FT Visual story | How China is setting up shop in Mexico

An increasingly close trade relationship is causing concern in Washington

ig.ft.com/china-mexico-tariffs/

Interactive Brokers (IBKR), IBKR users, welcome!

Interactive Brokers (IBKR), IBKR users, welcome!

|

|

Dec 16 2024, 05:35 PM Dec 16 2024, 05:35 PM

Return to original view | IPv6 | Post

#1

|

Junior Member

358 posts Joined: Dec 2024 |

FT Visual story | How China is setting up shop in Mexico An increasingly close trade relationship is causing concern in Washington ig.ft.com/china-mexico-tariffs/ MasBoleh! liked this post

|

|

|

|

|

|

Dec 19 2024, 07:40 PM Dec 19 2024, 07:40 PM

Return to original view | IPv6 | Post

#2

|

Junior Member

358 posts Joined: Dec 2024 |

FT Federal Reserve

Donald Trump’s pledges seep into Federal Reserve’s outlook Tariff threats partly to blame for ‘striking’ increase in central bank’s US inflation forecasts, say economists www.ft.com/content/4a3bcfac-f095-4ca9-9002-e0a5b3618dcf -------------------------- FT US politics & policy US government nears shutdown after Donald Trump attacks bipartisan funding bill President-elect’s intervention raises odds of federal closures by weekend www.ft.com/content/8fd25371-384c-469e-ba0b-7a2b861e7ff8 |

|

|

Dec 30 2024, 08:47 PM Dec 30 2024, 08:47 PM

Return to original view | IPv6 | Post

#3

|

Junior Member

358 posts Joined: Dec 2024 |

QUOTE(kanasai @ Dec 30 2024, 05:12 PM) Hi all, im trying withdraw money from IB to my CIMB account, but it asked me to select the intermediary bank for CIMB. It seems like CIMB customer support is not even sure of this. Anyone has idea what this intermediary bank is about and what is the intermediary bank for CIMB? IBKR to CIMB SG or CIMB MY, and in which currency? Direct telegraphic transfer is very expensive, 10-20 USD fee + 2% FX markup... use SGD intermediary route is a lot cheaper |

|

|

Jan 5 2025, 08:34 AM Jan 5 2025, 08:34 AM

Return to original view | IPv6 | Post

#4

|

Junior Member

358 posts Joined: Dec 2024 |

SemiAnalysis | December 9, 2024

Intel on the Brink of Death | Culture Rot, Product Focus Flawed, Foundry Must Survive Board Short Circuits, Cultural Rot, x86 Has No Moat, Sell PC Business, Nvidia's PC CPU Push, Roadmap Review semianalysis.com/2024/12/09/intel-on-the-brink-of-death/ (no paywall) Source: www.wsj.com/tech/intel-microchip-competitors-challenges-562a42e3?st=tfMzx7&reflink=desktopwebshare_permalink |

|

|

Jan 6 2025, 10:37 AM Jan 6 2025, 10:37 AM

Return to original view | IPv6 | Post

#5

|

Junior Member

358 posts Joined: Dec 2024 |

Source: https://semiwiki.com/forum/index.php?thread...f-terror.21796/ Post count limit removed. Can post http link now. Can edit posts now. This post has been edited by TOS2: Jan 6 2025, 10:37 AM kimi0148 liked this post

|

|

|

Jan 7 2025, 04:02 PM Jan 7 2025, 04:02 PM

Return to original view | Post

#6

|

Junior Member

358 posts Joined: Dec 2024 |

FT Opinion | Employment

How much sick pay is too much sick pay? The contrasting cases of Germany and the UK are revealing about policy trade-offs by Sarah O'Connor https://www.ft.com/content/9f146cfc-7c0f-42...f9-c2abc94cfb41 ---------------------------------- FT Airlines New jets help passengers avoid congestion at hub airports Airlines launch long-haul routes using smaller but more fuel-efficient aircraft https://www.ft.com/content/ee4f65ab-b788-4a...47-d02fbeaab40f --------------------- FT Opinion | Lex Mom and pop pension savers could benefit from private markets, at the right price Private equity made strong returns from investing in alternative assets over the past 30 years https://www.ft.com/content/3be4aa0b-3010-4c...cd-d226492b865c QUOTE A cynical, if reasonable view, is that the big alternative asset managers have bled traditional institutional channels dry. Therefore, the only way for those firms to justify the asset growth that underpins their huge valuations — the likes of Blackstone, KKR and Apollo have equity values of at least $100bn — is to tap the massive individual investor market. |

