Outline ·

[ Standard ] ·

Linear+

Interactive Brokers (IBKR), IBKR users, welcome!

|

SUSTOS

|

May 5 2022, 12:59 PM May 5 2022, 12:59 PM

|

|

QUOTE(Toku @ May 5 2022, 12:27 PM) I tried the digital portal for several steps the other day and seems quite straightforward. I saw IBKR has DKK account so in theory it should allow us to keep DKK in the account for investment. My guess is the market data access that is preventing me from access. lol I don't think the Danish tax authorities will pay the refund to your IBKR account. (It does not even have an account number, IBKR doesn't provide banking services.) How come you can access the digital portal? Which browser did you use? I used Chrome on both W10 and W11, either one gives me something like this: » Click to show Spoiler - click again to hide... « |

|

|

|

|

|

SUSTOS

|

May 5 2022, 01:07 PM May 5 2022, 01:07 PM

|

|

FT 050522: https://drive.google.com/file/d/12aX4r5n0Sv...iew?usp=sharing» Click to show Spoiler - click again to hide... « This one from BT, but still kind of relevant. » Click to show Spoiler - click again to hide... « |

|

|

|

|

|

Toku

|

May 5 2022, 04:21 PM May 5 2022, 04:21 PM

|

Getting Started

|

QUOTE(TOS @ May 5 2022, 12:59 PM) lol I don't think the Danish tax authorities will pay the refund to your IBKR account. (It does not even have an account number, IBKR doesn't provide banking services.) How come you can access the digital portal? Which browser did you use? I used Chrome on both W10 and W11, either one gives me something like this: » Click to show Spoiler - click again to hide... « This is the page from the Danish dividend claim.  I checked we can wire DKK into IBKR. If the Danish tax authorities are not kind enough to pay the refund directly to IBKR account, perhaps they can pay to the DKK account in Wise. DKK account can be opened in Wise. I am not too sure the details on Wise cross border account though. Need Sifu to comment on whether Wise cross border account can be used for Danish tax authorities to transfer payment. |

|

|

|

|

|

SUSTOS

|

May 5 2022, 04:43 PM May 5 2022, 04:43 PM

|

|

QUOTE(Toku @ May 5 2022, 04:21 PM) This is the page from the Danish dividend claim.  I checked we can wire DKK into IBKR. If the Danish tax authorities are not kind enough to pay the refund directly to IBKR account, perhaps they can pay to the DKK account in Wise. DKK account can be opened in Wise. I am not too sure the details on Wise cross border account though. Need Sifu to comment on whether Wise cross border account can be used for Danish tax authorities to transfer payment. Try click on that link in that page. That link is the one which does not work for me. And forget about OMX Copenhagen... Verdict from IB is: » Click to show Spoiler - click again to hide... « |

|

|

|

|

|

dwRK

|

May 5 2022, 06:32 PM May 5 2022, 06:32 PM

|

|

QUOTE(Toku @ May 5 2022, 04:21 PM) Need Sifu to comment on whether Wise cross border account can be used for Danish tax authorities to transfer payment. cannot...no physical account This post has been edited by dwRK: May 5 2022, 06:49 PM |

