Outline ·

[ Standard ] ·

Linear+

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

|

ViktorJ

|

May 24 2019, 05:42 PM May 24 2019, 05:42 PM

|

|

QUOTE(GenY @ May 24 2019, 05:35 PM) Diversified ETFs also no protection when the stupid herd decides to sell blindly Most of my gains this year wiped out  Nola, it does cushion it somewhat as compared to a non-diversified portfolio Besides, it has only been 6 months. SA sort of strategy requires a much longer term view, which is why their targets are like 30 or something years Btw, fast editing skills! hehehe |

|

|

|

|

|

ViktorJ

|

May 24 2019, 10:11 PM May 24 2019, 10:11 PM

|

|

QUOTE(GenY @ May 24 2019, 10:08 PM) Yeah, accidentally posted an insurance topic here .... guess I'm dizzy from bleeding money  Oh dear, bleeding money, that bad ka? Is it still on track to outperform FD by year end? |

|

|

|

|

|

ViktorJ

|

Jun 3 2019, 01:24 PM Jun 3 2019, 01:24 PM

|

|

QUOTE(Ancient-XinG- @ Jun 3 2019, 12:54 PM) Wowowow. Spark liang reviewed SA. Incoming capital surge hahaha Is he not kinda dodgy? This post has been edited by ViktorJ: Jun 3 2019, 01:24 PM |

|

|

|

|

|

ViktorJ

|

Jun 3 2019, 06:33 PM Jun 3 2019, 06:33 PM

|

|

QUOTE(roarus @ Jun 3 2019, 06:00 PM) Please help to feedback to SA to get rid of GLD for 36% Risk  I been meaning to ask. Why the dislike for GLD ar? Sorry, am noob. |

|

|

|

|

|

ViktorJ

|

Jun 3 2019, 07:25 PM Jun 3 2019, 07:25 PM

|

|

QUOTE(honsiong @ Jun 3 2019, 07:20 PM) Gold just sits there and do nothing, it's like Bitcoin but a lot more people believe in it - suddenly it has real value.  Oh yeah, thats true fundamentally they are quite crap, especially now that no one is using the Gold Standard anymore. But I guess SA is just using it because of its inverse nature to S&P500 haha |

|

|

|

|

|

ViktorJ

|

Jun 3 2019, 07:37 PM Jun 3 2019, 07:37 PM

|

|

QUOTE(Ancient-XinG- @ Jun 3 2019, 07:29 PM) Gold are depreciating in nature. I would love they make GLD to USD haha. Better for Malaysian. Yes, I think the 4% holding could be in bonds instead. Got dividend also. For my SA, it has now breached the 9% mark due to the bonds holdings. |

|

|

|

|

|

ViktorJ

|

Jun 3 2019, 08:22 PM Jun 3 2019, 08:22 PM

|

|

QUOTE(Ancient-XinG- @ Jun 3 2019, 08:10 PM) 9% in GLD? Mine down to 5% Nah, I meant my entire portfolio is now above +9%, cuz bonds keeps climbing. The 6.5 no-balls port has no GLD. This post has been edited by ViktorJ: Jun 3 2019, 08:28 PM |

|

|

|

|

|

ViktorJ

|

Jun 15 2019, 12:17 PM Jun 15 2019, 12:17 PM

|

|

QUOTE(Ancient-XinG- @ Jun 15 2019, 11:39 AM) My return back to peak. But most of the securities aren't back to peak. Dayummmmmm this is good stuff lol Peak aka around 20%? |

|

|

|

|

|

ViktorJ

|

Jun 15 2019, 07:01 PM Jun 15 2019, 07:01 PM

|

|

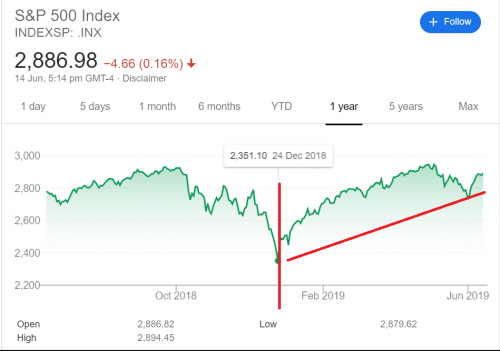

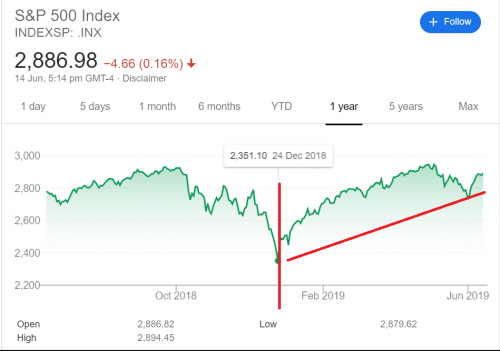

QUOTE(tadashi987 @ Jun 15 2019, 06:58 PM) +10.6% here entered around end of last year  This, ladies and gentlemen, is the sifu of market timing. |

