QUOTE(Hoshiyuu @ Mar 17 2022, 10:39 PM)

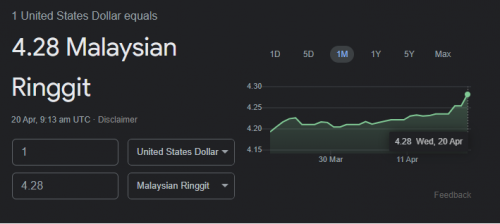

It'll depend on your deposit route, but try to keep your total transaction fee under 1% (0.5% ideally for me) - if you deposit and convert RM200 every month, you are going to lose quite a bit of fixed cost every month (2USD fixed currency conversion fee at IBKR for SGD->USD, Wise conversion fee for MYR->SGD or MYR->USD is around RM4 for RM200). Might wanna just hold onto it and deposit in longer interval (bimonthly, quarterly?) and later on, use low amount of margin (1.2x or below) to smooth out the buy interval if needed.

Losing 9% (MYR->(WISE)->SGD->(IBKR FX)->USD) or 2% (MYR->(WISE)->USD) of your deposit before you do anything is pretty bad.

The minimum deposit amount using the cheapest route at low volume would be MYR->(WISE)->USD at RM400 per deposit (~1% cost of conversion + 0.35USD for US stock/~2USD for LSE stock purchase) - if you buy Irish domiciled ETFs and stocks, MYR1200 per deposit via the MYR-USD route would be optimal-ish I guess? In that case I would suggest buying US-domiciled equivalent and forgo the 15% withholding tax gain until you decide to commit more per month in the future to cut down on purchase cost.

But don't overthink it too much either - sometimes being invested is the important part. There is a lot of nuance to this, so you can always come back and ask here with reference to what ticker you would be buying.

QUOTE(Takudan @ Mar 18 2022, 12:33 AM)

Adding on to sifu's advice above, I think you can consider tapping into your savings/short-term investments for that mini-lump sum to IBKR.

For example, right now you have 10k saved up for rainy days. Take half of that, you'll have a healthy sum for a relatively lower transaction cost (conversion fee, commission etc). For the next half year, rebuild that missing 5k back into your savings, rinse and repeat. It does mean that you will be risking those few months where you're shorter on emergency funds.

My point is, always prioritise on having a healthy sum of emergency funds. Holding cash gives you a lot more choices and less worries. Only invest with with an amount that you can part with for a loooong period of time (e.g. 5 years+)

QUOTE(polarzbearz @ Mar 18 2022, 12:57 AM)

Generally, the lower the amount, the less transaction fee incurred would be ideal (e.g. try to accumulate to 1k tranche; buy one fund per month; etc.). Otherwise the fees (albeit little) will add up very quickly.

Just to illustrate:

Wise/FTT transaction: between 1% ~ 2% depending on how much you transfer.

IBKR Conversion fee: 0% (if you direct debit via Wise USD multicurrency account) or ~1-2% if you use IBKR in-app conversion, again, depending on how much you transfer.

IBKR transaction fees$0.50 out of $50.00 is 1%

$0.50 out of $500.00 is 0.1%

For myself (just started this month after stopping my SA DCA

), I'm going with RM2k/month into 1 fund (or max, two funds only).

Will rotate my ETF choice on month-to-month basis between VWRA (primary) or my complementary sector/region ETFs (e.g. CSPX, KWEB/3067, 3040, etc.) - topping up whichever ETF's that has lower valuation / other factors at play.

QUOTE(dwRK @ Mar 18 2022, 09:21 AM)

ideas are good and valid... but i'll give y'all a more balance view

in a bull market like the us has been in the past 13 yrs... time in market is just as important

so whilst depositing every month... you lose out in fees... you win back in capital gains+dividends... take voo or qqq as example, y'all can do the maths to confirm

obviously in a bear market... take your time...

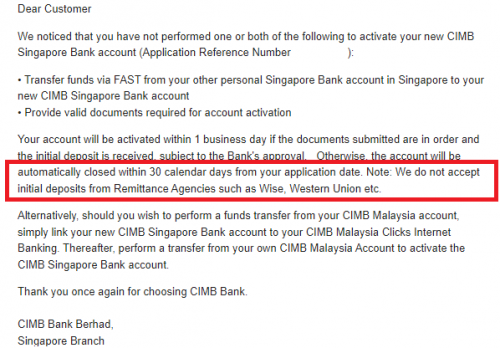

Thanks everyone! I actually got scared because of the startup fund for opening a CIMB SG account which is S$1k, I just need some assurance to convince my inner self that i'm doing the right thing. Will definetely considering this route "MYR->(WISE)->USD" in the future if my transaction is less than $250, making multiple small transaction while paying the conversion rate doesn't really make sense as i'll be losing more in the long run. Initially i'm looking at using Rakuten solely, but then realize that they does not have the fraction share option. Now i'm slightly relief, will start my IBKR Journey with USD $1k, and use CIMB SG as my first transaction.

Mar 2 2022, 03:10 PM

Mar 2 2022, 03:10 PM

Quote

Quote

0.2528sec

0.2528sec

0.45

0.45

7 queries

7 queries

GZIP Disabled

GZIP Disabled