Outline ·

[ Standard ] ·

Linear+

Money market fund

|

AnasM

|

Jan 30 2021, 08:20 PM Jan 30 2021, 08:20 PM

|

|

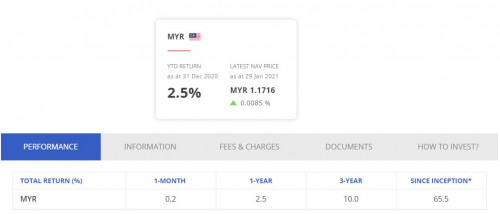

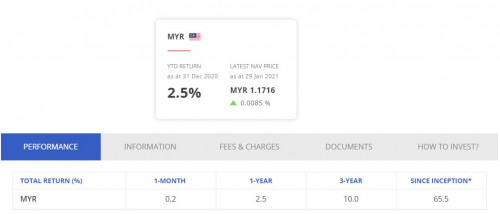

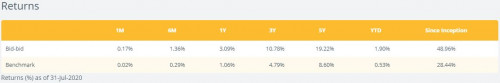

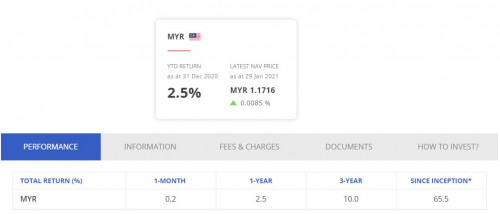

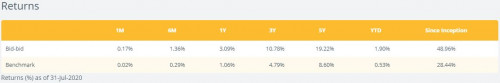

QUOTE(GrumpyNooby @ Jan 30 2021, 07:35 PM) It is very close to what Affin reported:  YTD: 2.5% as of 31/12/2020 But Eastspring reported 1.9% for its YTD:  And SAMY is still projecting 2.4% pa why SAMY still say 2.4% pa? |

|

|

|

|

|

GrumpyNooby

|

Jan 30 2021, 08:22 PM Jan 30 2021, 08:22 PM

|

|

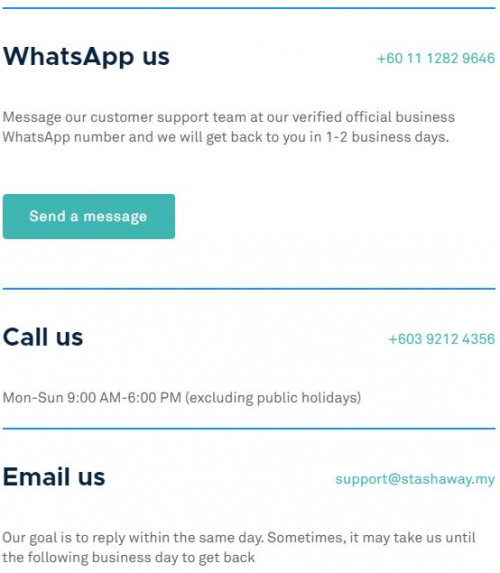

QUOTE(AnasM @ Jan 30 2021, 08:20 PM) why SAMY still say 2.4% pa? Please ask clarification from SAMY: https://www.stashaway.my/contact |

|

|

|

|

|

AnasM

|

Jan 30 2021, 08:22 PM Jan 30 2021, 08:22 PM

|

|

QUOTE(GrumpyNooby @ Jan 30 2021, 08:22 PM) Please ask clarification from SAMY: https://www.stashaway.my/contact can u ask and tel us here? |

|

|

|

|

|

GrumpyNooby

|

Jan 30 2021, 08:25 PM Jan 30 2021, 08:25 PM

|

|

QUOTE(AnasM @ Jan 30 2021, 08:22 PM) can u ask and tel us here? I have no interest over Simple™ or have any holdings in Simple™; hence no interest over this product nor how SAMY maintain the projection. Sorry for the inconveniences caused. |

|

|

|

|

|

ericlaiys

|

Jan 30 2021, 08:39 PM Jan 30 2021, 08:39 PM

|

|

QUOTE(thecurious @ Jan 30 2021, 04:37 PM) Sidetrack abit, you are able to buy funds using the allocate + app? Wait till it commit on next business day. 1st time deposit will take longer time & cut off time is Friday. So need to wait on Tuesday. Monday Federal holiday. Update status next week |

|

|

|

|

|

ironman16

|

Jan 30 2021, 09:19 PM Jan 30 2021, 09:19 PM

|

|

QUOTE(ericlaiys @ Jan 30 2021, 08:39 PM) Wait till it commit on next business day. 1st time deposit will take longer time & cut off time is Friday. So need to wait on Tuesday. Monday Federal holiday. Update status next week remember update here....   |

|

|

|

|

|

Ramjade

|

Jan 30 2021, 10:32 PM Jan 30 2021, 10:32 PM

|

|

I have always like Versa before Stashaway simple. This is because faster withdrawal time. Glad finally it's live.

