.

This post has been edited by _gmsk: Dec 20 2024, 09:47 PM

Wise (Transferwise) Malaysia Discussion, v1.0

Wise (Transferwise) Malaysia Discussion, v1.0

|

|

Nov 22 2024, 07:50 PM Nov 22 2024, 07:50 PM

|

Newbie

22 posts Joined: Mar 2018 |

.

This post has been edited by _gmsk: Dec 20 2024, 09:47 PM |

|

|

|

|

|

Nov 23 2024, 02:11 PM Nov 23 2024, 02:11 PM

|

Senior Member

2,027 posts Joined: Jan 2003 From: PJ |

QUOTE(alexkos @ Nov 22 2024, 11:05 AM) If I use wise card at local Maybank will kena RM1 fee? No. Done many times - no RM 1 charge for withdrawal.I read from wise max 1k withdrawal no charge, but not sure if our local banks will eat RM1 or not alexkos liked this post

|

|

|

Nov 23 2024, 02:21 PM Nov 23 2024, 02:21 PM

Show posts by this member only | IPv6 | Post

#2703

|

Senior Member

2,275 posts Joined: Jun 2010 |

|

|

|

Nov 23 2024, 02:40 PM Nov 23 2024, 02:40 PM

|

Senior Member

3,488 posts Joined: Jan 2003 |

alexkos should've told us your intention so we can advise you better. if your maybank debit card is charging you RM8 annually, just go to bank and change to FOC type. Wise is not a bank and my wise acct has RM0.00

QUOTE(Ramjade @ Jan 7 2019, 08:44 AM) For maybank, yes. Walk in and convert to free account. Need to sign. Keep in mind the no of withdrawal restriction or free account. furthermore, GX bank now has free MEPS fee until mid-2025This post has been edited by Medufsaid: Nov 23 2024, 04:31 PM |

|

|

Nov 23 2024, 03:31 PM Nov 23 2024, 03:31 PM

|

Senior Member

2,027 posts Joined: Jan 2003 From: PJ |

QUOTE(alexkos @ Nov 23 2024, 02:21 PM) Just remember to stick with the limit for cash withdrawals alexkos liked this post

|

|

|

Nov 29 2024, 03:00 PM Nov 29 2024, 03:00 PM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

FT Wise

Wise rebuked by European watchdog over money laundering controls Regulatory review in 2022 found fintech lacked proof of address for hundreds of thousands of customers https://www.ft.com/content/db1fa3d5-ebe7-46...b2-d4ea3f1e1027 QUOTE European regulators rebuked Wise, the London-listed fintech, over its anti-money laundering controls and forced the payments group into a formal remediation plan, according to five people familiar with the matter. This post has been edited by TOS: Nov 29 2024, 03:01 PMA review by the Belgian National Bank, which supervises Wise in Europe, found in early 2022 that the fintech lacked proof of address for hundreds of thousands of customers, said three of the people. As a result, Wise devised a remediation plan, approved by the regulator, that required it to contact all of the customers in a matter of weeks to request their proof of address, the three people said. The plan also required it to freeze the accounts of customers who did not provide the documents in time, they added. The probe highlights the challenges for fast-growing fintechs looking to scale up their anti-financial crime capabilities while balancing user experience with adequate risk controls. Wise, formerly known as TransferWise, allows customers to send fast payments across borders at a cheap rate. Many of its customers use its service to send large sums across borders to buy property. Wise said it took “its responsibility to protect its customers and prevent money laundering very seriously”. “In 2021, the National Bank of Belgium carried out a routine review of Wise Europe as part of a marketwide exercise in the wake of Brexit. We worked closely with our regulator in Belgium and have fully implemented their recommendations.” The Belgian National Bank declined to comment. To cope with the scale of the task, Wise moved some of its customer service staff to its anti-financial crime function and experienced a jump in queries from customers, said two people familiar with Wise’s efforts. “Around a third of our global team is dedicated to fighting financial crime and helping to ensure that we are in compliance with the requirements of the more than 65 regulatory licences that we maintain around the world,” Wise said. Wise implemented the remediation plan in the weeks that followed Russia’s invasion of Ukraine, which led the EU to put sanctions on many individuals connected to Russian President Vladimir Putin’s regime. One person familiar with the process said that the company had been presented with the findings of the probe before the start of the war. Later that year, Wise received a $360,000 fine from the United Arab Emirates’ financial regulator over failures in its anti-money laundering controls including its due diligence for high-risk customers. In 2023, the UK’s Office of Financial Sanctions Implementation disclosed that Wise had allowed the account of a company owned by an individual on the country’s Russia sanctions list to transfer £250. The group also paused the onboarding of its UK and European business customers last year, with then-interim chief executive Harsh Sinha telling the FT that Wise had not anticipated the degree of extra due diligence that would be required following the wave of sanctions stemming from Russia’s invasion of Ukraine. Wise listed in London in 2021 at a £9bn valuation, a move that was hailed as a vote of confidence in the UK market, which has long struggled to compete with New York as a destination for fast-growing tech companies. |