|

|

|

|

|

Lon3Rang3r00

|

May 5 2022, 08:43 PM May 5 2022, 08:43 PM

|

|

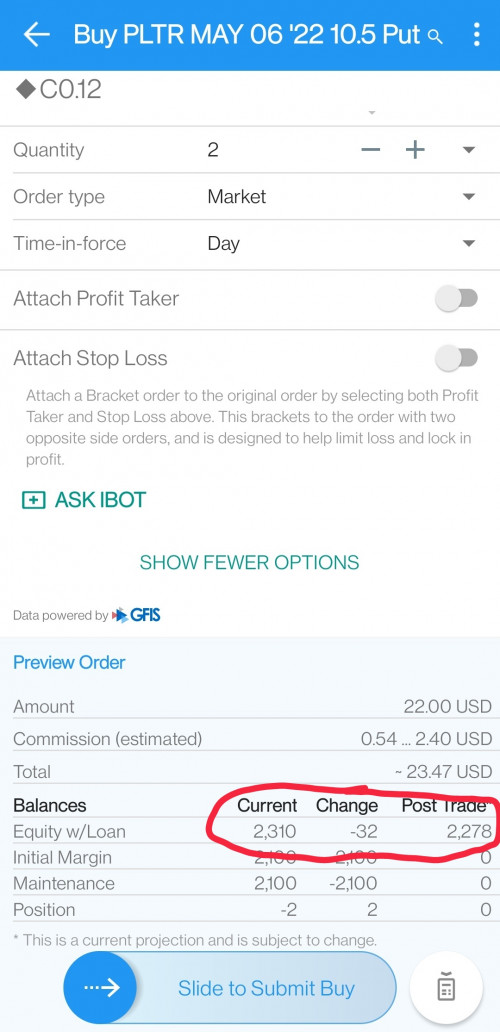

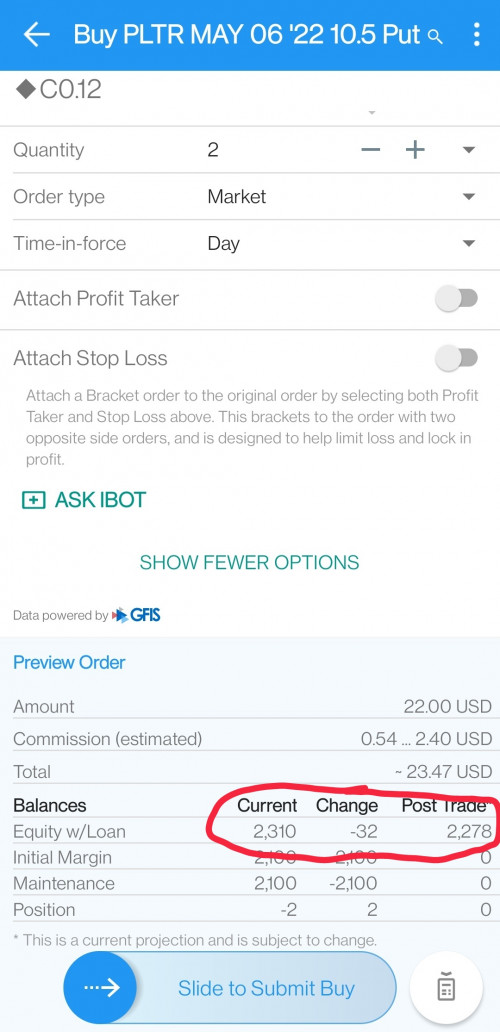

When you buy to close an option you got this calculator, can anyone explain what's Equity w/loans shown in the screenshot This post has been edited by Lon3Rang3r00: May 5 2022, 08:44 PM |

|

|

|

|

|

Yggdrasil

|

May 5 2022, 09:25 PM May 5 2022, 09:25 PM

|

|

QUOTE(Lon3Rang3r00 @ May 5 2022, 08:43 PM) When you buy to close an option you got this calculator, can anyone explain what's Equity w/loans shown in the screenshot Most definitions can be found here.Why are you keying in a market order btw? |

|

|

|

|

|

SUSTOS

|

May 5 2022, 11:06 PM May 5 2022, 11:06 PM

|

|

Heard on the Street Shell’s Foggy Outlook Sways Investors but Not Politicians Record profits have raised the risk of a U.K. windfall tax, even though investors don’t expect the good times to last https://www.wsj.com/articles/shells-foggy-o...share_permalink------------------------------------------------------------------- Beer Shows Pricing Muscle Despite Its Underdog Status Global brewers Anheuser-Busch InBev and Heineken managed to charge drinkers more than liquor-obsessed investors expected https://www.wsj.com/articles/beer-shows-pri...share_permalink |

|

|

|

|

|

SUSTOS

|

May 5 2022, 11:19 PM May 5 2022, 11:19 PM

|

|

Alert to all Swiss stock investors, including those who hold Swiss ADRs on NYSE. Takudan TokuMy Swiss tax specialist just shared with me this useful service for your future dividend WHT refunds: https://www.ictax.admin.ch/extern/en.html#/searchThis is an official portal for you to verify whether you can claim for tax refunds from Swiss tax authorities. I am pleased that Swiss ADRs like Novartis' level II ADR (ISIN No. US66987V1098) are listed too. So, if IBKR does not refund you the 35% WHT (for ADR case, i.e., IB does not inform the ADR custodian bank about your tax residency), you can claim the refund via Form 60 together with all your SIX-listed securities, say ROG.SW or NESN.SW. Hope that helps. |

|

|

|

|

|

dwRK

|

May 5 2022, 11:38 PM May 5 2022, 11:38 PM

|

|

QUOTE(TOS @ May 5 2022, 11:53 AM) Did you try accessing the digital portal? I can't access the link: https://skat.dk/data.aspx?oid=2246531&lang=uslink no issue... |

|

|

|

|

|

SUSTOS

|

May 5 2022, 11:40 PM May 5 2022, 11:40 PM

|

|

QUOTE(dwRK @ May 5 2022, 11:38 PM) Maybe HK internet ban lol Can you show a screenshot of the immediate page when you click on the link, just for reference? |

|

|

|

|

|

dwRK

|

May 5 2022, 11:44 PM May 5 2022, 11:44 PM

|

|

QUOTE(TOS @ May 5 2022, 11:40 PM) Maybe HK internet ban lol Can you show a screenshot of the immediate page when you click on the link, just for reference? same as toku's tried on edge, firefox, chrome, brave... all ok... |

|

|

|

|

|

SUSTOS

|

May 5 2022, 11:44 PM May 5 2022, 11:44 PM

|

|

QUOTE(dwRK @ May 5 2022, 11:44 PM) same as toku's tried on edge, firefox, chrome, brave... all ok... lol I mean the "Open digital form used for claiming refund of Danish dividend tax" link on that page. Try click on that and see. |

