QUOTE(??!! @ Jul 2 2020, 12:57 AM)

If ignoring the wealth/insurance portion extra 2%..what will be the optimum amount to put in this account to hit the 3.6% p.a.? 100k?

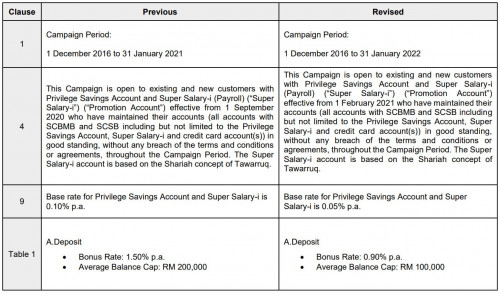

First 100k will entitle 3.6% p.a (0.1+2.0+1.5)Amount after the first 100k will entitle 2.1% p.a only.

Can refer back the tnc from previous page

So back to your question. To hit 3.6% p.a yes. Only 100k but monthly still need fresh funds 3k transaction 2.0% and spending 1k on SC credit card 1.5%

This post has been edited by Batusai: Jul 2 2020, 11:08 AM

Jul 2 2020, 01:30 AM

Jul 2 2020, 01:30 AM

Quote

Quote

0.0258sec

0.0258sec

0.71

0.71

7 queries

7 queries

GZIP Disabled

GZIP Disabled