In my opinion (layman), distribution can consider lock the profit, the amount we invest still the same but we get more units, once NAV increase, our investment get more return.

Opus Touch, Self-Service UT Platform

Opus Touch, Self-Service UT Platform

|

|

Aug 26 2020, 09:21 PM Aug 26 2020, 09:21 PM

|

Junior Member

524 posts Joined: May 2019 |

In my opinion (layman), distribution can consider lock the profit, the amount we invest still the same but we get more units, once NAV increase, our investment get more return.

|

|

|

|

|

|

Aug 26 2020, 09:39 PM Aug 26 2020, 09:39 PM

|

Senior Member

2,239 posts Joined: Aug 2009 |

|

|

|

Aug 27 2020, 03:50 AM Aug 27 2020, 03:50 AM

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(majorarmstrong @ Aug 26 2020, 09:11 PM) i am still very noob when come to income distribution YES, that is very true for the amount of money you have in a UT fund before or after distribution is (about) the same.to me i see got distribute no distribute is the same thing after distribute price drop so it is like same same QUOTE(majorarmstrong @ Aug 26 2020, 09:39 PM) that is why i cannot understand and i want to ask the question lo This is NOT correct....as after the dust of the distribution had been settled,...any movement in the NAV will affect the total amount of money in your UT fund.for example distribute 10 points the next day drop 9 points meaning up 1 point saja correct? if the next day, the NAV drops 0.9% your money will be impacted by 0.9% also if the next day, the NAV rises 0.1%, your money will be impacted by 0.1% also (as after the dust of the distribution had been settled, the amount of money you have in a UT fund before or after distribution is (about) the same.) |

|

|

Aug 27 2020, 05:21 AM Aug 27 2020, 05:21 AM

Show posts by this member only | IPv6 | Post

#1784

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(yklooi @ Aug 27 2020, 03:50 AM) YES, that is very true for the amount of money you have in a UT fund before or after distribution is (about) the same. I'm not going to explain anymore.This is NOT correct....as after the dust of the distribution had been settled,...any movement in the NAV will affect the total amount of money in your UT fund. if the next day, the NAV drops 0.9% your money will be impacted by 0.9% also if the next day, the NAV rises 0.1%, your money will be impacted by 0.1% also (as after the dust of the distribution had been settled, the amount of money you have in a UT fund before or after distribution is (about) the same.) I had explained many many times including examples quoted from experts at other fund houses. |

|

|

Aug 27 2020, 09:33 AM Aug 27 2020, 09:33 AM

|

Senior Member

2,239 posts Joined: Aug 2009 |

QUOTE(GrumpyNooby @ Aug 27 2020, 05:21 AM) I'm not going to explain anymore. read through many timesI had explained many many times including examples quoted from experts at other fund houses. read the link you quoted yet i still tak faham i even ask my son to explain to me he also google and show me some article still i tak faham |

|

|

Aug 27 2020, 09:40 AM Aug 27 2020, 09:40 AM

|

Senior Member

2,239 posts Joined: Aug 2009 |

IPF i thought income distribution

1.0976 - 1.0954 = 22 points drop |

|

|

|

|

|

Aug 27 2020, 10:41 AM Aug 27 2020, 10:41 AM

|

Junior Member

569 posts Joined: Aug 2020 |

QUOTE(yklooi @ Aug 27 2020, 03:50 AM) YES, that is very true for the amount of money you have in a UT fund before or after distribution is (about) the same. Assume IPF have total fund size of RM 1000, with RM 10 per unit so total 100 unit.This is NOT correct....as after the dust of the distribution had been settled,...any movement in the NAV will affect the total amount of money in your UT fund. if the next day, the NAV drops 0.9% your money will be impacted by 0.9% also if the next day, the NAV rises 0.1%, your money will be impacted by 0.1% also (as after the dust of the distribution had been settled, the amount of money you have in a UT fund before or after distribution is (about) the same.) If IPF want to declare dividend of RM 1 per unit. Does it mean after distribution, the total fund size will be RM 1000 also?(assuming the bond price is static not moving) So u mean that IPF no need to give tax to government for the dividend distribution? QUOTE(majorarmstrong @ Aug 27 2020, 09:33 AM) |

