QUOTE(Yamcookies66 @ Jul 3 2020, 08:45 AM)

Haha you're right. RM30 difference seems little, but the premium will increase a bit from time to time right...

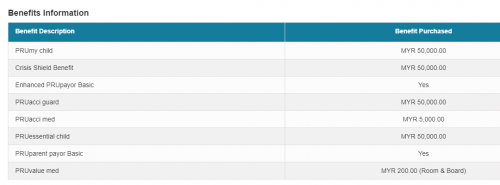

Also, I'm working full time now and my company provides insurance benefits of RM5,000 per year, but after 2 years I plan to quit my job and work as a freelancer. Thus, I'm thinking of taking RM5,000 deductible for these 2 years and I plan to not make any claims for 2 years. However the agent from Company B advised me to take non-deductible now. He said if I take deductible for these 2 years, and then upon switching back to non-deductible, the premium will be higher.

I could not make any sense of it. Is it true?

When you change your plan from deductible to non-deductible, you have to re-declare your health status, if you got health problem by then so sorry you won't be able to make the changes and have to stick with your deductible plan, if your deductible is very high then you have to always fork out that amount whenever you get admitted before the balance is paid by the insurance company.Also, I'm working full time now and my company provides insurance benefits of RM5,000 per year, but after 2 years I plan to quit my job and work as a freelancer. Thus, I'm thinking of taking RM5,000 deductible for these 2 years and I plan to not make any claims for 2 years. However the agent from Company B advised me to take non-deductible now. He said if I take deductible for these 2 years, and then upon switching back to non-deductible, the premium will be higher.

I could not make any sense of it. Is it true?

Let me guess Company A - Pru, Company B - Allianz

Jul 3 2020, 09:42 AM

Jul 3 2020, 09:42 AM

Quote

Quote

0.0195sec

0.0195sec

0.29

0.29

6 queries

6 queries

GZIP Disabled

GZIP Disabled