Outline ·

[ Standard ] ·

Linear+

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

|

xander2k8

|

Mar 8 2023, 04:13 PM Mar 8 2023, 04:13 PM

|

|

QUOTE(MUM @ Mar 8 2023, 03:40 PM) I think his word for silly imply if " just afraid of losing money or for wealth preservation purposes, .... " FD could be better suited than using that 2 SRI Rather than being silly he should the purpose of it instead |

|

|

|

|

|

James.L1M

|

Mar 15 2023, 02:03 PM Mar 15 2023, 02:03 PM

|

New Member

|

On average, real inflation eats FD rates for breakfast. Currently interest rates are relatively high while The Fed continues to raise interest rates, negatively affecting equity markets overall. 2023 still looks rather choppy and will certainly affect StashAway's performance across the board.

|

|

|

|

|

|

xander2k8

|

Mar 15 2023, 05:51 PM Mar 15 2023, 05:51 PM

|

|

QUOTE(James.L1M @ Mar 15 2023, 02:03 PM) On average, real inflation eats FD rates for breakfast. Currently interest rates are relatively high while The Fed continues to raise interest rates, negatively affecting equity markets overall. 2023 still looks rather choppy and will certainly affect StashAway's performance across the board. Not necessary 🤦♀️ because the lower SRI holding more cash equivalents |

|

|

|

|

|

James.L1M

|

Mar 16 2023, 01:16 PM Mar 16 2023, 01:16 PM

|

New Member

|

QUOTE(xander2k8 @ Mar 15 2023, 05:51 PM) Not necessary 🤦♀️ because the lower SRI holding more cash equivalents Agreed to some extent but there is still partial exposure to equity markets. |

|

|

|

|

|

xander2k8

|

Mar 16 2023, 05:24 PM Mar 16 2023, 05:24 PM

|

|

QUOTE(James.L1M @ Mar 16 2023, 01:16 PM) Agreed to some extent but there is still partial exposure to equity markets. Very small % only less than a quarter exposure with most of it going cyclical and defensive equities |

|

|

|

|

|

zstan

|

Mar 18 2023, 12:55 PM Mar 18 2023, 12:55 PM

|

|

Wew luckily SAMY sold all the finance related ETFs. The 10% gold is carrying the portfolio now

|

|

|

|

|

|

xander2k8

|

Mar 18 2023, 05:00 PM Mar 18 2023, 05:00 PM

|

|

QUOTE(zstan @ Mar 18 2023, 12:55 PM) Wew luckily SAMY sold all the finance related ETFs. The 10% gold is carrying the portfolio now In fact they bought after the peak and sold down with losses at 15% just on XLF If they still holding on it it will be like mini KWEB meltdown 2 🤦♀️ |

|

|

|

|

|

red streak

|

Mar 19 2023, 12:44 AM Mar 19 2023, 12:44 AM

|

|

Wow 1000+ of money losing posts. Glad to see that SA is still burning through their investors and customers money, and yet the usual suckers are still hoping they turn things around  |

|

|

|

|

|

MUM

|

Mar 19 2023, 12:55 AM Mar 19 2023, 12:55 AM

|

|

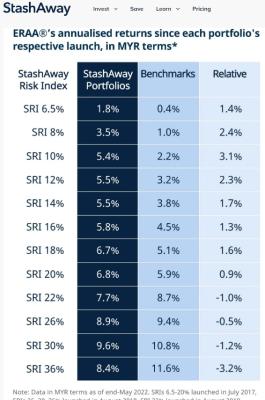

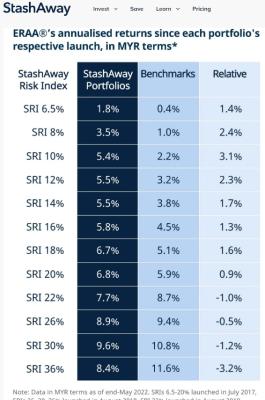

QUOTE(red streak @ Mar 19 2023, 12:44 AM) Wow 1000+ of money losing posts. Glad to see that SA is still burning through their investors and customers money, and yet the usual suckers are still hoping they turn things around  did you lose money and was hoping for a turn around?? image sourced from https://www.stashaway.my/r/returns-since-launch-YTD-2022This post has been edited by MUM: Mar 19 2023, 12:59 AM Attached thumbnail(s)

