Outline ·

[ Standard ] ·

Linear+

Banking Privilege$aver by Standard Chartered, up to 4.75%, Seems like so few people talk about it

|

GrumpyNooby

|

Mar 2 2021, 03:35 PM Mar 2 2021, 03:35 PM

|

|

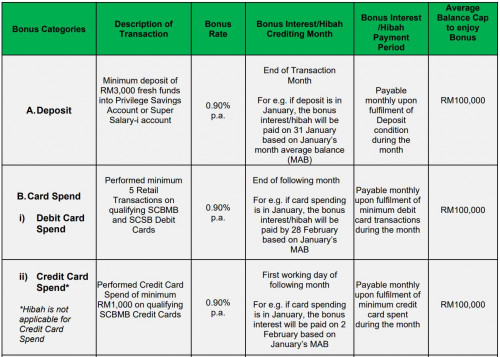

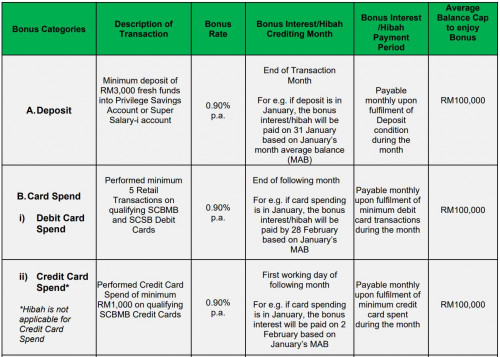

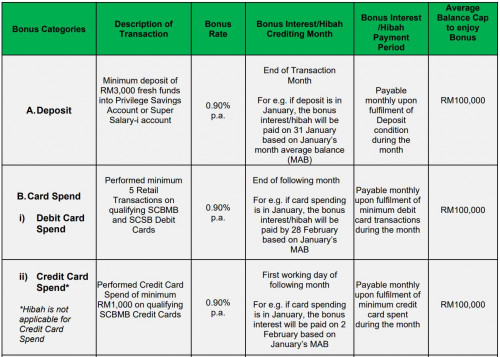

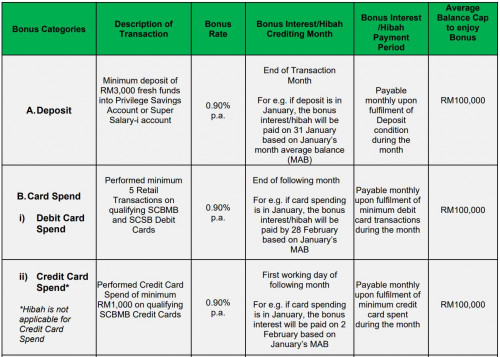

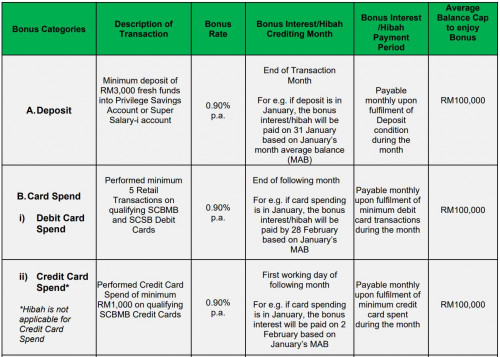

QUOTE(Batusai @ Mar 2 2021, 03:33 PM) 69.04 is for CC spend. The 0.9% max out only at 100k. So RM900 P.A divided by 365 days, its RM2.465 times with 28 days (Feb) = RM69.04 I thought save bonus interest is also capped at RM 100k.  https://av.sc.com/my/content/docs/my-privilegesaver-tcs.pdfThis post has been edited by GrumpyNooby: Mar 2 2021, 03:38 PM https://av.sc.com/my/content/docs/my-privilegesaver-tcs.pdfThis post has been edited by GrumpyNooby: Mar 2 2021, 03:38 PM |

