QUOTE(fuzzy @ Feb 16 2025, 12:13 PM)

Hello all.

I'm interested to explore IBKR as my main account. I'm currently on an SG platform but I feel the fees has remained high so it's eating into my general trade profits.

I have some questions:

1) I do purchase ETFs like VUAA on a regular basis, can someone advise me on the fees as I seem to get different answers via Google.

2) Does it make sense to transfer all my current holdings to IBKR, or just leave things as it and just start to buy shares in IBKR moving forward. Anyone has any idea if the fees they charge?

3) Is there any difference if we are to transfer a relatively large amount (say 1mil) one time vs in tranches?

1.I am using IBKR as my main trading account.

From my statement, I notice trading 10 VUAA will cost me usd1.91 in fees/comm. There was once I bought 122 VUAA, and the fees charged were usd5.91.

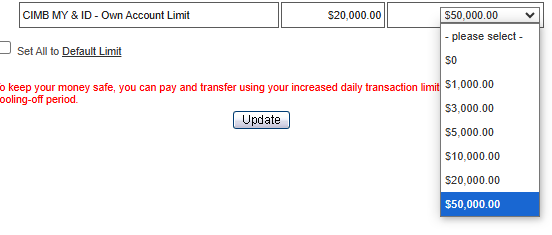

How much IBKR charges you also depend on your Account settings. They have different tiers, I can't remember which tier I am on, but if you read the forum pages, you may find some good tips from other investors.

2. As far as I know, not only IBKR gives the most competitive rates, but they give the best currency exchange rates within the platform.

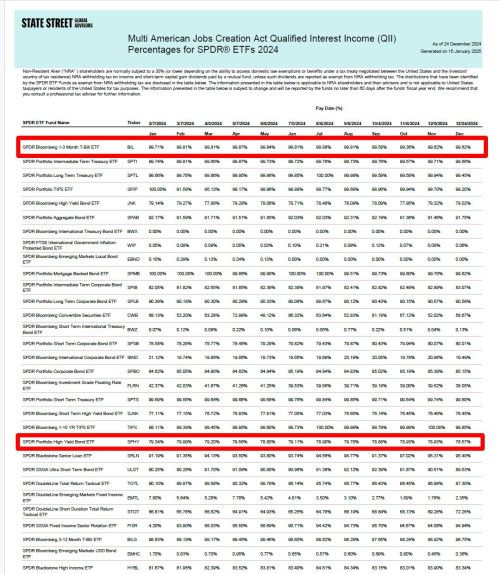

3. But beware that IBKR, being a US based company, may apply estate duty taxes on US shares, should anything happen to you. So, if you have a million $ in your account, the estate duty may be hefty, as the estate duty exemption is only $60,000. Just remember, don't exceed $60,000 on US situs assets. Btw, I reckon you probably know that VUAA is UCITS compliant, and therefore, not subject to US estate duty.

This post has been edited by swiss228: Feb 19 2025, 12:41 AM

Feb 3 2025, 11:13 PM

Feb 3 2025, 11:13 PM

Quote

Quote

0.0221sec

0.0221sec

0.34

0.34

6 queries

6 queries

GZIP Disabled

GZIP Disabled