|

|

|

|

|

|

red streak

|

Mar 19 2023, 01:21 AM Mar 19 2023, 01:21 AM

|

|

QUOTE(MUM @ Mar 19 2023, 12:55 AM) did you lose money and was hoping for a turn around??[/url] ...and here's the main guy himself  I got out while still green after they did the genius move of exiting the US ETF market right before they boomed. That was when I knew they didn't know shit and were just glorified stock pickers. In my exit survey I told them they were idiots for getting out of the best market in the world just to pivot to China. I was proven right when they bought at KWEB's peak and then exited it at its lowest point as well. Meanwhile almost all the US ETFs they dropped went up as high as 100% or better. How many times have they bought and sold since then?  But yes, keep regurgitating that marketing drivel from SA as if it means anything. Even the sinkies are laughing at you at paying a very high management fee to incompetents who are good at losing money. It's not like they fired 14% of their workforce last year because they can't make money right?   Edit: But hey even an SA bootlicker like you doesn't have to take my word for it. Just look at page 300 and you can see it for yourself and refresh your memory. I know you guys tend to have really short-term ones or you wouldn't still be here with your Stockholm Syndrome. This post has been edited by red streak: Mar 19 2023, 01:28 AM |

|

|

|

|

|

MUM

|

Mar 19 2023, 01:27 AM Mar 19 2023, 01:27 AM

|

|

QUOTE(red streak @ Mar 19 2023, 01:21 AM) ...and here's the main guy himself  I got out while still green after they did the genius move of exiting the US ETF market right before they boomed. That was when I knew they didn't know shit and were just glorified stock pickers. In my exit survey I told them they were idiots for getting out of the best market in the world just to pivot to China. I was proven right when they bought at KWEB's peak and then exited it at its lowest point as well. Meanwhile almost all the US ETFs they dropped went up as high as 100% or better. How many times have they bought and sold since then?  But yes, keep regurgitating that marketing drivel from SA as if it means anything. Even the sinkies are laughing at you at paying a very high management fee to incompetents who are good at losing money. It's not like they fired 14% of their workforce last year because they can't make money right?   the RETURNS that they posted in the earlier image....is AFTER all the fees, right?.... so it is still NOT losing but still make money,...even "high" fees they charged |

|

|

|

|

|

xander2k8

|

Mar 19 2023, 01:29 AM Mar 19 2023, 01:29 AM

|

|

QUOTE(MUM @ Mar 19 2023, 12:55 AM) did you lose money and was hoping for a turn around?? image sourced from https://www.stashaway.my/r/returns-since-launch-YTD-2022Those are glorified returns when the fees and depreciation of currency not taken account into 🤦♀️ QUOTE(red streak @ Mar 19 2023, 01:21 AM) ...and here's the main guy himself  I got out while still green after they did the genius move of exiting the US ETF market right before they boomed. That was when I knew they didn't know shit and were just glorified stock pickers. In my exit survey I told them they were idiots for getting out of the best market in the world just to pivot to China. I was proven right when they bought at KWEB's peak and then exited it at its lowest point as well. Meanwhile almost all the US ETFs they dropped went up as high as 100% or better. How many times have they bought and sold since then?  But yes, keep regurgitating that marketing drivel from SA as if it means anything. Even the sinkies are laughing at you at paying a very high management fee to incompetents who are good at losing money. It's not like they fired 14% of their workforce last year because they can't make money right?   Don’t bother because they just doesn’t realised how much is losing while on top paying more in fees for SA to lose more For sure soon they will reopt again because even latest defensive play it is not working 🤦♀️ |

|

|

|

|

|

red streak

|

Mar 19 2023, 01:32 AM Mar 19 2023, 01:32 AM

|

|

QUOTE(MUM @ Mar 19 2023, 01:27 AM) the RETURNS that they posted in the earlier image....is AFTER all the fees, right?.... so it is still NOT losing but still make money,...even "high" fees they charged Really? Tell me what the real numbers are in USD. Surely the MYR becoming more toilet paper-y has nothing to do with their returns right?  I mean if they had some real returns then surely they would post a comparison chart in USD as well right? |

