Dear Investors,

In view of the challenging market environment, Opus Asset Management Sdn Bhd (OpusAM) will be organising a Webinar this Saturday, 2nd May 2020 to share our insights on the market as well as provide an educational session on fixed income investments.

The details of the event are as below:

Topic : “Bond with OpusAM: Navigating through these Uncertain Times with Fixed Income”

Time : Saturday, 2nd May 2020 ; 2:00 PM – 3:00 PM (UTC +08:00 Kuala Lumpur)

Online Event : Microsoft Teams Webinar

Agenda

2:00 PM – 2:10 PM Opening Speech by Managing Director

2:10 PM – 2:25 PM Understanding Bonds & Investments

2:25 PM – 2:40 PM Market Review, Outlook & Strategy

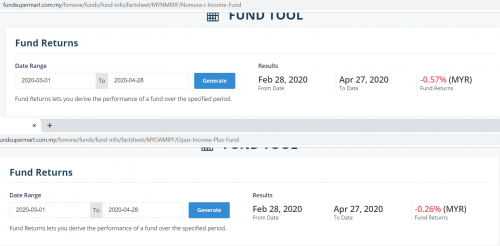

2:40 PM – 2:50 PM Updates on our Unit Trust Funds

2:50 PM – 3:00 PM Question & Answer (Q&A) Session

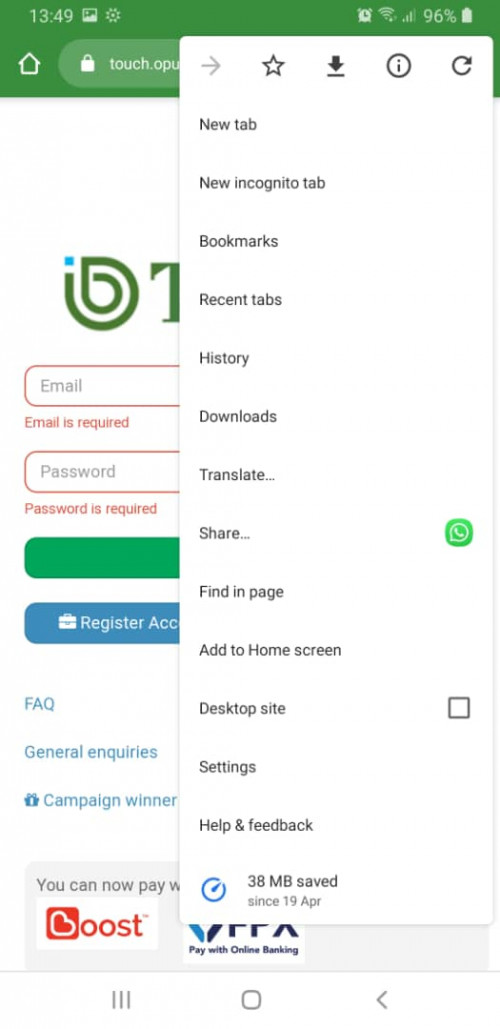

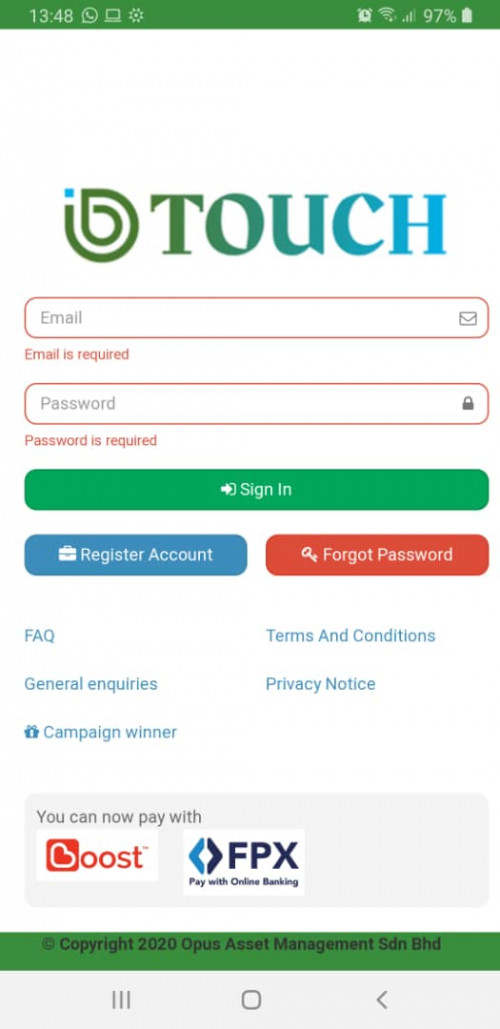

Kindly click on the link below to register for the event.

Microsoft Teams

Registration FormAlternatively, you may paste this URL into your browser and press Enter if the above link does not work.

https://forms.office.com/Pages/ResponsePage...0NQNDJMVDdNVS4uUpon registration in this form, you will be sent another e-mail with a Microsoft Teams link to join the Webinar.

In the event you do not receive the e-mail with the link to the event, kindly check your "Junk" or "Spam”.

We look forward to your participation at our online event, and stay safe during this pandemic season.

Thank you.

So put in the money regularly in IPF for a period of time then redeem it when the bond price is high, am I right? I assume this is a long term investment right?

They are having a live webinar later. May be is good to join and learn. I am joining as I am still new to bond market. Good to learn more about investment to gain passive income.

Mar 31 2020, 03:14 PM

Mar 31 2020, 03:14 PM

Quote

Quote

0.0711sec

0.0711sec

0.81

0.81

7 queries

7 queries

GZIP Disabled

GZIP Disabled