|

|

|

|

|

Batusai

|

Mar 2 2021, 03:39 PM Mar 2 2021, 03:39 PM

|

|

QUOTE(GrumpyNooby @ Mar 2 2021, 03:35 PM) I thought save bonua interest also capped at RM 100k. oh yeah. its in the new TnC is it? If I remember correctly, before this new TnC the save bonus is not capped? my save bonus was more than RM70.82 though. This post has been edited by Batusai: Mar 2 2021, 03:40 PM |

|

|

|

|

|

GrumpyNooby

|

Mar 2 2021, 03:41 PM Mar 2 2021, 03:41 PM

|

|

QUOTE(Batusai @ Mar 2 2021, 03:39 PM) oh yeah. its in the new TnC is it? If I remember correctly, before this new TnC the save bonus is not capped? my save bonus was more than RM70.82 though. Before revision it was capped at RM200k. |

|

|

|

|

|

Batusai

|

Mar 2 2021, 03:43 PM Mar 2 2021, 03:43 PM

|

|

QUOTE(GrumpyNooby @ Mar 2 2021, 03:41 PM) Before revision it was capped at RM200k. ah yes, probably some error in Feb? where the cap was still 200k and not adjusted to 100k for save bonus. |

|

|

|

|

|

cclim2011

|

Mar 2 2021, 03:59 PM Mar 2 2021, 03:59 PM

|

|

QUOTE(Batusai @ Mar 2 2021, 03:43 PM) ah yes, probably some error in Feb? where the cap was still 200k and not adjusted to 100k for save bonus. oh okok. forgot about there some save interest after 100k (previously). always tried to have ~=100k monthly earlier. |

|

|

|

|

|

MGM

|

Mar 2 2021, 04:11 PM Mar 2 2021, 04:11 PM

|

|

QUOTE(cclim2011 @ Mar 2 2021, 03:59 PM) oh okok. forgot about there some save interest after 100k (previously). always tried to have ~=100k monthly earlier. U mean u consistently keep 100k in PSA every month? Arent there better product that gives >3%? |

|

|

|

|

|

cclim2011

|

Mar 2 2021, 04:37 PM Mar 2 2021, 04:37 PM

|

|

QUOTE(MGM @ Mar 2 2021, 04:11 PM) U mean u consistently keep 100k in PSA every month? Arent there better product that gives >3%? yaya. 100k monthly average (did some excel calculation, and will keep the same amount after 1st week or so. treating this as fd. 😁 my liquidity is still with ocbc360. i buy some shares and do fd only. happy to have bought some before the poker king last month. not familiar with other investments. 😂 |

|

|

|

|

|

GrumpyNooby

|

Mar 2 2021, 04:43 PM Mar 2 2021, 04:43 PM

|

|

QUOTE(cclim2011 @ Mar 2 2021, 04:37 PM) yaya. 100k monthly average (did some excel calculation, and will keep the same amount after 1st week or so. treating this as fd. 😁 my liquidity is still with ocbc360. i buy some shares and do fd only. happy to have bought some before the poker king last month. not familiar with other investments. 😂 Optimally is slightly above RM 100k. The rest will be at my salary account with UOB. |

|

|

|

|

|

Batusai

|

Mar 2 2021, 04:43 PM Mar 2 2021, 04:43 PM

|

|

QUOTE(MGM @ Mar 2 2021, 04:11 PM) U mean u consistently keep 100k in PSA every month? Arent there better product that gives >3%? what other products that give >3%? mind sharing? |

|

|

|

|

|

MGM

|

Mar 2 2021, 05:15 PM Mar 2 2021, 05:15 PM

|

|

QUOTE(cclim2011 @ Mar 2 2021, 04:37 PM) yaya. 100k monthly average (did some excel calculation, and will keep the same amount after 1st week or so. treating this as fd. 😁 my liquidity is still with ocbc360. i buy some shares and do fd only. happy to have bought some before the poker king last month. not familiar with other investments. 😂 QUOTE(Batusai @ Mar 2 2021, 04:43 PM) what other products that give >3%? mind sharing? I am using EPF n ASMx for passive income n >55yo. PSA, SSPN, Credit card, Ewallet n cheap credit for liquidity. This post has been edited by MGM: Mar 2 2021, 05:22 PM |

