QUOTE(ckokwei @ Oct 13 2022, 12:50 PM)

Hi the transfer money from EU account to local MY account does it incur any charges ?

Like I said, you can see all the fees when you initiate the transfers.

I just opened the app, and right now if I want to send 100 euro from my Wise EU account to local CIMB account. It says:

0.88 EUR: Balance transfer fee.

99.12 EUR: Total amount we'll convert

4.56295: Guaranteed exchange rate

Recipient gets: 452.28 MYR

Here you can already see the fees, the exchange and how much you're getting.

And yes, I will get MYR452.28 in my local CIMB account, no additional fees or charges by banks.

QUOTE

Transfer USD : If let say a person pay me (transfer me) 100 USD into my WISE account.

Receiving USD : How much do I receive then ? Can I say the amount could be lesser than 100 USD because there are some fee ? Or I will receive exact 100 USD into my WISE account ?

If the person is transferring from a US account to your WISE US account, and presumably there is

free transfer among US banks/institutiosn, then you should get 100 USD in your WISE

US account. At least that's my experience with Euro. I have another Euro account, and I top up my Wise account to use as prepaid card. Thanks to EU regulations, transfer between EU accounts are free. So I transfer 100 euro from my own EU account to my Wise EU account, no fees. But withdrawing from my Wise EU account does have some fees, but I never withdraw and just use it as prepaid card. And of course I also top up my WISE EU account, to send back as MYR occasionally.

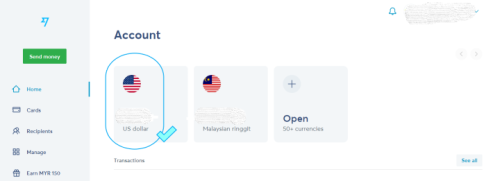

You need to be aware that Wise is a multi-currency account. You need to "open" an account for each country you're interested.

That's why I always specify Wise US account. If you go to the Wise website, you can see images with different country flags in the app - each flag represent an account.

E.g. a person can hold:

100 USD

150 Euro

50 in SGD

200 GBP

All at the same time, within the Wise app. There is not just one WISE account, but it depends on how many account/countries you wish to open (AFAIK it's one account per country).

For me and likely for you, there is no need to open a Wise MY account since we already have a local bank. In your case, you would need to tap and "open" a US account within Wise first, which will give you the US account details you can forward to the sender in US.

However, if for example you opena GBP (UK) account in your WISE app and you give this UK account details to your friend in US, then there could be bank charges since the bank in US is paying in USD to a UK account.

QUOTE

then proceed to transfer from my WISE Account to local bank account (cimb), this will use Wise's rate am I right ?

From your WISE US account to your local MY CIMB account, that is correct.

QUOTE

Do you know usually how long the request after we transfer from wise account to local bank account ?

I'm not sure about US -> MY, I've only done Euro to MYR. The first transaction might take longer, but these days for me it's usually 1 business day. Actually no, since last year I think it's within minutes for me.

Edit: btw, I can provide you with a referral code before you sign up so you can waive the transfer fees for your first transfer.

This post has been edited by jonoave: Oct 13 2022, 07:56 PM

Oct 13 2022, 03:13 PM

Oct 13 2022, 03:13 PM

Quote

Quote

0.0245sec

0.0245sec

0.61

0.61

6 queries

6 queries

GZIP Disabled

GZIP Disabled