|

|

|

|

|

Dec 14 2024, 12:13 AM Dec 14 2024, 12:13 AM

Show posts by this member only | IPv6 | Post

#2707

|

Junior Member

61 posts Joined: Jun 2007 |

Hi, can we top up our Wise account using debit card? I newly activated my account but the option to add money using debit or credit card is not activated. Only FPX and manual bank transfer is possible for me. Also, anyone has tried top up Wise with multi currency debit card? Any charges by Wise if transfer foreign currency directly in to the same currency account in Wise via the multi currency debit card? This post has been edited by on2920: Dec 14 2024, 12:15 AM laymank liked this post

|

|

|

Dec 14 2024, 01:51 AM Dec 14 2024, 01:51 AM

|

Senior Member

3,488 posts Joined: Jan 2003 |

on2920 if you are on Wise Malaysia, you can never deposit money from debit card into Wise what Multi currency debit card do you have? on2920 liked this post

|

|

|

Dec 14 2024, 03:16 PM Dec 14 2024, 03:16 PM

Show posts by this member only | IPv6 | Post

#2709

|

Senior Member

2,115 posts Joined: Mar 2009 |

QUOTE(moonsatelite @ Apr 17 2024, 12:45 PM) free, use UOB ATM's or Maybank ATM's (harder to find) Is this still valid, if I have SGD in wise account already, i just withdraw from the atm right, anything i need to take note like choose decline conversion etc?do not use OCBC nor DBS/ POSB ATM's, they charge $5 - $8 SGD per withdrawal i saw that you have already opened a Singapore bank account, why not use their debit card from the bank you applied for or you have yet to obtain the debit card Edit: if you are withdrawing with a Malaysian debit card or any non Singaporean debit card, please choose "Decline Conversion" UOB offers their own conversion which is SGD $50 for MYR 182.50 i performed a withdraw via GXBank Debit Card, SGD $50 for MYR 177 or MYR 175.80, performed ATM withdrawals on 2 separate days |

|

|

Dec 14 2024, 09:15 PM Dec 14 2024, 09:15 PM

|

Junior Member

737 posts Joined: Mar 2016 |

|

|

|

Dec 14 2024, 10:08 PM Dec 14 2024, 10:08 PM

Show posts by this member only | IPv6 | Post

#2711

|

Junior Member

61 posts Joined: Jun 2007 |

|

|

|

Dec 17 2024, 07:47 AM Dec 17 2024, 07:47 AM

|

Senior Member

2,115 posts Joined: Mar 2009 |

QUOTE(w1z4rd @ Jun 19 2022, 05:13 PM) Yes, tried at UOB atm. they will ask which account to withdraw from(savings, current, credit card cash advance). I just chose credit card cash advance. no withdrawal fee if still within your atm withdrawal limit (less than RM1000 equivalent in foreign currency / twice a month) means withdraw 100 sgd, they deduct 100 sgd from your wise account, that's it. QUOTE(moonsatelite @ Apr 17 2024, 12:45 PM) free, use UOB ATM's or Maybank ATM's (harder to find) So we should choose credit card cash advance as account to withdraw from instead of savings/current?do not use OCBC nor DBS/ POSB ATM's, they charge $5 - $8 SGD per withdrawal i saw that you have already opened a Singapore bank account, why not use their debit card from the bank you applied for or you have yet to obtain the debit card Edit: if you are withdrawing with a Malaysian debit card or any non Singaporean debit card, please choose "Decline Conversion" UOB offers their own conversion which is SGD $50 for MYR 182.50 i performed a withdraw via GXBank Debit Card, SGD $50 for MYR 177 or MYR 175.80, performed ATM withdrawals on 2 separate days Thanks This post has been edited by adam1190: Dec 17 2024, 07:47 AM |

