good morning

uncle reporting into OpusTouch

uncle newbie

i do read faq

Opus Touch, Self-Service UT Platform

Opus Touch, Self-Service UT Platform

|

|

Jul 20 2020, 10:57 AM Jul 20 2020, 10:57 AM

Return to original view | Post

#1

|

Senior Member

2,239 posts Joined: Aug 2009 |

good morning

uncle reporting into OpusTouch uncle newbie i do read faq |

|

|

|

|

|

Jul 20 2020, 11:01 AM Jul 20 2020, 11:01 AM

Return to original view | Post

#2

|

Senior Member

2,239 posts Joined: Aug 2009 |

here come the question, the OpusTouch only can buy 1 fund saja?

when i sign up got 2 option, then i choose the Opus Income Plus Fund, then now my account approve it give me only 1 option is this correct? why opus is not like FSM where you can have multiple fund to select? |

|

|

Jul 20 2020, 11:08 AM Jul 20 2020, 11:08 AM

Return to original view | Post

#3

|

Senior Member

2,239 posts Joined: Aug 2009 |

QUOTE(tan_aniki @ Jul 20 2020, 11:04 AM) i just spoken to customer service here is the info:1. register that time can choose 2 fund 2. when put money inside account approve can see only your selected fund 3. move to accepted for processing status continue to see 1 fund 4. once the money is invested can see 4 funds hebat system kan |

|

|

Jul 20 2020, 11:41 AM Jul 20 2020, 11:41 AM

Return to original view | Post

#4

|

Senior Member

2,239 posts Joined: Aug 2009 |

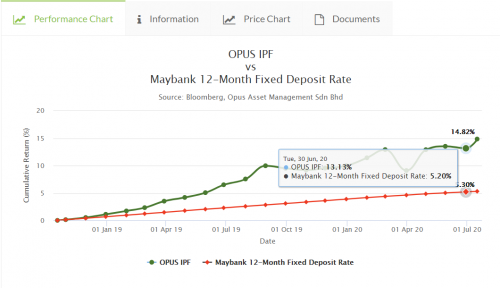

QUOTE(funboy555 @ Jul 20 2020, 11:37 AM)  I mean Month-To-Date, based on their performance chart at website last month close at 13.13%, as at last Friday is 14.82%, so i just take simple minus calculation to estimate, should be 1.6%+ up since 1st July till now. Correct? all i want is when 1 tahun i go inside and cash out some money for my daily expenses ---------- question: so opus touch vs fsm is the 0.05% per annum charges, where now i buy with Opus they no charge me  This post has been edited by majorarmstrong: Jul 20 2020, 11:43 AM |

|

|

Jul 20 2020, 02:48 PM Jul 20 2020, 02:48 PM

Return to original view | Post

#5

|

Senior Member

2,239 posts Joined: Aug 2009 |

QUOTE(yklooi @ Jul 20 2020, 12:08 PM) i read it say FSM 0.05% per quarter for platform charges ma which i guess translate into 0.2% per annum and our understanding is correctso back to Opus vs FSM so buy from Opus is free la save the 0.05% lo compare to FSM again FSM interface cantik a bit Opus interface very lousy Opus is like college project interface |

|

|

Jul 20 2020, 03:49 PM Jul 20 2020, 03:49 PM

Return to original view | Post

#6

|

Senior Member

2,239 posts Joined: Aug 2009 |

QUOTE(tan_aniki @ Jul 20 2020, 03:02 PM) which one fasterFSM or Opus? cause when uncle need money for medical expenses i really need fast fast like 3 to 5 days lo for those who still young pls make sure keep 1 or 2 credit card that has high limit like 50k or 100k even you are cash rich you still need credit card cause u wont carry 50k to 100k cash go out but u will carry 1 single piece of platics to go out ma reason being when u go hospital credit card do wonders everything can speed up if you have one if dont have things go super slow sometimes 5 mins saves life |

|

|

|

|

|

Jul 20 2020, 03:53 PM Jul 20 2020, 03:53 PM

Return to original view | Post

#7

|

Senior Member

2,239 posts Joined: Aug 2009 |

QUOTE(yklooi @ Jul 20 2020, 03:13 PM) yes that 0.2%pa in FSM... you talk deepwhich to go depended on which one makes you feels better to go to? are you really mind about the 0.2% pa? do you liked the non transaction related issues provided? does the lower quality interface transaction suffice to your investment need? etc etc.... just like those that take coffee at high end shops.... do they really enjoying or know how to enjoy the coffee there, or are they just there for the "feels" of there? uncle go starbucks when my son bring me there i dont even like the coffee there i rather go my to those chinese coffee shop cheap and nice so i guess all i need is to be able to withdraw and does not take more than 1 week i will just go with Opus honestly for me even PMO interface very lousy all i need is to top up and withdraw |

|

|

Jul 20 2020, 03:54 PM Jul 20 2020, 03:54 PM

Return to original view | Post

#8

|

Senior Member

2,239 posts Joined: Aug 2009 |

|

|

|

Jul 20 2020, 03:59 PM Jul 20 2020, 03:59 PM

Return to original view | Post

#9

|

Senior Member

2,239 posts Joined: Aug 2009 |

btw can i use my son Boost account to top up?

