QUOTE(pinksapphire @ Mar 6 2021, 04:40 PM)

I have not much experience in stocks, wouldn't venture into those for now, thanks for listing them down.

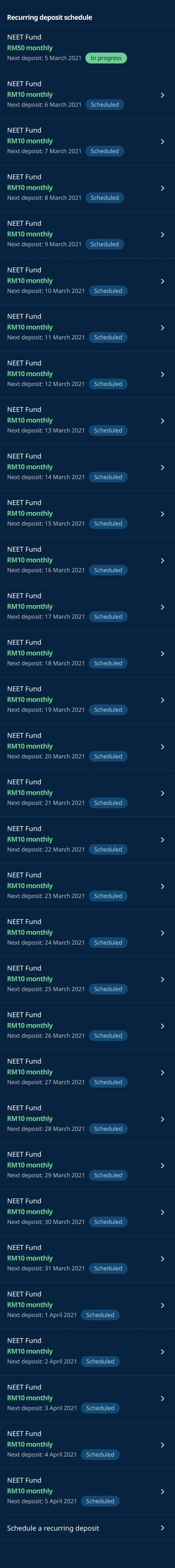

What I'm trying to approach by having different RIs is to diversify long term returns in case one of the RIs suddenly pooped by market, lol...macam more like back-up plans.

Example, 36% is more aggressive approach to go more on retirement financial freedom, 8% is for retirement emergencies. If that makes sense.

Not trying to game it cuz SA is supposed to alleviate my worries by not monitoring, sorta, lol

Don't know if this thinking is right, I welcome feedbacks.

Hahaha, for me, I try to keep it simple... a single portfolio at 36%.

IMO, even at 36% risk, its already far and beyond safe compared to me going to bursa and pick stocks. No reason to be too safe during growth. If you have a 8% and 16%, you are going to bite your lips when your 36% is on a massive bull and be tempted to fiddle with your portfolios.

Plus, at 36%, there is more chance for big discount topups excitements on top of regular fixed interval deposit. (i am not gonna used that cursed, perverted term in this thread

)

( Well, technically, I do have another 36% portfolio. It's a RM500 one time deposit portfolio, never going to add any more to it, using it for benchmark/tracking purpose )

This post has been edited by Hoshiyuu: Mar 6 2021, 08:34 PM

Mar 5 2021, 11:02 PM

Mar 5 2021, 11:02 PM

Quote

Quote

0.0398sec

0.0398sec

0.70

0.70

7 queries

7 queries

GZIP Disabled

GZIP Disabled