|

|

Aug 27 2020, 10:48 AM Aug 27 2020, 10:48 AM

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(AnasM @ Aug 27 2020, 10:41 AM) Assume IPF have total fund size of RM 1000, with RM 10 per unit so total 100 unit. Distribution that you received is nett and you're not required to pay income tax for it.If IPF want to declare dividend of RM 1 per unit. Does it mean after distribution, the total fund size will be RM 1000 also?(assuming the bond price is static not moving) So u mean that IPF no need to give tax to government for the dividend distribution? This post has been edited by GrumpyNooby: Aug 27 2020, 10:48 AM |

|

|

Aug 27 2020, 10:49 AM Aug 27 2020, 10:49 AM

|

Senior Member

8,188 posts Joined: Apr 2013 |

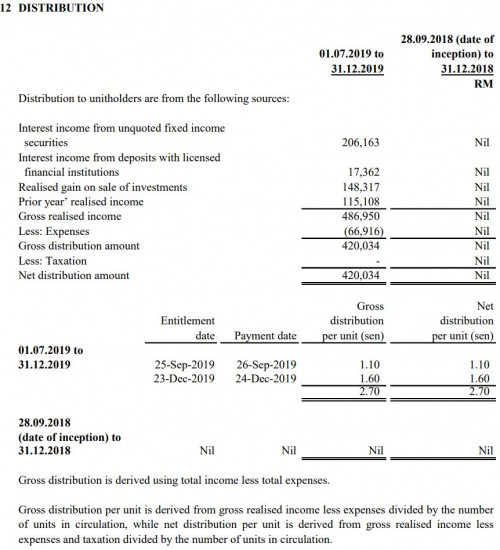

QUOTE(AnasM @ Aug 27 2020, 10:41 AM) Assume IPF have total fund size of RM 1000, with RM 10 per unit so total 100 unit. first, i mentioned "the amount of money you have in a UT fund before or after distribution is (about) the same."If IPF want to declare dividend of RM 1 per unit. Does it mean after distribution, the total fund size will be RM 1000 also?(assuming the bond price is static not moving) So u mean that IPF no need to give tax to government for the dividend distribution? in the NAV calculation it has this factor "Minus all liabilities"...thus govt tax had been inputed in the calculation of the new/latest NAV post dividend not sure if this article had been posted before, Understanding Unit trusts Dividends https://www.interpac-asset.com.my/understan...he%20long%20run. This post has been edited by yklooi: Aug 27 2020, 10:56 AM Attached thumbnail(s)

|

|

|

Aug 27 2020, 10:59 AM Aug 27 2020, 10:59 AM

|

Junior Member

569 posts Joined: Aug 2020 |

QUOTE(yklooi @ Aug 27 2020, 10:49 AM) first, i mentioned "the amount of money you have in a UT fund before or after distribution is (about) the same." So does the fund size in term of RM will be reduced after distribution?in the NAV calculation it has this factor "Minus all liabilities"...thus govt tax had been inputed in the calculation of the new/latest NAV post dividend not sure if this article had been posted before, Understanding Unit trusts Dividends https://www.interpac-asset.com.my/understan...he%20long%20run. Since tax had been factored in, why there's no reduction in the total fund size in term of RM? IPF use who's money to pay the tax? |

|

|

Aug 27 2020, 11:13 AM Aug 27 2020, 11:13 AM

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(AnasM @ Aug 27 2020, 10:59 AM) So does the fund size in term of RM will be reduced after distribution? you you want a definite, reliable and intelligence answersSince tax had been factored in, why there's no reduction in the total fund size in term of RM? IPF use who's money to pay the tax? read the highlighted text of the image, then go back to the earlier page to get the source of that article, then check with them? (my posts has "is (about) the same", yet they are more definite, they did not put in "about") then after that, please do come back to enlighten us will you? thanks Attached thumbnail(s)

|

|

|

Aug 27 2020, 11:20 AM Aug 27 2020, 11:20 AM

Show posts by this member only | IPv6 | Post

#1792

|

Junior Member

74 posts Joined: Mar 2020 |

QUOTE(AnasM @ Aug 27 2020, 10:59 AM) So does the fund size in term of RM will be reduced after distribution? I think some of us have explained earlier in the post.Since tax had been factored in, why there's no reduction in the total fund size in term of RM? IPF use who's money to pay the tax? Taking your scenario if you have RM1000 in Opus IPF, and they distribute RM10 and given the scenario that the bond valuation has no movement, but ignore the complication of fee calculation. In short explanation, NAV is derive from Asset - Liability. Price is NAV / Units in Circulation. So let says, NAV is RM 1000 (ignore the fee accrued). After distribution of RM10 and if you reinvest back, then yes, the NAV will still be RM1000. But because of your Units in circulation is more, hence the price dropped. Of course if you choose to payout the distribution, your units holding doesn't change, but the price will reflect that you have taken RM10 profits, hence your value will become RM990. But the RM10 is back to your pocket. Hope this explains well. As for the taxation, I think Grumpy has been sharing the article stated that for Bond Investment, there is no tax in malaysia, so all income earned are tax free. As for cases if there are taxation, the Fund manager will accrued it daily with a provision and estimation of tax and reflect it in the daily price. So is a fair calculation daily. |

