QUOTE(LlinusLove Fangay @ Mar 17 2021, 02:19 AM)

Hi guys, saw the discussion above about DIY yourself buy ETF, or let Stashaway handle, and one of the discussion is about the fees.good discuss so far.

One thing I would like to ask though ? Doesn't Stashaway actually have lower fee , compare to DIY buying ETF ?

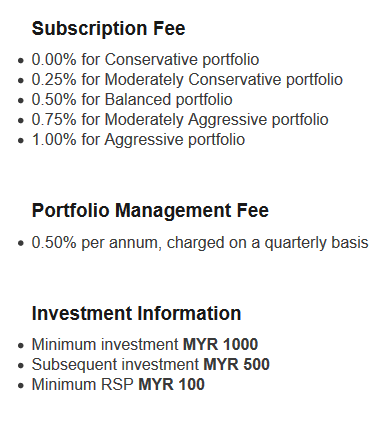

Stashaway fees : (0.2% to 0.8% management fee) + ( 0.1% conversion fee to USD when invest ) + ( 0.1% when withdraw back to MYR )

Self DIY buy ETF : ( roughly 0.5-0.6% conversion rate fee, using instarem or transferwise ) X 2 times ( deposit to invest , and withdraw back to MYR )

+ ( Brokers fee )

Expense ratio for ETF both are same.

Which also means, maximum fee for stashaway is 1.0%, while the minimum fee to DIY buy ETF is already at least more than 1% , right ?

Which also means , if you DCA weekly/monthly/quarterly, doesn't self DIY buy ETF actually cost you more fee ?

Can someone clarify me on this fee issue ? Thanks.

My total fees needed for 1 transaction, for conversion + brokerage fees is approx RM25. Lets say I really hand itchy and I start doing 1k DCA monthly with this route. ( 2.5% fee),

RM12k investment, annual fees is RM300?

Withdrawal is about 0.6% or so, lets say I withdraw 3k every month just for an example, so every month cost RM18 + ~RM8 withdrawal fee, lets call it RM25 too. RM300 on withdrawal.

(In a real scenario, its unlikely that I will still be depositing when I start withdrawing - and by the time I start withdrawing, there should be new fintech fee improvements)

So total expense on napkin math is RM600 a year for me. And this is being really generous because of high frequency very low volume DCA to a foreign brokerage.

----

Stashaway fees: 0.2% to 0.8% (I'm dropping ETF fees since its same/lower on DIY, and conversion fee because its one time and I'm lazy)

At RM50,000 invested, your annual fees are (50000*0.8%) = RM400

At RM100,000 invested, your annual fees are (50000*0.8%)+(50000*0.7%) = RM750

At RM250,000 invested, your annual fees are (50000*0.8%)+(50000*0.7%)+(150000*0.6%) = RM1650

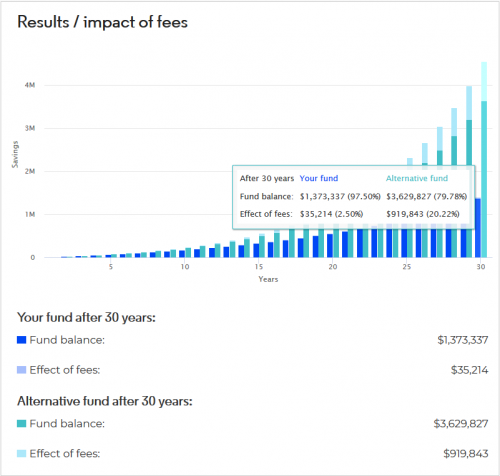

And if you treat SA like your EPF, to make 1mil/2mil then eat off it - it'd go up to RM4900 @ 1mil, RM6900 @ 2mil.

And these numbers are compounding VS flat comparing to DIY.

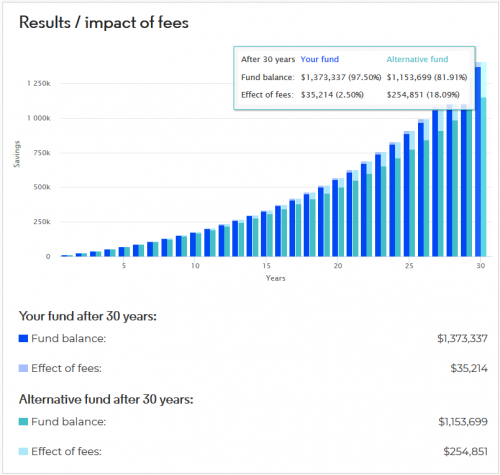

Most FIRE calculators will suggest that, at 4% withdrawal per year, on a 50/50 portfolio, on a 30 year horizon, that 1% means a drop of about 30% (100%->70%) success rate of the portfolio, if I remember correctly, and a drop of about 55% (100% -> 45%) success rate if it cost another 1%.

So while these number doesn't matter right now, if I stay invested for the next 3 decade, these numbers start to hurt a little, and will hurt more and more and more and it'll only get worst. So I hope you can see why I am tempted to research for a DIY solution. Earnings are not guaranteed, but fees are set in stone.

On the flip side, if SA is returning 20% and DIY is returning 10% then all of these goes out the window, which is a valid point that zstan has brought up.

Please correct if any of my numbers are off! Very napkin math that I typed out during my tea break.

This post has been edited by Hoshiyuu: Mar 17 2021, 10:04 AM

Mar 16 2021, 12:42 PM

Mar 16 2021, 12:42 PM

Quote

Quote

0.3503sec

0.3503sec

0.80

0.80

7 queries

7 queries

GZIP Disabled

GZIP Disabled