QUOTE(Bearberry @ Jul 1 2020, 04:07 PM)

Is Personal Accident another type of rider like CI? Does it mean that if I got into an accident (touch wood), it will provide a payout?

Not required at the moment but I can still add the rider in future if I need it right?

Hi ckdenion. The payout for CI is only applicable after the patient is discharged is it? I have another question though. For female illnesses, it's not covered in any Medical Card right?

Sorry but what is the main difference between standalone and term life insurance?

Not required at the moment but I can still add the rider in future if I need it right?

Hi ckdenion. The payout for CI is only applicable after the patient is discharged is it? I have another question though. For female illnesses, it's not covered in any Medical Card right?

Sorry but what is the main difference between standalone and term life insurance?

QUOTE

Is Personal Accident another type of rider like CI? Does it mean that if I got into an accident (touch wood), it will provide a payout?

Yes personal accident is a rider that you can add on. It basically pays out if there is loss of limbs, accidental Death and injuries sustained from accidents.

QUOTE

Not required at the moment but I can still add the rider in future if I need it right?

You may add on any rider in the future subject to your health status at that later time.

QUOTE

The payout for CI is only applicable after the patient is discharged is it? I have another question though. For female illnesses, it's not covered in any Medical Card right?

Yes payout for CI will normally have a survival clause which is somewhere around 30 days from the incident.

Female illness or should I say anything related to hospitalization is covered by medical card but if you need extra pocket money to sustain your lifestyle then a female specific illness plan will help to provide that extra financial support.

QUOTE

Sorry but what is the main difference between standalone and term life insurance?

Standalone or term insurance is the same. You normally can't add on rider on it, it doesn't have any investment elements and you pay only the cost of insurance for the coverage. You may sometimes get to specify your term of coverage ie Life insurance but not applicable for medical insurance in this case.

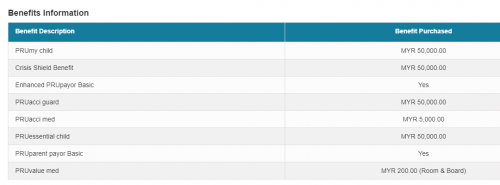

You may choose an ILP investment link policy insurance where you have a basic death benefit where you can add on riders such as

Critical illness

Personal accident

Hospital & surgical benefit

Waiver of premium

Etc.

Cheers.

This post has been edited by lifebalance: Jul 1 2020, 04:25 PM

Jul 1 2020, 04:22 PM

Jul 1 2020, 04:22 PM

Quote

Quote

0.0281sec

0.0281sec

0.56

0.56

6 queries

6 queries

GZIP Disabled

GZIP Disabled