Outline ·

[ Standard ] ·

Linear+

Banking Privilege$aver by Standard Chartered, up to 4.75%, Seems like so few people talk about it

|

GrumpyNooby

|

Jul 12 2020, 08:30 AM Jul 12 2020, 08:30 AM

|

|

1. PSA or Super Salary-i (Payroll) must have a debit card tagged for it. - Clause 15

2. Spending on credit card must be min RM 1k within the month (not according to credit card statement month).

|

|

|

|

|

|

mamamia

|

Jul 12 2020, 10:10 AM Jul 12 2020, 10:10 AM

|

|

QUOTE(Tronoh @ Jul 11 2020, 11:42 PM) I spend 1k on my credit card. I already got a hunch that if i go for Islamic PSA, the spend must be on debit card as shown in website. I specifically asked the banker last month when I apply for PSA, he said credit card also can. aiya. looks like I have to go to branch and migrate my PSA to non Islamic one. or if anyone knows how I can do it online, I'd appreciate it. I believe u need to spend on credit card.. but to get the card spending bonus interest, u must have debit card that link to the acc.. But, where did u see this that the spend must be on debit card? Bcoz what I see is u must spend on credit card and not debit card..Can share the link? This post has been edited by mamamia: Jul 12 2020, 10:11 AM |

|

|

|

|

|

TheEquatorian

|

Jul 12 2020, 07:30 PM Jul 12 2020, 07:30 PM

|

|

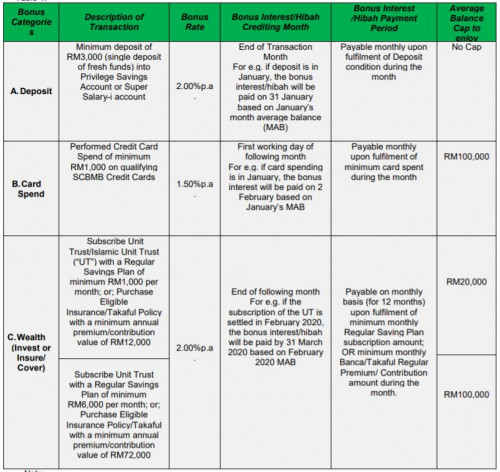

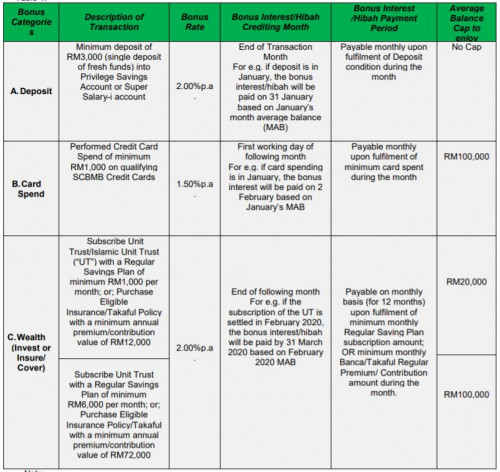

QUOTE(GrumpyNooby @ Jun 5 2020, 10:43 PM)  Refer to the table to understand when each category of interest will be credited into account. The 2% without any cap on amount must be one of the best deals in town! |

|

|

|

|

|

LostAndFound

|

Jul 12 2020, 08:37 PM Jul 12 2020, 08:37 PM

|

|

I'm holding the Islamic account for this as I just happened to apply for it in a Saadiq branch. Can confirm that spending must be on a Stan Chart credit card (I've never spent from my debit card). And must be AFTER opening the account, spend from before is not counted.

|

|

|

|

|

|

cclim2011

|

Jul 13 2020, 07:04 PM Jul 13 2020, 07:04 PM

|

|

hi guys, i think someone mentioned on how to delete future recurring bank transfer (from psa) but couldnt search it. can anyone help? thanks.

|

|

|

|

|

|

mamamia

|

Jul 13 2020, 07:25 PM Jul 13 2020, 07:25 PM

|

|

QUOTE(cclim2011 @ Jul 13 2020, 07:04 PM) hi guys, i think someone mentioned on how to delete future recurring bank transfer (from psa) but couldnt search it. can anyone help? thanks. Go to transfer history, Look for ur future transfer txn, click on the date to edit/ delete |

|

|

|

|

|

cclim2011

|

Jul 13 2020, 07:53 PM Jul 13 2020, 07:53 PM

|

|

QUOTE(mamamia @ Jul 13 2020, 07:25 PM) Go to transfer history, Look for ur future transfer txn, click on the date to edit/ delete got it. tq. |

|

|

|

|

|

TheEquatorian

|

Jul 14 2020, 04:08 PM Jul 14 2020, 04:08 PM

|

|

On the card spend portion, the T&C states retail transactions. I have my maintenance fee as monthly charge on the card. Will that count as a valid card transaction?