|

|

|

|

|

ViktorJ

|

Jun 16 2019, 08:23 PM Jun 16 2019, 08:23 PM

|

|

QUOTE(kelvinfixx @ Jun 16 2019, 07:56 PM) Can I withdraw my money anytime or have to commit years? can I buy different amount every month? You can deposit any amount every month as you like. |

|

|

|

|

|

ViktorJ

|

Jun 18 2019, 07:32 PM Jun 18 2019, 07:32 PM

|

|

QUOTE(starianz @ Jun 18 2019, 06:22 PM) Hi, i'm really really newbie in Investment. Can somebody share with me, what is stashaway, and how does it work?  Can PM me? Thank you. Just check first page, it will answer 99% of your questions |

|

|

|

|

|

ViktorJ

|

Jun 18 2019, 11:44 PM Jun 18 2019, 11:44 PM

|

|

QUOTE(kelvinfixx @ Jun 18 2019, 11:21 PM) Usually when you put money? weekly? the cost of entry is higher for weekly compare to monthly? Cost of entry is the same for: Daily DCA Weekly DCA Monthly DCA or lump sum because there is no cost of entry, just a tiny charge for FX  |

|

|

|

|

|

ViktorJ

|

Jun 18 2019, 11:45 PM Jun 18 2019, 11:45 PM

|

|

QUOTE(y3ivan @ Jun 18 2019, 11:33 PM) Sorry all, maybe this has been answered before but how do you know if the dividend withholding tax has been processed by Saxo? Seems like something that Stashaway can improve transparency on... at the moment we have no idea if and when they are processing this refund on our behalf.. It looks exactly like this!  QUOTE(honsiong @ Jun 18 2019, 11:54 AM)  LONG LONG MAAAAAAAAAN |

|

|

|

|

|

ViktorJ

|

Jun 20 2019, 10:27 PM Jun 20 2019, 10:27 PM

|

|

QUOTE(tadashi987 @ Jun 20 2019, 09:58 PM) wow that crazy jump again Are you talking about US market? |

|

|

|

|

|

ViktorJ

|

Jun 20 2019, 10:47 PM Jun 20 2019, 10:47 PM

|

|

QUOTE(tadashi987 @ Jun 20 2019, 10:46 PM) You guys' portfolio explode liao boh? +20%? |

|

|

|

|

|

ViktorJ

|

Jun 21 2019, 01:57 PM Jun 21 2019, 01:57 PM

|

|

QUOTE(Ancient-XinG- @ Jun 21 2019, 01:46 PM) Yea. A few post of him in oct dec and may all mentioned that recession is yet to come and trade war number are insignificant to the whole market. Which is related to the market. compare to other analyst so many saying great bear is coming etc recession in few months etc etc from last dec. haha Teddy? Siapa ni? Recession is yet to come? Means that he is not bearish? |

|

|

|

|

|

ViktorJ

|

Jun 22 2019, 10:35 PM Jun 22 2019, 10:35 PM

|

|

QUOTE(Ancient-XinG- @ Jun 22 2019, 10:33 PM) Ahhh. Vanguard.... I also wish some of the top robo from US coming to our country.... Too bad. Malaysian tooooooo obsessed with mutual fund.... MY also kinda small They are more likely to go to SG and Indo than us hehe |

|

|

|

|

|

ViktorJ

|

Jun 27 2019, 09:07 PM Jun 27 2019, 09:07 PM

|

|

QUOTE(preducer @ Jun 27 2019, 09:06 PM) Out of curiosity, how many of those who came here asking for referral actually invested? I feel like not many 1 out of 2 for me lol |

|

|

|

|

|

ViktorJ

|

Jun 28 2019, 11:03 AM Jun 28 2019, 11:03 AM

|

|

QUOTE(AOL24 @ Jun 28 2019, 11:01 AM) Tbh, I'm currently applying for the client engagement team. So doing my level best to understand SAMY's users needs, wants and any feedback that will better their experience. Best of luck! |

|

|

|

|

|

ViktorJ

|

Jun 28 2019, 10:56 PM Jun 28 2019, 10:56 PM

|

|

QUOTE(vanitas @ Jun 28 2019, 10:15 PM) Second robo advisor coming to Malaysia, https://fintechnews.my/20967/wealthtech-mal...o-robo-advisor/Official website and pricing structure, https://mytheo.my/mytheo/hello-from-mytheo/price-structureEdit: Not sure was it an old news for you all, just sharing as I seeing the above article today. Good to share nevertheless  QUOTE(preducer @ Jun 28 2019, 10:33 PM) I think we should open a thread for myTheo Go go! We will support! |

|

|

|

|

May 24 2019, 05:42 PM

May 24 2019, 05:42 PM

Quote

Quote

0.0384sec

0.0384sec

0.21

0.21

7 queries

7 queries

GZIP Disabled

GZIP Disabled