QUOTE(dwRK @ Mar 29 2022, 06:06 PM)

Coz so far I transfer all next day can arrive. This is the first time taking longer. Likely the bigger the amount the longer the wait.Interactive Brokers (IBKR), IBKR users, welcome!

Interactive Brokers (IBKR), IBKR users, welcome!

|

|

Mar 29 2022, 06:38 PM Mar 29 2022, 06:38 PM

|

Senior Member

3,520 posts Joined: Jan 2003 |

QUOTE(dwRK @ Mar 29 2022, 06:06 PM) Coz so far I transfer all next day can arrive. This is the first time taking longer. Likely the bigger the amount the longer the wait. TOS liked this post

|

|

|

|

|

|

Mar 29 2022, 07:08 PM Mar 29 2022, 07:08 PM

Show posts by this member only | IPv6 | Post

#5352

|

Junior Member

471 posts Joined: Jun 2006 |

QUOTE(Davidtcf @ Mar 29 2022, 08:42 AM) just did a transfer from Wise to IBKR last Friday. Usually I would receive it on Monday.. but until now can't see the money. Any reason why you are not using cimb Singapore to IBKR?it is a bigger amount than usual. Anyone experienced such delays before? Hope I dont have to wait till 5 working days for it. No email nothing from IBKR also, Wise side said money has been sent. I used back my favourites in Wise after last successful transfer to IBKR, double checked details there all correct. Logged a ticket to IBKR also but as usual they slow to respond. |

|

|

Mar 29 2022, 07:30 PM Mar 29 2022, 07:30 PM

|

Senior Member

3,520 posts Joined: Jan 2003 |

QUOTE(sp3d2 @ Mar 29 2022, 07:08 PM) Coz it is cheaper. Ziet Invest video got compare both. Cimb SG for Malaysians we need do x2 currency conversion, at Wise then at IBKR . But imo after this likely I will use cimb sg. Can’t wait like this not knowing what’s going on. TOS liked this post

|

|

|

Mar 29 2022, 08:24 PM Mar 29 2022, 08:24 PM

Show posts by this member only | IPv6 | Post

#5354

|

Junior Member

471 posts Joined: Jun 2006 |

QUOTE(Davidtcf @ Mar 29 2022, 07:30 PM) Coz it is cheaper. Ziet Invest video got compare both. Cimb SG for Malaysians we need do x2 currency conversion, at Wise then at IBKR . I see.But imo after this likely I will use cimb sg. Can’t wait like this not knowing what’s going on. I saw that video as well. I am more familiar with cimb method and the savings using direct wise is not that much actually for someone that rarely transfer the money like me. Also using cimb, the transfer to IBKR is lightning fast to my standard. Davidtcf liked this post

|

|

|

Mar 29 2022, 08:29 PM Mar 29 2022, 08:29 PM

Show posts by this member only | IPv6 | Post

#5355

|

Senior Member

3,520 posts Joined: Jan 2003 |

QUOTE(sp3d2 @ Mar 29 2022, 08:24 PM) I see. From CIMB SG to IBKR, how fast do you usually get the money usually?I saw that video as well. I am more familiar with cimb method and the savings using direct wise is not that much actually for someone that rarely transfer the money like me. Also using cimb, the transfer to IBKR is lightning fast to my standard. |

|

|

Mar 29 2022, 08:30 PM Mar 29 2022, 08:30 PM

Show posts by this member only | IPv6 | Post

#5356

|

Junior Member

471 posts Joined: Jun 2006 |

QUOTE(Davidtcf @ Mar 29 2022, 08:29 PM) For me, it is less than 15 minutes. Yes seriously. |

