QUOTE(!@#$%^ @ Jan 18 2022, 03:53 PM)

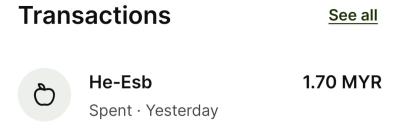

Unfortunately, processing costs for card payments have gone up over the past few months. We need to raise our fees to cover the new costs.

This will mean an increase of 0.09% when you transfer money and pay with a credit or debit card.

You’ll see these new fees starting 18/03/2022.

We know that this isn’t great news, and we’re sorry about that. Our mission is to charge our customers as little as possible and we’ll bring our fees back down as soon as we can.

I tried to find an article or circulation for this but I cannot find it, is this even true?This will mean an increase of 0.09% when you transfer money and pay with a credit or debit card.

You’ll see these new fees starting 18/03/2022.

We know that this isn’t great news, and we’re sorry about that. Our mission is to charge our customers as little as possible and we’ll bring our fees back down as soon as we can.

Jan 18 2022, 04:08 PM

Jan 18 2022, 04:08 PM

Quote

Quote

0.0314sec

0.0314sec

0.39

0.39

7 queries

7 queries

GZIP Disabled

GZIP Disabled