|

|

|

|

|

Jan 8 2025, 10:38 AM Jan 8 2025, 10:38 AM

Return to original view | IPv6 | Post

#7

|

Junior Member

358 posts Joined: Dec 2024 |

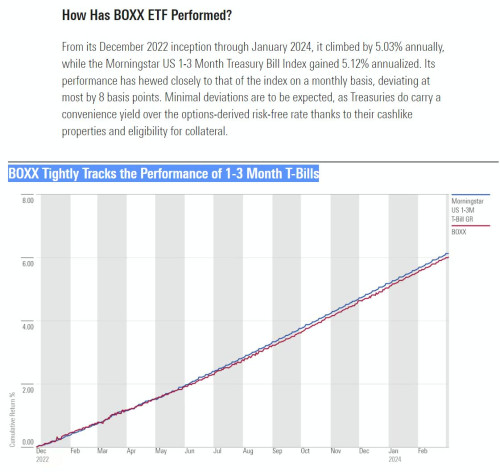

For BIL, SGOV (and their equivalent) investors:

WSJ Markets & Finance | Investing | Heard on the Street Your Fancy, New ETF Might Be a Little Too Fancy Exchange-traded funds have mostly been great investments, but they are getting too complex for their own good https://www.wsj.com/finance/investing/your-...share_permalink Be careful not to buy the wrong ETF... Oh, and February is coming... for IBKR users, your T-bill ETF(s) distribution WHT are about to be reversed ------------------------------- Bloomberg Businessweek | Business Luxury Brands Need to Get Over Their Youth Fixation to Offset Drag From Trump’s Tariffs Courting consumers 55 and older should be a priority for purveyors of high-end goods in 2025, say experts. https://www.bloomberg.com/news/articles/202...older-consumers This post has been edited by TOS2: Jan 8 2025, 10:39 AM |

|

|

Jan 8 2025, 10:43 AM Jan 8 2025, 10:43 AM

Return to original view | IPv6 | Post

#8

|

Junior Member

358 posts Joined: Dec 2024 |

QUOTE(Gwynbleidd @ Feb 13 2024, 06:07 PM) I was wondering why do you have that. No, I'm not holding BIL, I have ZROZ instead. For short duration holding, I use BOXX, which does not have any distribution so far. QUOTE(diffyhelman2 @ Mar 7 2024, 12:52 AM) I went with BIL. but take note, after researching more, if you do not want to have to wait for your WHT to refund (up to one year opportunity cost), the next best thing seems to be the BOXX non dividend distributing T bill ETF. In the WSJ link above, I made a stunning discovery. https://www.wsj.com/finance/investing/your-...share_permalinkTER is ~0.19% up to jan 2025 https://www.morningstar.com/etfs/boxx-promi...-taxable-income  QUOTE The Alpha Architect 1-3 Month Box ETF, or BOXX, for example, tries to match or surpass T-bill returns with options so as not to trigger taxable distributions. Still, it was forced to do one last year under counsel from its legal advisers. https://www.barrons.com/advisor/articles/bo...bution-47f5b26a So, Boxx will still pay distribution. IRS is the big guy, you don't wanna run afoul of them... Better stick to BIL/SGOV... |