|

|

|

|

|

Mar 29 2022, 08:37 PM Mar 29 2022, 08:37 PM

Show posts by this member only | IPv6 | Post

#5357

|

Senior Member

3,520 posts Joined: Jan 2003 |

|

|

|

Mar 29 2022, 08:38 PM Mar 29 2022, 08:38 PM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(sp3d2 @ Mar 29 2022, 08:30 PM) That's very fast. Mine is usually 30 min to an hour. When did you often do the transfer? Is it during office hours/lunch time/morning/afternoon? Davidtcf liked this post

|

|

|

Mar 29 2022, 08:50 PM Mar 29 2022, 08:50 PM

|

Senior Member

6,236 posts Joined: Jun 2006 |

swift wire is almost instant lah... but the biggest delay factor is the bank's back end processing... I think some is done by batches and after cut off time... the next day... This post has been edited by dwRK: Mar 29 2022, 08:51 PM Davidtcf liked this post

|

|

|

Mar 29 2022, 09:00 PM Mar 29 2022, 09:00 PM

|

Junior Member

471 posts Joined: Jun 2006 |

QUOTE(Davidtcf @ Mar 29 2022, 08:37 PM) I'm sorry to inform that my transfer last time Maybe small amount so it is fast. However all this Time all of it below 1 hour la QUOTE(TOS @ Mar 29 2022, 08:38 PM) That's very fast. Mine is usually 30 min to an hour. When did you often do the transfer? Is it during office hours/lunch time/morning/afternoon? It is morning office hours. TOS liked this post

|

|

|

Mar 29 2022, 10:44 PM Mar 29 2022, 10:44 PM

Show posts by this member only | IPv6 | Post

#5361

|

Senior Member

3,520 posts Joined: Jan 2003 |

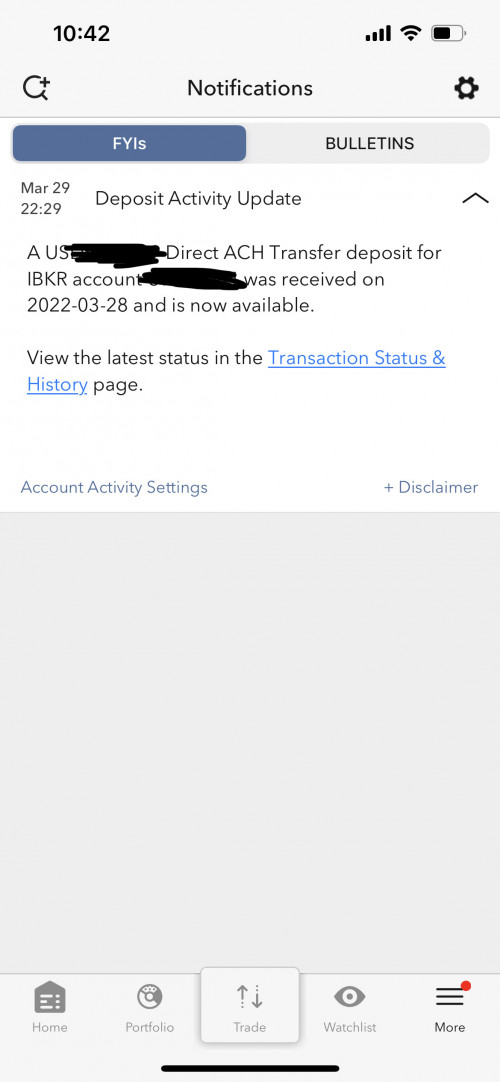

Finally got the money at 10.29pm. Longest wait for me for a Wise to IBKR transfer.  Next time will try CIMB SG to IBKR. This post has been edited by Davidtcf: Mar 29 2022, 10:45 PM TOS liked this post

|

|

|

Mar 30 2022, 04:09 AM Mar 30 2022, 04:09 AM

|

Junior Member

71 posts Joined: Dec 2021 |

|

|

|

Mar 30 2022, 08:13 AM Mar 30 2022, 08:13 AM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

|

|

|

|

|

|

Mar 30 2022, 08:32 AM Mar 30 2022, 08:32 AM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