|

|

|

|

|

|

wyh

|

Jul 14 2020, 10:04 PM Jul 14 2020, 10:04 PM

|

|

QUOTE(TheEquatorian @ Jul 14 2020, 04:08 PM) On the card spend portion, the T&C states retail transactions. I have my maintenance fee as monthly charge on the card. Will that count as a valid card transaction? yes is a transaction. |

|

|

|

|

|

GrumpyNooby

|

Jul 15 2020, 08:30 PM Jul 15 2020, 08:30 PM

|

|

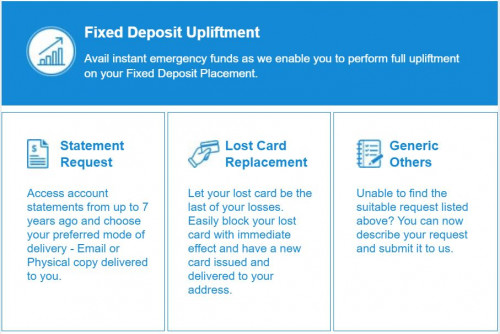

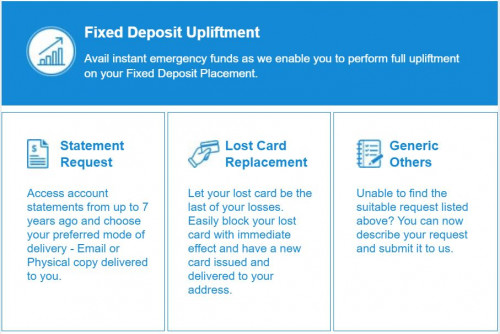

Take full control of your finances right at your fingertips. Have a look:  |

|

|

|

|

|

majorarmstrong

|

Jul 25 2020, 12:17 AM Jul 25 2020, 12:17 AM

|

|

Just heard that 3.6 will cut down to 2.6 starting September

Anyone hear anything?

|

|

|

|

|

|

GrumpyNooby

|

Jul 25 2020, 07:59 AM Jul 25 2020, 07:59 AM

|

|

QUOTE(majorarmstrong @ Jul 25 2020, 12:17 AM) Just heard that 3.6 will cut down to 2.6 starting September Anyone hear anything? 2.6% pa is still a decent number. |

|

|

|

|

|

majorarmstrong

|

Jul 25 2020, 10:22 AM Jul 25 2020, 10:22 AM

|

|

QUOTE(GrumpyNooby @ Jul 25 2020, 07:59 AM) 2.6% pa is still a decent number. At least very liquid lo |

|

|

|

|

|

!@#$%^

|

Jul 25 2020, 11:09 AM Jul 25 2020, 11:09 AM

|

|

the key is how it does compare to its peers

|

|

|

|

|

|

majorarmstrong

|

Jul 25 2020, 11:29 AM Jul 25 2020, 11:29 AM

|

|

QUOTE(!@#$%^ @ Jul 25 2020, 11:09 AM) the key is how it does compare to its peers better than ocbc 360 lo |

|

|

|

|

|

monkey9926

|

Jul 27 2020, 08:56 AM Jul 27 2020, 08:56 AM

|

Getting Started

|

QUOTE(TheEquatorian @ Jul 12 2020, 07:30 PM) The 2% without any cap on amount must be one of the best deals in town! i choose the 2% no cap over the 2% invest 6k and cap at 100k. but i din to the math to verify. |

|

|

|

|

|

zenquix

|

Jul 29 2020, 02:18 AM Jul 29 2020, 02:18 AM

|

|

QUOTE(majorarmstrong @ Jul 25 2020, 12:17 AM) Just heard that 3.6 will cut down to 2.6 starting September Anyone hear anything? just got the same mesg from a bank staff save bonus is going to be capped at 200k @ 1.5% credit card spend @ 1% |

|

|

|

|

|

GrumpyNooby

|

Jul 29 2020, 06:31 AM Jul 29 2020, 06:31 AM

|

|

QUOTE(zenquix @ Jul 29 2020, 02:18 AM) just got the same mesg from a bank staff save bonus is going to be capped at 200k @ 1.5% credit card spend @ 1% This is huge reduction but well, it's bounded to happen. |

|

|

|

|

|

GrumpyNooby

|

Jul 29 2020, 06:52 PM Jul 29 2020, 06:52 PM

|

|

Notice – Standard Chartered Mobile App Forced Upgrade to Latest VersionPlease be informed that effective 29th July 2020, we will introduce new/enhanced features in our Malaysia SC Mobile App as part of our continuous efforts to provide the best mobile banking experience to all our clients. https://av.sc.com/my/content/docs/sc-mobile...ced-upgrade.pdf

|

|

|

|

|

|

monkey9926

|

Jul 29 2020, 10:08 PM Jul 29 2020, 10:08 PM

|

Getting Started

|

QUOTE(GrumpyNooby @ Jul 29 2020, 06:31 AM) This is huge reduction but well, it's bounded to happen. no more fun |

|

|

|

|

Jul 12 2020, 08:30 AM

Jul 12 2020, 08:30 AM

Quote

Quote

0.0266sec

0.0266sec

0.72

0.72

6 queries

6 queries

GZIP Disabled

GZIP Disabled