QUOTE(kimi0148 @ Oct 5 2022, 08:29 AM)

if i want to save monthly MYR to SGD for eventual investment using USD in IBKR, which to chose?

a) save the RM500 per month into wise SGD or

b) to save in CIMB SG account?

any pros and cons to this methods?

PS: To lock in monthly forex rate

In your options, definitely (a). Sounds to me you plan to use TT via CIMB MY to CIMB SG for (b) and that is actually very expensive -- always check all the fintech/money exchangers you have access to, to compare the money to be received.

One more note, it's generally better to transfer more at one go. E.g.

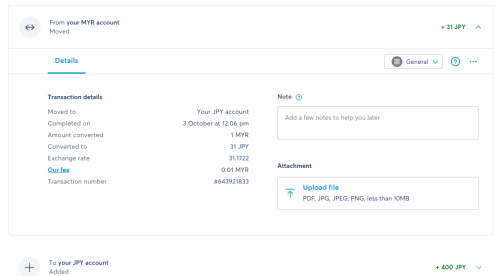

- Wise has

fixed fee on top of % fee, making its low-amount transfer less favourable

- SunwayMoney offers discount when you exceed certain amount

...So with that said, I would recommend you to park the amount into a liquid instrument (MMF or monthly-tenure online FD), then transfer more at one go (bimonthly? Quarterly?). I can't read the future and I haven't done the maths, but I feel securing the little bit of interest + saving a bit of fee is better than betting on MYR to keep bleeding more... I also want MYR to stop bleeding also la 😢

Anyway, not investment advice, this is up to you ya. I also understand 1 month can lose quite a lot in rate :')

QUOTE(ChipZ @ Oct 6 2022, 01:10 AM)

I always purchase stuff from Ebay and am using PayPal (which charges quite a bit). Will using Wise help on this?

Another question, I have some $ on Etrade (company stock). Can I transfer those to my Wise account?

I don't have experience with eBay/overseas purchase via wise yet, but I would imagine yes.... Can use Wise in FPX ah??

anyway, note that you would be at Wise's mercy in terms of the transfer rate. By depositing the minimum required amount, you can get IBAN/SWIFT (bank account number) to make it work like your personal bank account, but for anti-money laundering purpose, it will not accept 3rd party money (which, other fintech transfer would count as such)...

--

For brokerage withdrawal, I have only heard that Wise hates crypto sources e.g. Binance, because they're risk averse (crypto is very often associated with money laundering and scam). Don't know about stock brokerage though.......

This post has been edited by Takudan: Oct 6 2022, 01:46 AM

Sep 28 2022, 06:26 PM

Sep 28 2022, 06:26 PM

Quote

Quote

0.0331sec

0.0331sec

0.22

0.22

6 queries

6 queries

GZIP Disabled

GZIP Disabled