QUOTE(Soul Seeker @ Apr 5 2024, 02:13 AM)

Yes second that, except the spread are so huge i dont see the needs of overthinking about it. Sometime there are much more important thing for us to focus on.

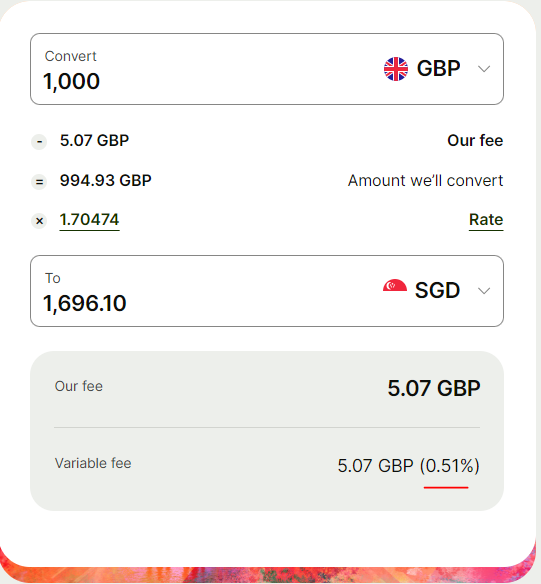

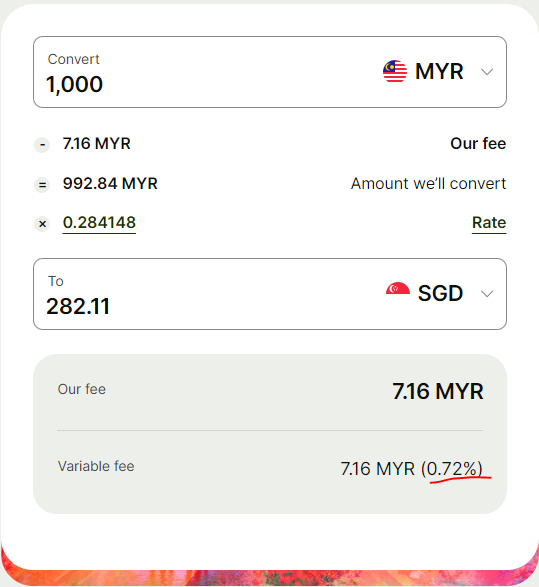

For me i just use wise oversea , makes my life much more easier than go to mv for exchanging notes. Not to mention the time spend on travelling there , search for parking and sometime the long queue.

True, but be warned for countries that do not fully support cashless, or in case card system or internet is down, having cash is always your best bet (diversification). Using Wise at overseas ATM to withdraw cash may have extra fees (some may even be percentage based??) imposed by the overseas bank (to my understanding, that fee is similar to how if you use a card of a different bank to that ATM like CIMB card on Maybank ATM). So consider avoiding unless you know the country/bank system well.

QUOTE(Medufsaid @ Apr 7 2024, 08:27 AM)

i linked my google pay to my virtual wise debit card number, no issues whatsoever. no physical card to insert into ATM also

yup. daily S$0.60 surcharge

QUOTE(ericlaiys @ Apr 7 2024, 09:46 AM)

the card need to use pin once before u can paywave. it is mandatory.

administration fees is common when use oversea

Hey folks, may I know how does this admin fee show in your transaction details? So far I've always preconverted my MYR to the currency I want for my upcoming travels, so every transaction overseas I'm just charged by the same currency, there's no extra. Curious to know how the fees add up and all.

Apr 7 2024, 08:27 AM

Apr 7 2024, 08:27 AM

Quote

Quote

0.0261sec

0.0261sec

0.83

0.83

6 queries

6 queries

GZIP Disabled

GZIP Disabled