|

|

Jan 8 2025, 02:03 PM Jan 8 2025, 02:03 PM

|

Junior Member

472 posts Joined: Jul 2006 |

Hi All,

Is the ATM withdrawal pin 4 digit? I forget that I've set it in the past but from the app I can see my pin is 4 digit. How do I change my pin number to 6 digit and whether that's possible? |

|

|

|

|

|

Jan 8 2025, 08:11 PM Jan 8 2025, 08:11 PM

Show posts by this member only | IPv6 | Post

#2714

|

Junior Member

663 posts Joined: Jun 2017 |

QUOTE(Sitting Duck @ Jan 8 2025, 02:03 PM) Hi All, in UK, they use 4 digit pin. Wise coming from there, follow the system. Cannot change to 6 digit pin.Is the ATM withdrawal pin 4 digit? I forget that I've set it in the past but from the app I can see my pin is 4 digit. How do I change my pin number to 6 digit and whether that's possible? Sitting Duck and plantcloner liked this post

|

|

|

Jan 12 2025, 02:53 PM Jan 12 2025, 02:53 PM

Show posts by this member only | IPv6 | Post

#2715

|

Junior Member

22 posts Joined: Aug 2016 |

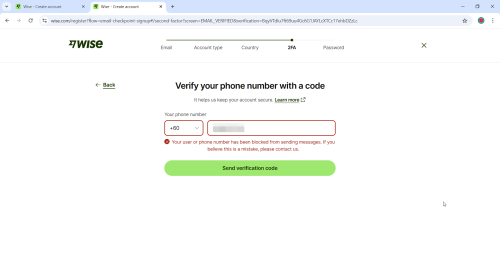

QUOTE(OoiTY @ Nov 18 2024, 12:07 AM) Hey guys, ran into a problem when trying to register for wise for the first time. When I get to the page where they ask for the phone number, it gives me an error message saying that my number has been blocked? Anyone encounter this problem before? I was trying to register yesterday and came across the same error ("Your user or phone number has been blocked from sending messages. If you believe this is a mistake, please contact us"). Did you manage to get it resolved? If yes, how did you get it resolved?I used their contact form to send an email to customer support and I'm still waiting for their reply. I also tried calling their Malaysia phone number but the person told me only the email team can fix the issue.  ------ Update Got an email reply after ~2.5 days and the issue was resolved for me (yay!) p/s: I did get another email much earlier i.e. within 10 minutes or so after submitting the contact form. But it read like an automated reply. I did reply to that first email explaining that I tried calling them and the person on the phone couldn't resolve my issue. This post has been edited by milo.dinosaur: Jan 14 2025, 12:20 AM |

|

|

Jan 13 2025, 11:45 PM Jan 13 2025, 11:45 PM

|

Junior Member

501 posts Joined: Apr 2020 |

I have MYR and USD in the account. It states total RM 600. So if I go to ATM I can withdraw all RM 600? Or only the one with myr

|

|

|

Jan 14 2025, 12:05 AM Jan 14 2025, 12:05 AM

|

Senior Member

3,488 posts Joined: Jan 2003 |

HumbleBF it'll auto-convert. unless you accidentally lock your USD or MYR in a wise jar

|

|

|

Jan 17 2025, 10:38 AM Jan 17 2025, 10:38 AM

|

Junior Member

918 posts Joined: Aug 2009 |

I've been reading many TS recommending to use Wise card for overseas trip. Just curious is the rate really that competitive? Not comparing to credit card, usually I go for the old fashioned way of exchange foreign currency notes prior my oversea trip. Just curious if this is as good as bringing cash then I don't have to bring so much cash or go to exchange the notes before flying.

|

|

|

Jan 17 2025, 10:42 AM Jan 17 2025, 10:42 AM

|

Senior Member

3,488 posts Joined: Jan 2003 |

starry-starry can always compare the rates online. for

|

|

|

Jan 17 2025, 10:48 AM Jan 17 2025, 10:48 AM

|

Junior Member

918 posts Joined: Aug 2009 |

QUOTE(Medufsaid @ Jan 17 2025, 10:42 AM) starry-starry can always compare the rates online. for Thanks for sharing the links, very helpful!

I couldn't seem to find TWD in Wise, is it unavailable since it is not listed? ps: okay, did a quick search and many already mentioned NTD is not in the list but somehow able to use wise, need to read more first... For those who have travelled to Taiwan, would you recommend to use Wise or bring cash better? This post has been edited by starry-starry: Jan 17 2025, 10:54 AM |

| Change to: |  0.0184sec 0.0184sec

0.36 0.36

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 4th December 2025 - 08:28 AM |