Knives Out in India: Zomato Needs to Expand the Menu, Quickly: https://www.wsj.com/articles/knives-out-in-...share_permalink

|

|

|

Mar 30 2022, 09:18 AM Mar 30 2022, 09:18 AM

|

Junior Member

71 posts Joined: Dec 2021 |

QUOTE(TOS @ Mar 30 2022, 08:13 AM) NQ Thanks. |

|

|

Mar 30 2022, 12:30 PM Mar 30 2022, 12:30 PM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

|

|

|

Mar 30 2022, 06:48 PM Mar 30 2022, 06:48 PM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

dwRK

https://www.reuters.com/business/finance/us...019-2022-03-29/ Does the yield curve inversion tell you anything from "TA" point of view? This post has been edited by TOS: Mar 30 2022, 10:54 PM |

|

|

Mar 30 2022, 06:58 PM Mar 30 2022, 06:58 PM

|

Senior Member

1,210 posts Joined: Nov 2011 |

Anyone have experience selling box spread for low interest loans?

https://www.lesswrong.com/posts/8NSKMMDXS8g...slightly-faster |

|

|

Mar 30 2022, 08:06 PM Mar 30 2022, 08:06 PM

|

Senior Member

6,236 posts Joined: Jun 2006 |

QUOTE(TOS @ Mar 30 2022, 06:48 PM) dwRK these are mostly noise...https://www.reuters.com/business/finance/us...019-2022-03-29/ Does the yield curve inversion tells you anything from "TA" point of view? few years back... I think the 5 and 10 inverted...then ppl jumping on recession talk... before that yellen increase rates... ppl talk of market crash... then last year I think feds doing massive reverse repo... crash n recession talks again... seriously I've been waiting on recession since 2017... lol quite sure a recession will come... just dunno when... usually needs a trigger for the meltdown... like the subprime last time... I was hoping covid n ukraine be it but no... lol... right now US bonds are sitting on trend line support... if it breaks and drops further, then market is ok... if it starts going back up, then big players are in risk off mode and buying bonds...and we should be very carefully... usually the news and analysts will be especially bullish to reassure market is good and healthy... this is the sign to run... If you look at Russell 2000... it's not that pretty compared to S&P, Nasdaq, Dow... this means only a few big companies are "supporting" the market now... with cpi all time high... let's see... TOS liked this post

|

|

|

Mar 30 2022, 09:53 PM Mar 30 2022, 09:53 PM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(dwRK @ Mar 30 2022, 08:06 PM) these are mostly noise... Which bond index are you watching? From FA point of view, stocks are priced in large part due to risk premium over the risk-free yield. So knowing the bond markets movementcan give a lot of hints actually.few years back... I think the 5 and 10 inverted...then ppl jumping on recession talk... before that yellen increase rates... ppl talk of market crash... then last year I think feds doing massive reverse repo... crash n recession talks again... seriously I've been waiting on recession since 2017... lol quite sure a recession will come... just dunno when... usually needs a trigger for the meltdown... like the subprime last time... I was hoping covid n ukraine be it but no... lol... right now US bonds are sitting on trend line support... if it breaks and drops further, then market is ok... if it starts going back up, then big players are in risk off mode and buying bonds...and we should be very carefully... usually the news and analysts will be especially bullish to reassure market is good and healthy... this is the sign to run... If you look at Russell 2000... it's not that pretty compared to S&P, Nasdaq, Dow... this means only a few big companies are "supporting" the market now... with cpi all time high... let's see... Let me guess. You are watching the UST 10 year? From my experience, most professionals price stocks using the 10-year yield as the risk free rate (since you usually hold stocks for that long, hence bearing risk for a similar term). This post has been edited by TOS: Mar 30 2022, 10:11 PM |

| Change to: |  0.0275sec 0.0275sec

0.76 0.76

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 14th December 2025 - 10:31 AM |