|

|

Aug 27 2020, 11:23 AM Aug 27 2020, 11:23 AM

|

All Stars

14,965 posts Joined: Mar 2015 |

QUOTE(AnasM @ Aug 27 2020, 10:59 AM) So does the fund size in term of RM will be reduced after distribution? how much money they gives out as distribution?Since tax had been factored in, why there's no reduction in the total fund size in term of RM? IPF use who's money to pay the tax? what is the % of taxes on distribution? (individual retailer investor do not investment gain tax), thus i think the taxes would not be much?, any idea of the tax %? So does the fund size in term of RM will be reduced after distribution? i think YES Since tax had been factored in, why there's no reduction in the total fund size in term of RM? if the amount of distribution pay out is so little compared to the total fund size, then coupled with the X% of tax NOT on the overall fund size but the amount of distributed amount, then i think there should not be alot of impact to the fund size. IPF use who's money to pay the tax? i think, they use the IPF fund's money(asset) |

|

|

|

|

|

Aug 27 2020, 11:23 AM Aug 27 2020, 11:23 AM

|

Senior Member

2,239 posts Joined: Aug 2009 |

QUOTE(funboy555 @ Aug 27 2020, 11:20 AM) I think some of us have explained earlier in the post. your explanation is how i understand lo - RM1000 distirbutor RM10, then reinvest RM10 still total value is RM1000Taking your scenario if you have RM1000 in Opus IPF, and they distribute RM10 and given the scenario that the bond valuation has no movement, but ignore the complication of fee calculation. In short explanation, NAV is derive from Asset - Liability. Price is NAV / Units in Circulation. So let says, NAV is RM 1000 (ignore the fee accrued). After distribution of RM10 and if you reinvest back, then yes, the NAV will still be RM1000. But because of your Units in circulation is more, hence the price dropped. Of course if you choose to payout the distribution, your units holding doesn't change, but the price will reflect that you have taken RM10 profits, hence your value will become RM990. But the RM10 is back to your pocket. Hope this explains well. As for the taxation, I think Grumpy has been sharing the article stated that for Bond Investment, there is no tax in malaysia, so all income earned are tax free. As for cases if there are taxation, the Fund manager will accrued it daily with a provision and estimation of tax and reflect it in the daily price. So is a fair calculation daily. so until the end my chinese friend will say LPPL lo |

|

|

Aug 27 2020, 11:45 AM Aug 27 2020, 11:45 AM

Show posts by this member only | IPv6 | Post

#1795

|

Junior Member

74 posts Joined: Mar 2020 |

QUOTE(majorarmstrong @ Aug 27 2020, 11:23 AM) your explanation is how i understand lo - RM1000 distirbutor RM10, then reinvest RM10 still total value is RM1000 Unit Trust and shares dividend are different la.so until the end my chinese friend will say LPPL lo As I also explained earlier, Distribution is to cater for some big investors who need regular stream of income to be payout for their operational use, it is more applicable to those corporate and big firm who put in millions to billions dollar. They want the fund to realised the profit over the period and payout to them and back to their company bank account for may be some operational cost usage. Retail investors like us just reinvest back and continue to save and invest lo. I also pening see some of you treat Unit Trust like a shares market. Are you trader or are you investor? Ask this question yourself lo. |

|

|

Aug 27 2020, 11:50 AM Aug 27 2020, 11:50 AM

|

Senior Member

5,752 posts Joined: Jan 2012 |

QUOTE(funboy555 @ Aug 27 2020, 11:45 AM) Unit Trust and shares dividend are different la. I told you guys. Ignore him only. As I also explained earlier, Distribution is to cater for some big investors who need regular stream of income to be payout for their operational use, it is more applicable to those corporate and big firm who put in millions to billions dollar. They want the fund to realised the profit over the period and payout to them and back to their company bank account for may be some operational cost usage. Retail investors like us just reinvest back and continue to save and invest lo. I also pening see some of you treat Unit Trust like a shares market. Are you trader or are you investor? Ask this question yourself lo. He won’t accept what he don’t want to accept. funboy555 liked this post