|

|

|

Jul 20 2020, 04:58 PM Jul 20 2020, 04:58 PM

Return to original view | Post

#10

|

Senior Member

2,239 posts Joined: Aug 2009 |

opus got a referral program?, i want to open for my son

he is 19 years old this year |

|

|

Jul 20 2020, 11:45 PM Jul 20 2020, 11:45 PM

Return to original view | Post

#11

|

Senior Member

2,239 posts Joined: Aug 2009 |

uncle masuk 10k each into MPF and IPF

dont know good or bad move masuk today so tomorrow should get invested |

|

|

Jul 21 2020, 09:39 AM Jul 21 2020, 09:39 AM

Return to original view | Post

#12

|

Senior Member

2,239 posts Joined: Aug 2009 |

|

|

|

Jul 21 2020, 10:18 AM Jul 21 2020, 10:18 AM

Return to original view | Post

#13

|

Senior Member

2,239 posts Joined: Aug 2009 |

QUOTE(tan_aniki @ Jul 21 2020, 10:12 AM) you can view all the transaction history with time stamp uncle still dont know what is IPF vs MPFbelieve me, once you addicted to IPF, you won't put money into MPF all i know is IPF higher risk MPF lower risk that is all i know so i put in both 10k each la then come back after 1 to 2 years to see see look look |

|

|

|

|

|

Jul 21 2020, 10:37 AM Jul 21 2020, 10:37 AM

Return to original view | Post

#14

|

Senior Member

2,239 posts Joined: Aug 2009 |

QUOTE(funboy555 @ Jul 21 2020, 10:25 AM) Agreed. That's why for new investors they suggest IPF and SIPF. understand and thanks for the explanationUncle, IPF is for medium to long term investment, you can always checkout their website to download the fund factsheet or call their customer services to explain to you, i think they are quite helpful and more than willing to share with uncle the difference. I personally put both before, MPF is rather safe is just slightly better than FD rate, but FD although higher risk, but looking at their credit profile and sectors allocation in fund fact sheet, most of the holdings are quite liquid. As at June, the portfolio yield for IPF is 3.4%, MPF is 2.5%. meaning to say the bond holdings that they had in the portfolio, without any movement and they hold it till maturity then that's the yield you may gain from the investment. But uncle has to understand, higher risk, higher return or higher loss. That's the main difference from my point of view. |

|

|

Jul 21 2020, 10:38 AM Jul 21 2020, 10:38 AM

Return to original view | Post

#15

|

Senior Member

2,239 posts Joined: Aug 2009 |

QUOTE(ironman16 @ Jul 21 2020, 10:36 AM) Uncle, MPF normally for the fund that we gonna use may in one year / emergency fund bcoz almost same rate with FD (sure hard to beat inflasi) . IPF use for the fund for medium to long term investment (if u r Conservative investors) in case u need it if urgent oso may b loss a bit. duit dah masuk so let it be loi put 10k each |

|

|

Jul 22 2020, 11:50 AM Jul 22 2020, 11:50 AM

Return to original view | Post

#16

|

Senior Member

2,239 posts Joined: Aug 2009 |

QUOTE(ironman16 @ Jul 22 2020, 11:38 AM) i masuk duit so i must get myself updated and always learn new things mamy duit tak banyak sikit saja tapi perlu juga ambil tahu ironman16 liked this post

|

|

|

Jul 22 2020, 09:03 PM Jul 22 2020, 09:03 PM

Return to original view | Post

#17

|

Senior Member

2,239 posts Joined: Aug 2009 |

i actually still tak faham NAV

|

|

|

Jul 22 2020, 11:43 PM Jul 22 2020, 11:43 PM

Return to original view | Post

#18

|

Senior Member

2,239 posts Joined: Aug 2009 |

question - after income distribution, will NAV drop?

let us just say in circulation now there is 100 then NAV = 1.00 income distribution 0.01 so now after income distribution how may in ciruclation? still 100? Also NAV become 1.01? |

|

|

Jul 23 2020, 09:40 AM Jul 23 2020, 09:40 AM

Return to original view | IPv6 | Post

#19

|

Senior Member

2,239 posts Joined: Aug 2009 |

Tak boleh masuk

This post has been edited by majorarmstrong: Jul 23 2020, 09:40 AM |

|

|

Jul 23 2020, 09:41 AM Jul 23 2020, 09:41 AM

Return to original view | IPv6 | Post

#20

|

Senior Member

2,239 posts Joined: Aug 2009 |

Today totally cannot login

Like stuck there |

| Change to: |  0.0857sec 0.0857sec

0.40 0.40

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 9th December 2025 - 03:22 PM |