QUOTE(xander83 @ Apr 14 2021, 09:45 PM)

Tuesday will be interest accrued because adjusted buying price from Monday not on Tuesday

Payout it is every fortnight because they adjust the price and added more units as bonus

If you want better liquidity yet earning interest better off going with Frank because GO+ is rubbish earnings lower than OPR rate

Frank :

I've been applying for for Frank since last year..what a mess..

They've been throwing me around various branches, end up require me to go all the way back to the branch nearest to my address in IC. Same thing with customer service, some says no issue, while some ghosted me. With the off and on MCO, been delaying since last year when I first tried.

Besides, for Frank, there's some annual fee or something incurred.. I did the calculations long time ago (sorry, forgot).. And i considered it cost incurred, and to recover that amount may cut into "profits/time" as well.

Go+ :

In terms of Go+, not much use for it anyway and it's a dilemma for my case. Not much use due to the 9.5k limit, and I'm not able to cash in via FPX, shows unsuccessful. Currently just playing around by reloading through FPX into ewallet then into Go+, but afraid of being flagged or whatever for withdrawal and stuff. I know it should be okay since I'm not using credit card for that, but who knows what they think. Besides, I do reload with credit card for ewallet transactions. So I'd rather not have issue with them as their customer support takes ages to reply, and I do depend on the app alot for tolls.

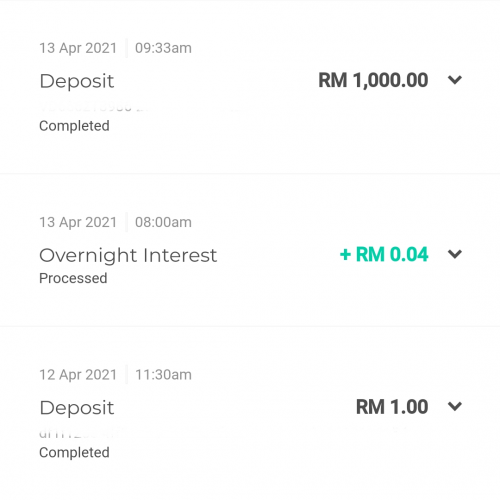

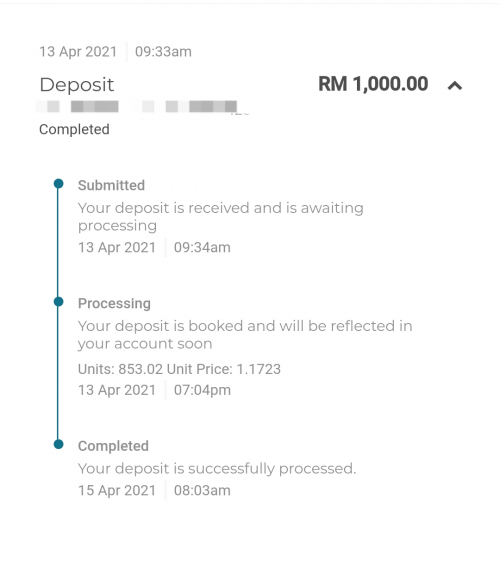

Anyway, thanks for all the replies, I'll assume for now that "Tuesday" incrues interest. So it's around 4 days for Versa, while Go+ is 3 days. Meanwhile, I'll reconsider Frank again if I have the motivation to go to the branch.

With the current projected inflation rate, I'm squeezing every bit just to stay.

This post has been edited by shawnme: Apr 14 2021, 10:18 PM

Apr 14 2021, 05:56 PM

Apr 14 2021, 05:56 PM

Quote

Quote

0.0559sec

0.0559sec

0.38

0.38

7 queries

7 queries

GZIP Disabled

GZIP Disabled