QUOTE(Medufsaid @ Jan 17 2025, 10:58 AM)

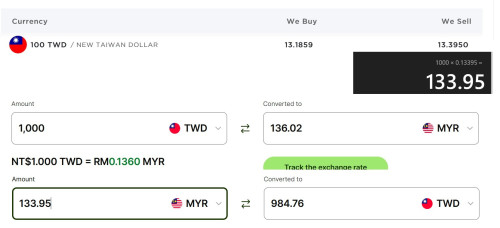

u can spend TWD in wise, but you cannot hold TWD cash balance in wise. that page is to show what currencies u can hold as immediate cash in your wise acct

i also can recommend you GX bank debit card, there's 1% rebate for international purchases

QUOTE(touristking @ Jan 17 2025, 11:24 AM)

Yes. Rates are comparable plus cash back. Best to bring both because for some unknown reason, it can stop working suddenly and then work again.

Honestly, I don't have both cards...That's the reason why I'd like to explore which is better and more convenient.

So i guess if I apply for these 2 cards, I don't have to bring my CC anymore right? Hmm... which one is actually better? GX debit card works the same as Wise cars too?

QUOTE(Takudan @ Jan 18 2025, 01:20 AM)

Competitive? Not always. There were times cash exchange at certain shops win Wise rates. I guess it's more of an easy win if compared to local credit cards, which charge like 2%(?) for every overseas transaction, on top of shitty exchange rate, so there I'd say Wise is a decent replacement.

Old fashioned way is always a good alternative because cash is king:

- some places may not support digital/card payment

- you may not have (stable) internet access

- you may lose access to your account (connection/theft, touch wood)

But of course, too much cash on hand also induces anxiety so best is to diversify and put your money in several "pockets".

Never been to Taiwan yet but I make it my personal rule of thumb to have both when travelling to any country, and try not to have too much cash. As Meduf

said

, excess in Wise is easily convertible/transferrable for reuse, but cash would mean going back to the shop.

Alright, that was what I thought too but somehow get used to cashless, wish to bring lesser cash during oversea travel..

QUOTE(touristking @ Jan 18 2025, 09:24 AM)

Like others has suggested. For overseas, bring both Wise and GX, Generally speaking, both beat normal credit cards hands down.

I do bring cash but minimal amount as backup, just in case. Normally USD because is the most convenient anywhere around the world. It is amazing how widely accepted are USD in South America.

QUOTE(plantcloner @ Jan 18 2025, 01:58 PM)

If you have apple pay or google pay working (NFC phone needed, I think), you can add Wise debit card to them. I did just that in Nov 2024 in TW and had no issue paying wherever that ApplePay/Google Pay was accepted.

So was it worth it spending via Wise card? Since we can't hold NTD in Wise, how does the conversion work? I don't even have this wise card yet, hope my question doesn't sound too dumb.

Jan 17 2025, 10:38 AM

Jan 17 2025, 10:38 AM

Quote

Quote

0.0575sec

0.0575sec

0.36

0.36

7 queries

7 queries

GZIP Disabled

GZIP Disabled