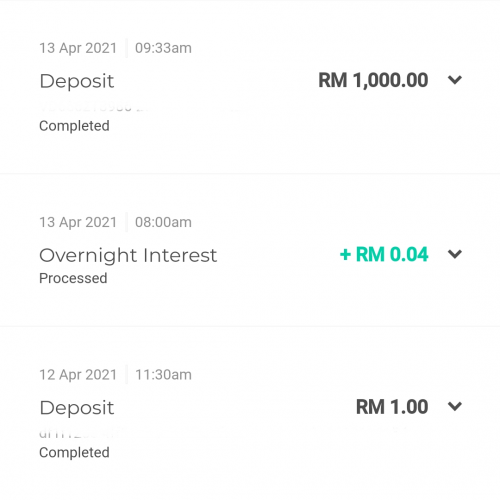

Go+ rate is 1.4%, Frank is 2.4% annually, with RM1000 initial deposit with no subsequent deposit, GO+ you get RM14 interest, Frank you get RM24 in interest, deduct the RM8 annually you also untung 0.2% already la, you deposit more emergency fund into Frank that RM8 is peanuts.

Sometimes you have to think of economies at scale, don't be penny wise pound foolish. My application to OCBC Frank was very smooth, register online, walk into branch instant get debit card, the banker explain everything in detail. Just they will also hardsell you insurance at the same time so beware. You can try apply at Subang USJ branch if it's convenient for you.

Damn.. Silly me.. I kept recalling it being RM 20+...thanks for the reminder.Go+ rate is 1.4%, Frank is 2.4% annually, with RM1000 initial deposit with no subsequent deposit, GO+ you get RM14 interest, Frank you get RM24 in interest, deduct the RM8 annually you also untung 0.2% already la, you deposit more emergency fund into Frank that RM8 is peanuts.

Sometimes you have to think of economies at scale, don't be penny wise pound foolish. My application to OCBC Frank was very smooth, register online, walk into branch instant get debit card, the banker explain everything in detail. Just they will also hardsell you insurance at the same time so beware. You can try apply at Subang USJ branch if it's convenient for you.

Also, I thought Frank is 1.8%?

Apr 15 2021, 10:02 AM

Apr 15 2021, 10:02 AM

Quote

Quote

0.0329sec

0.0329sec

0.29

0.29

6 queries

6 queries

GZIP Disabled

GZIP Disabled