|

|

|

|

|

dwRK

|

May 5 2022, 11:54 PM May 5 2022, 11:54 PM

|

|

QUOTE(TOS @ May 5 2022, 11:44 PM) lol I mean the "Open digital form used for claiming refund of Danish dividend tax" link on that page. Try click on that and see. lol... my bad ok not working... |

|

|

|

|

|

Toku

|

May 6 2022, 09:12 AM May 6 2022, 09:12 AM

|

Getting Started

|

QUOTE(dwRK @ May 5 2022, 06:32 PM) cannot...no physical account If there is no convenient way to open a DKK account for the tax refund, then the Danish stock is not a viable long term investment. |

|

|

|

|

|

Toku

|

May 6 2022, 09:18 AM May 6 2022, 09:18 AM

|

Getting Started

|

QUOTE(TOS @ May 5 2022, 11:19 PM) Alert to all Swiss stock investors, including those who hold Swiss ADRs on NYSE. Takudan TokuMy Swiss tax specialist just shared with me this useful service for your future dividend WHT refunds: https://www.ictax.admin.ch/extern/en.html#/searchThis is an official portal for you to verify whether you can claim for tax refunds from Swiss tax authorities. I am pleased that Swiss ADRs like Novartis' level II ADR (ISIN No. US66987V1098) are listed too. So, if IBKR does not refund you the 35% WHT (for ADR case, i.e., IB does not inform the ADR custodian bank about your tax residency), you can claim the refund via Form 60 together with all your SIX-listed securities, say ROG.SW or NESN.SW. Hope that helps. IBKR did withhold 35% dividend on ROG.SW that I hold. Should I expect IBKR to refund it? I doubt IBKR willing to put up a human to help on this type of things since they mostly automated their process and bots are the one handling customer... Think just to get ready the form 60 for 3yrs claim then go for local tax department to validate once before sending it to Swiss tax department. But I still have to ask for tax voucher from IBKR each year right? |

|

|

|

|

|

SUSTOS

|

May 6 2022, 10:22 AM May 6 2022, 10:22 AM

|

|

QUOTE(Toku @ May 6 2022, 09:18 AM) IBKR did withhold 35% dividend on ROG.SW that I hold. Should I expect IBKR to refund it? I doubt IBKR willing to put up a human to help on this type of things since they mostly automated their process and bots are the one handling customer... Think just to get ready the form 60 for 3yrs claim then go for local tax department to validate once before sending it to Swiss tax department. But I still have to ask for tax voucher from IBKR each year right? No, just claim from Swiss Tax Adminsitration every 3 years. IB does not handle that (the WHT reclaim). Yes, prepare Form 60 and get it stamped with LHDN every year. After 3 years, send it to Swiss with all the relevant IBKR statements. |

|

|

|

|

|

Toku

|

May 6 2022, 12:52 PM May 6 2022, 12:52 PM

|

Getting Started

|

QUOTE(TOS @ May 6 2022, 10:22 AM) No, just claim from Swiss Tax Adminsitration every 3 years. IB does not handle that (the WHT reclaim). Yes, prepare Form 60 and get it stamped with LHDN every year. After 3 years, send it to Swiss with all the relevant IBKR statements. The Form 60 allows 3yrs of claims entered into single page for submission. Should be able to get it stamped with LHDN on the 3rd year before submission. LHDN only need to validate our status as Malaysian citizen (those $$ claim each year has nothing to do with LHDN). What do you think? |

|

|

|

|

|

SUSTOS

|

May 6 2022, 01:02 PM May 6 2022, 01:02 PM

|

|

FT 060522: https://drive.google.com/file/d/1-wUJ6N4SBz...iew?usp=sharing» Click to show Spoiler - click again to hide... « |

|

|

|

|

|

SUSTOS

|

May 6 2022, 01:07 PM May 6 2022, 01:07 PM

|

|

QUOTE(Toku @ May 6 2022, 12:52 PM) The Form 60 allows 3yrs of claims entered into single page for submission. Should be able to get it stamped with LHDN on the 3rd year before submission. LHDN only need to validate our status as Malaysian citizen (those $$ claim each year has nothing to do with LHDN). What do you think? My tax specialist says it is ok to combine all 3 years on one Form 60, but I think it's best you split it into 3 forms, since you never know if your tax residency will change in any certain year in the future. » Click to show Spoiler - click again to hide... « LHDN's job is just to validate your tax residency. Follow the instructions of Form 60 and you should be fine. The stamp especially is important (it shows your tax residency for the particular financial year), the rest are just fine details. |

|

|

|

|

May 5 2022, 12:59 PM

May 5 2022, 12:59 PM

Quote

Quote

0.0223sec

0.0223sec

0.75

0.75

6 queries

6 queries

GZIP Disabled

GZIP Disabled