|

|

Jan 8 2025, 02:08 PM Jan 8 2025, 02:08 PM

Return to original view | Post

#9

|

Junior Member

358 posts Joined: Dec 2024 |

FT Book | Books

House of Huawei — inside China’s ‘most powerful company’ Eva Dou’s authoritative account of the secretive tech company that became a flashpoint in US-China relations https://www.ft.com/content/12ab5104-2407-42...f3-f3a67d270d65 (Book not available on Libgen or Zlibrary yet, from what I checked. --------------------- FT Citigroup Inc Wall Street casts doubt on Citi chief Jane Fraser’s bid to hit crucial target Bank has lagged well behind rivals on important measure of profitability https://www.ft.com/content/eb633a7e-57aa-45...ad-ea520ba6de7b -------------------------- FT The Big Read | Robotics The fight over robots threatening American jobs As automation becomes a reality everywhere from retail warehouses to restaurant kitchens, the use of robots is increasingly controversial https://www.ft.com/content/eb11f69c-e45c-4f...93-0ca5866b4b67 ------------------------------- FT Samsung Electronics Co Ltd Samsung’s profit estimates disappoint as it fights for Nvidia’s AI business Fourth-quarter earnings hit by greater investments in advanced chip manufacturing https://www.ft.com/content/30b74b44-f2ed-46...65-4a919e5f5236 ------------------------------- FT Chinese business & finance Chinese airlines rush into Europe as western carriers retreat Ability to keep flying over Russia helps three big state-owned carriers undercut European rivals https://www.ft.com/content/a3eeb268-5daa-45...8b-eab93b28d3c7 -------------------------------- FT Opinion | Automobiles Car companies have an infuriating software problem Managing smooth updates is becoming ever important with the spread of EVs and more sophisticated systems by Brooke Masters https://www.ft.com/content/b231210a-79a8-45...47-eaec9a029dc9 |

|

|

Jan 10 2025, 09:32 AM Jan 10 2025, 09:32 AM

Return to original view | IPv6 | Post

#10

|

Junior Member

358 posts Joined: Dec 2024 |

FT Books

The Chairman’s Lounge — Joe Aston on the downfall of Qantas The story of how the once loved Australian airline became a ‘national pariah’ (by Nic Fildes 9 hours ago) https://www.ft.com/content/c51986cc-a6ce-4f...f7-b44f6177ae9f |

|

|

Jan 12 2025, 09:27 AM Jan 12 2025, 09:27 AM

Return to original view | IPv6 | Post

#11

|

Junior Member

358 posts Joined: Dec 2024 |

FT Personal Finance

The race to stop ‘predatory marriage’ in old age Cases have grown since the pandemic — with relatives complaining they have been cut out of a loved one’s will https://www.ft.com/content/51ee56a1-bbec-4f...d9-693442aaa09c ----------------------------- FT Opinion | Marriage and divorce For richer, for poorer: the changing finances of divorce Budget changes make navigating the economic dynamics of relationships more taxing by Claer Barrett https://www.ft.com/content/57a69d2f-0c87-47...3d-ecc1dc75d268 -------------------------------- FT Opinion | Data Points The relationship recession is going global A rise in the number of single people is becoming a key driver of falling birth rates by John Burn-Murdoch https://www.ft.com/content/43e2b4f6-5ab7-4c...fd-d611c36dad74 ---------------------------------- FT Opinion | Markets Insight The big new role for private credit Profound funding shift might contribute to huge investment needed for data centres, energy and reshoring of industry by Huw van Steenis https://www.ft.com/content/43c7b43e-0b69-48...4a-8cac8de84f84 ------------------------------- FT Opinion | The FT View The rising cost of a caffeine fix Climate, disease and flawed regulation are squeezing coffee and chocolate lovers by The editorial board https://www.ft.com/content/255b3819-152e-4c...02-0b6148751bcc |

|

|

Jan 14 2025, 10:23 PM Jan 14 2025, 10:23 PM

Return to original view | IPv6 | Post

#12

|

Junior Member

358 posts Joined: Dec 2024 |

PATMI? Operating profit? EBITDA? Adjusted EBITDA?

There is only one bottom line: PATMI https://www.sinchew.com.my/news/20250114/%e...4%ba%ba/6215850 |

|

|

Jan 16 2025, 01:25 PM Jan 16 2025, 01:25 PM

Return to original view | IPv6 | Post

#13

|

Junior Member

358 posts Joined: Dec 2024 |

QUOTE(JusticeLeagueMY @ Jan 16 2025, 09:50 AM) I thought this thread is discussing anything to do with IBKR. How come so many market news posts by TO2? The main issue is we have a USA stocks discussion thread and no non-US stocks discussion thread and IBKR is used mostly by people who buy non-US. non-Malaysian (e.g. European, Japanese) shares, so I posted them here. But of course, if you don't want any of these to appear here, I can remove them. To be fair, IBKR is geared towards trading, so people who follow this thread may want to follow non-US shares news. And lastly, the thread title says IBKR users are welcomed, and no specific instructions state that this thread is solely for IBKR discussions only. TS moosset is no longer around, too bad. This post has been edited by TOS2: Jan 16 2025, 02:42 PM |