|

|

|

|

|

weiseang72

|

Mar 2 2021, 09:54 PM Mar 2 2021, 09:54 PM

|

|

any1 get both credit & debit spend 0.9% d? i seem like only get 0.9% but not sure under debit or credit, however i also got use 5 time for patrol in debit card.....

|

|

|

|

|

|

GrumpyNooby

|

Mar 2 2021, 09:56 PM Mar 2 2021, 09:56 PM

|

|

QUOTE(weiseang72 @ Mar 2 2021, 09:54 PM) any1 get both credit & debit spend 0.9% d? i seem like only get 0.9% but not sure under debit or credit, however i also got use 5 time for patrol in debit card..... Debit Card Spend Bonus will be credited by end of this month (31/3/2021).  This post has been edited by GrumpyNooby: Mar 2 2021, 09:56 PM This post has been edited by GrumpyNooby: Mar 2 2021, 09:56 PM |

|

|

|

|

|

wyh

|

Mar 3 2021, 02:15 PM Mar 3 2021, 02:15 PM

|

|

The retail spending interest bonus is based on transaction date or posting date ?

|

|

|

|

|

|

GrumpyNooby

|

Mar 3 2021, 02:16 PM Mar 3 2021, 02:16 PM

|

|

QUOTE(wyh @ Mar 3 2021, 02:15 PM) The retail spending interest bonus is based on transaction date or posting date ? Posted within the calendar month. |

|

|

|

|

|

David_Yang

|

Mar 5 2021, 08:10 PM Mar 5 2021, 08:10 PM

|

|

Debit card bonus interest not arrived yet.

|

|

|

|

|

|

GrumpyNooby

|

Mar 5 2021, 08:12 PM Mar 5 2021, 08:12 PM

|

|

QUOTE(David_Yang @ Mar 5 2021, 08:10 PM) Debit card bonus interest not arrived yet. By 31/3/2021  |

|

|

|

|

|

David_Yang

|

Mar 5 2021, 10:59 PM Mar 5 2021, 10:59 PM

|

|

QUOTE(GrumpyNooby @ Mar 5 2021, 09:12 PM) By 31/3/2021  Thanks! |

|

|

|

|

|

no6

|

Mar 7 2021, 11:33 PM Mar 7 2021, 11:33 PM

|

|

QUOTE(GrumpyNooby @ Mar 2 2021, 03:35 PM) regarding this SCB program, does it mean to allocate 100k in one of the saving account and getting 2.75% per annum by fulfilling the 3 criteria (deposit of 3k monthly, debit card & credit card) ? |

|

|

|

|

|

GrumpyNooby

|

Mar 8 2021, 06:02 AM Mar 8 2021, 06:02 AM

|

|

QUOTE(no6 @ Mar 7 2021, 11:33 PM) regarding this SCB program, does it mean to allocate 100k in one of the saving account and getting 2.75% per annum by fulfilling the 3 criteria (deposit of 3k monthly, debit card & credit card) ? Either Privilege Savings Account in conventional banking or Super Salary-i (Payroll) in Islamic Banking. Bpnus interest is capped at RM 100K. |

|

|

|

|

|

kakikopiluwak

|

Mar 8 2021, 08:49 AM Mar 8 2021, 08:49 AM

|

Getting Started

|

The 5 debit card spend transactions can be top ups to BigPay & eWallets?

|

|

|

|

|

Mar 2 2021, 03:35 PM

Mar 2 2021, 03:35 PM

Quote

Quote 0.0263sec

0.0263sec

0.45

0.45

6 queries

6 queries

GZIP Disabled

GZIP Disabled