|

|

|

|

|

|

propertyfeature

|

Jan 30 2021, 11:49 PM Jan 30 2021, 11:49 PM

|

Getting Started

|

I think Versa's expected returns are around 1.8% to 2.1%

|

|

|

|

|

|

SUSxander83

|

Jan 31 2021, 08:09 AM Jan 31 2021, 08:09 AM

|

|

QUOTE(propertyfeature @ Jan 30 2021, 11:49 PM) I think Versa's expected returns are around 1.8% to 2.1% Possible at that rate with another OPR rate cut of 0.25 this year which looks like gonna happen by Q2 But the key feature fast liquidity so it’s better than sitting the money in savings if it’s workable as key selling point  |

|

|

|

|

|

GrumpyNooby

|

Jan 31 2021, 08:13 AM Jan 31 2021, 08:13 AM

|

|

QUOTE(xander83 @ Jan 31 2021, 08:09 AM) Possible at that rate with another OPR rate cut of 0.25 this year which looks like gonna happen by Q2 But the key feature fast liquidity so it’s better than sitting the money in savings if it’s workable as key selling point  Idling money can still be parked in conditional high yield saving/current account without lock in period;ie RHB Smart Account @ 2.85% pa This post has been edited by GrumpyNooby: Jan 31 2021, 08:16 AM |

|

|

|

|

|

SUSxander83

|

Jan 31 2021, 08:59 AM Jan 31 2021, 08:59 AM

|

|

QUOTE(GrumpyNooby @ Jan 31 2021, 08:13 AM) Idling money can still be parked in conditional high yield saving/current account without lock in period;ie RHB Smart Account @ 2.85% pa Not all high yielding because the minimum spent component which actually draining the earnings hence C is useless just like CMCO unless C is fulfilled by minimum spent  |

|

|

|

|

|

propertyfeature

|

Jan 31 2021, 10:58 AM Jan 31 2021, 10:58 AM

|

Getting Started

|

UOB's One Account is not too bad as well with interest rate ranging from 1.65% to 2.15% (provided criterias are fulfilled). Don't have the hassle transfer funds here & there.

|

|

|

|

|

|

SUSyklooi

|

Jan 31 2021, 10:59 AM Jan 31 2021, 10:59 AM

|

|

QUOTE(propertyfeature @ Jan 31 2021, 10:58 AM) UOB's One Account is not too bad as well with interest rate ranging from 1.65% to 2.15% (provided criterias are fulfilled). Don't have the hassle transfer funds here & there.  |

|

|

|

|

|

GrumpyNooby

|

Jan 31 2021, 11:01 AM Jan 31 2021, 11:01 AM

|

|

QUOTE(propertyfeature @ Jan 31 2021, 10:58 AM) UOB's One Account is not too bad as well with interest rate ranging from 1.65% to 2.15% (provided criterias are fulfilled). Don't have the hassle transfer funds here & there. UOB InvestPro can easily give 1.70% pa without any extra criteria at all. |

|

|

|

|

|

propertyfeature

|

Jan 31 2021, 11:07 AM Jan 31 2021, 11:07 AM

|

Getting Started

|

Not difficult to fulfill the criteria, as UOB One Account is my main bank account. Naturally, I will have bills to pay..

The best returns are still in stocks..

|

|

|

|

|

|

GrumpyNooby

|

Jan 31 2021, 11:09 AM Jan 31 2021, 11:09 AM

|

|

QUOTE(propertyfeature @ Jan 31 2021, 11:07 AM) Not difficult to fulfill the criteria, as UOB One Account is my main bank account. Naturally, I will have bills to pay.. The best returns are still in stocks.. InvestPro is my salary crediting account. I got Stash too but the tier band range is too high; so I abandoned it. |

|

|

|

|

|

!@#$%^

|

Jan 31 2021, 11:51 AM Jan 31 2021, 11:51 AM

|

|

any money market funds in singapore that is easily accessible to malaysians who have sg account? so far money only in sg bank account doing ntg, and im not ready to go into higher risk investments there yet.

|

|

|

|

|

|

GrumpyNooby

|

Jan 31 2021, 11:53 AM Jan 31 2021, 11:53 AM

|

|

QUOTE(!@#$%^ @ Jan 31 2021, 11:51 AM) any money market funds in singapore that is easily accessible to malaysians who have sg account? so far money only in sg bank account doing ntg, and im not ready to go into higher risk investments there yet. Via FSM SG? |

|

|

|

|

|

!@#$%^

|

Jan 31 2021, 12:11 PM Jan 31 2021, 12:11 PM

|

|

QUOTE(GrumpyNooby @ Jan 31 2021, 11:53 AM) hmm well i dun think anything worth. interest rates very low there. |

|

|

|

|

|

CSW1990

|

Jan 31 2021, 12:14 PM Jan 31 2021, 12:14 PM

|

|

QUOTE(propertyfeature @ Jan 31 2021, 11:07 AM) Not difficult to fulfill the criteria, as UOB One Account is my main bank account. Naturally, I will have bills to pay.. The best returns are still in stocks.. Yea I am using UOB one account to temporary park my cash. Easy to fulfill if using their credit card, also no hassle can in out anytime. I don’t like MMF, the pa only 0.x% higher than UOB one, but is T+x .. also my amount not big like millions, parking time not long like years, the return delta is actually negligible.. |

|

|

|

|

Jan 30 2021, 08:20 PM

Jan 30 2021, 08:20 PM

Quote

Quote

0.0154sec

0.0154sec

0.68

0.68

6 queries

6 queries

GZIP Disabled

GZIP Disabled