|

|

|

|

|

Jan 16 2025, 05:19 PM Jan 16 2025, 05:19 PM

Return to original view | IPv6 | Post

#14

|

Junior Member

358 posts Joined: Dec 2024 |

|

|

|

Jan 19 2025, 12:47 AM Jan 19 2025, 12:47 AM

Return to original view | IPv6 | Post

#15

|

Junior Member

358 posts Joined: Dec 2024 |

QUOTE(swiss228 @ Jan 19 2025, 12:34 AM) You missed a very important point:https://www.reddit.com/r/dividends/comments...o_more_popular/  In the long run holding an underperformer/overperformer for 4 quarters instead of 3 months will introduce extra volatility. And volatility is bad for returns in the long run, you can already see that obviously with those leveraged ETFs like TQQQ, SQQQ etc. (at the more extreme side that is). This post has been edited by TOS2: Jan 19 2025, 12:49 AM |

|

|

Feb 10 2025, 04:08 PM Feb 10 2025, 04:08 PM

Return to original view | IPv6 | Post

#16

|

Junior Member

358 posts Joined: Dec 2024 |

PSA: For those with US T-bills ETFs, your 30% dividend WHT has been refunded today. Do check the huge increase in USD cash balance. You have to wait for tomorrow/day after tomorrow for the WHT reversal to show up in the IBKR Activity statements though. I am looking at a 4.55% p.a. IRR with this latest 30% WHT refund, pretty close to the average short-term USD rate for 2024. This post has been edited by TOS2: Feb 10 2025, 04:15 PM Wedchar2912 liked this post

|

|

|

Feb 11 2025, 09:59 PM Feb 11 2025, 09:59 PM

Return to original view | IPv6 | Post

#17

|

Junior Member

358 posts Joined: Dec 2024 |

QUOTE(TOS2 @ Feb 10 2025, 04:08 PM) PSA: For those with US T-bills ETFs, your 30% dividend WHT has been refunded today. Do check the huge increase in USD cash balance. Not sure why some rows showed deduction of 0.07ish USD,,, You have to wait for tomorrow/day after tomorrow for the WHT reversal to show up in the IBKR Activity statements though. I am looking at a 4.55% p.a. IRR with this latest 30% WHT refund, pretty close to the average short-term USD rate for 2024.  |

|

|

Sep 10 2025, 02:58 PM Sep 10 2025, 02:58 PM

Return to original view | Post

#18

|

Junior Member

358 posts Joined: Dec 2024 |

|

|

|

Sep 10 2025, 05:44 PM Sep 10 2025, 05:44 PM

Return to original view | Post

#19

|

Junior Member

358 posts Joined: Dec 2024 |

QUOTE(Wedchar2912 @ Sep 10 2025, 04:18 PM) All in BIL ETF! Gotta save for my future family... but uhmm... no gf yet... watermineral and Wedchar2912 liked this post

|

|

|

Nov 23 2025, 02:07 PM Nov 23 2025, 02:07 PM

Return to original view | Post

#20

|

Junior Member

358 posts Joined: Dec 2024 |

Hi all,

I received email notification that my USD balance is about to close.  I wish to retain the USD balance so I will need to either transfer USD from IBKR to Wise USD balance or deposit MYR/SGD into Wise and convert via Wise internally to fund my USD balance. Do you guys have any suggestions which method costs less money? If I move money from IBKR to Wise, I will convert to MYR and move to my MY digital bank accounts. Conversion done by Wise will incur charges... Another alternative is to move money from IBKR to Wise, then move back again to IBKR... but not sure if there are charges for this. If move money from MYR/SGD to Wise then convert to USD, Wise will charge money in the process... still incur costs. Thanks for the suggestion ya everyone. Haven't been here for a looooong time |

| Change to: |  0.1119sec 0.1119sec

0.24 0.24

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 5th December 2025 - 04:00 AM |