QUOTE(PPZ @ Mar 23 2021, 10:35 AM)

maybe perhaps 15 to 20% will be good enough? Normally the rule of thumb of investing will be having 2 portfolios where one is high risk and one is low?

IMO "diversifying" in Stashaway for the sake of "diversification" is a little pointless.

I'd recommend this rule of thumb, not sure if other sifu agree:

Core Portfolio: This is likely the only one you need for long term investing (5yr+ to end of life?) -

22% if you want a good balance of risk to reward

Debunking high risk, high return36% if you want theoretically highest possible return but a bumpier ride, or more "discounts" opportunities. (Read: gut-wrenching drops that will make you question your risk tolerance)

Then, you can complement it with a short term portfolio if you need - as they suggest, planning for a marriage, house, big purchase - goals that have a deadline within 3-5 years and you'd like to not delay too much when you need the money.

These usually comes in the form of a portfolio of 6.5%~12% depending on your risk appetite - "how much you are willing to lose for chance of a bonus when the goal date is met"

and finally, you may park some cash in Stashaway Simple - cash that you don't mind needing 3 working days to withdraw, but also good enough to beat inflation at little to no risk to them.

QUOTE(cucumber @ Mar 23 2021, 10:47 AM)

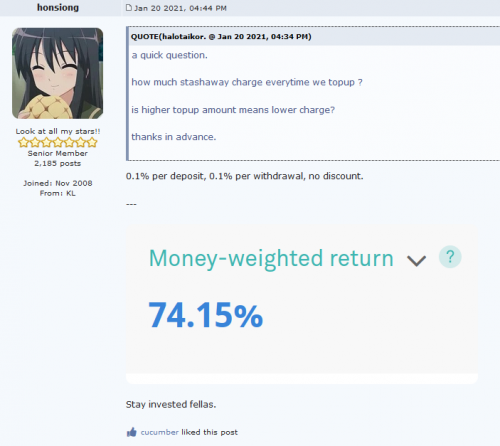

15% to 20% is not just 'good enough', that's fantastic return for a passive investment like this. I'm just afraid people are setting their expectations too high. Don't forget we're in a bull market right now (+ for the past 2 years), when we are in a bear market, it could potentially go negative. I remember 2018 was a bad year for everyone. So need to be prepared. Just my 2 cents.

if someone walked up to me and offered me 20% p.a., it's already hitting my "this feels like a get rich scheme, be very careful" alarms personally hahaha

but of course, nobody wants to get rich slowly.

This post has been edited by Hoshiyuu: Mar 23 2021, 11:18 AM

Mar 19 2021, 09:03 PM

Mar 19 2021, 09:03 PM

Quote

Quote

1.1081sec

1.1081sec

0.35

0.35

7 queries

7 queries

GZIP Disabled

GZIP Disabled