|

|

|

Aug 27 2020, 12:21 PM Aug 27 2020, 12:21 PM

|

Senior Member

2,239 posts Joined: Aug 2009 |

QUOTE(funboy555 @ Aug 27 2020, 11:20 AM) I think some of us have explained earlier in the post. faham nowTaking your scenario if you have RM1000 in Opus IPF, and they distribute RM10 and given the scenario that the bond valuation has no movement, but ignore the complication of fee calculation. In short explanation, NAV is derive from Asset - Liability. Price is NAV / Units in Circulation. So let says, NAV is RM 1000 (ignore the fee accrued). After distribution of RM10 and if you reinvest back, then yes, the NAV will still be RM1000. But because of your Units in circulation is more, hence the price dropped. Of course if you choose to payout the distribution, your units holding doesn't change, but the price will reflect that you have taken RM10 profits, hence your value will become RM990. But the RM10 is back to your pocket. Hope this explains well. As for the taxation, I think Grumpy has been sharing the article stated that for Bond Investment, there is no tax in malaysia, so all income earned are tax free. As for cases if there are taxation, the Fund manager will accrued it daily with a provision and estimation of tax and reflect it in the daily price. So is a fair calculation daily. thank you |

|

|

Aug 27 2020, 12:29 PM Aug 27 2020, 12:29 PM

Show posts by this member only | IPv6 | Post

#1798

|

Junior Member

74 posts Joined: Mar 2020 |

QUOTE(majorarmstrong @ Aug 27 2020, 12:21 PM) And one more thing that I would like to highlight is that the perception about price that when it is high means it is expensive, for shares may be it depends on the fair value of the company, for Unit trust, I would say not so much difference, but it is really hard to explain to everyone who is not understanding UT too much, your agent definitely won't teach you all these and most of the time you get that kind of message is that oh after distribution the price is low, good time to go in. Some agents will tell you, come in before distribution you can get the distribution profits. All the wrong concept has been implant in the market I would say.For me, UT price is just an indicative to value your units holding. the up and down of the price, be it 0.0001 or 0.1 or something, is the matter of % gain for the day. if a UT has a price of 100.0000, the 1% is 1.0000, a UT price at 1.0000 gain 1% is 0.01. Are you saying 1.0000 > 0.01? Again, think it and digest this yourself. Always look at % gain not the indicative value. Sekian, Terima Kasih. |

|

|

Aug 27 2020, 12:31 PM Aug 27 2020, 12:31 PM

|

All Stars

12,387 posts Joined: Feb 2020 |

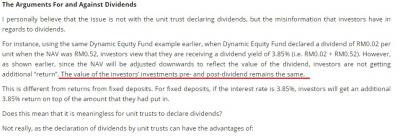

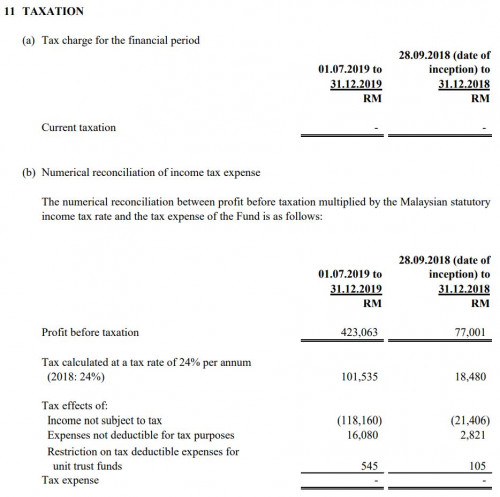

From IPF semi-annual report: FOR THE SIX MONTHS FINANCIAL PERIOD ENDED 31 DECEMBER 2019 Whether the fund pays taxes to the government or not:  And distribution declared by the fund:  If got time, do dig the annual or semi-annual report: https://www.opusasset.com/wp-content/upload...v=1598497343409 funboy555 liked this post

|

|

|

Aug 27 2020, 02:20 PM Aug 27 2020, 02:20 PM

|

Junior Member

92 posts Joined: Apr 2011 |

is there android app for this? cant find in google playstore

|

| Change to: |  0.0319sec 0.0319sec

0.59 0.59

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 22nd December 2025 - 10:37 PM |