|

|

|

|

|

MUM

|

Mar 19 2023, 01:33 AM Mar 19 2023, 01:33 AM

|

|

QUOTE(xander2k8 @ Mar 19 2023, 01:29 AM) Those are glorified returns when the fees and depreciation of currency not taken account into 🤦♀️ Don’t bother because they just doesn’t realised how much is losing while on top paying more in fees for SA to lose more For sure soon they will reopt again because even latest defensive play it is not working 🤦♀️ Depreciation of Currency is SA Fault??  |

|

|

|

|

|

MUM

|

Mar 19 2023, 01:34 AM Mar 19 2023, 01:34 AM

|

|

QUOTE(red streak @ Mar 19 2023, 01:32 AM) Really? Tell me what the real numbers are in USD. Surely the MYR becoming more toilet paper-y has nothing to do with their returns right?  I mean if they had some real returns then surely they would post a comparison chart in USD as well right? Depreciation of Currency is SA Fault?? you invest with MYR,..you calculates your returns in MYR. did SA portfolio loses your money if you follow what was in that image?? This post has been edited by MUM: Mar 19 2023, 01:36 AM |

|

|

|

|

|

red streak

|

Mar 19 2023, 01:39 AM Mar 19 2023, 01:39 AM

|

|

QUOTE(MUM @ Mar 19 2023, 01:34 AM) Depreciation of Currency is SA Fault?? you invest with MYR,..you calculates your returns in MYR. did SA portfolio loses your money if you follow what was in that image?? Then tell me what are the USD returns? It's not a hard question is it? Even you realize them using only MYR to benchmark returns is downright dishonest. Which is kinda funny. |

|

|

|

|

|

MUM

|

Mar 19 2023, 01:42 AM Mar 19 2023, 01:42 AM

|

|

QUOTE(red streak @ Mar 19 2023, 01:39 AM) Then tell me what are the USD returns? It's not a hard question is it? Even you realize them using only MYR to benchmark returns is downright dishonest. Which is kinda funny. if you want in USD terms....you have to ask SA... they use MYR because you use MYR to invest,.... they will use SGD if you invest with SGD thru Spore bcos i lived in Msia, my assets is in MYR, my EPF is in MYR, thus my total wealth including my investment returns is calculated in MYR.... |

|

|

|

|

|

xander2k8

|

Mar 19 2023, 07:00 AM Mar 19 2023, 07:00 AM

|

|

QUOTE(MUM @ Mar 19 2023, 01:33 AM) Depreciation of Currency is SA Fault??  Partly yes because they don’t hedge for depreciation 🤦♀️ If they allow direct USD then it is different story QUOTE(red streak @ Mar 19 2023, 01:39 AM) Then tell me what are the USD returns? It's not a hard question is it? Even you realize them using only MYR to benchmark returns is downright dishonest. Which is kinda funny. It is hard for them to project in USD because of the currency movement hence SA is partly to blame Unless they willing to show a fix amount of USD since day 1 performance it will be different story Anyway beware that in losing market SA is losing more of your money than what you think because of this blindside 🤦♀️ Don’t forget their TWR and MWR it is not accurate what you think and you should look at the amount being loss now |

|

|

|

|

|

MUM

|

Mar 19 2023, 07:07 AM Mar 19 2023, 07:07 AM

|

|

QUOTE(xander2k8 @ Mar 19 2023, 07:00 AM) Partly yes because they don’t hedge for depreciation 🤦♀️ If they allow direct USD then it is different story ..... If anyone want to blame any fund manager for those things you mentioned, ... Better blame themselves first. For not knowing what they are investing in For not fully understand what can that vehicle do and cannot do. Etc etc Putting blames on anything they can think of on someone else for their own failures is much easier. BTW, currencies hedging is a doubled edged sword. This post has been edited by MUM: Mar 19 2023, 08:10 AM |

|

|

|

|

|

Hoshiyuu

|

Mar 19 2023, 09:05 AM Mar 19 2023, 09:05 AM

|

|

Discussion doesn't have to be vitrolic, calm down friends.

Though, my personal two cents is that Stashaway's annualized return infographic can be very misleading to some extent?

Their numbers are very optimistic and not very representative of real use cases, and their methodology is not fully clear, there's plenty of way to fuzz the numbers to make it look a lot better than it is.

For example, in the returns infographic, it does not take into factors such as

1. Stashaway Fees

2. Reoptimization

3. Deposit/Withdrawal timings

4. USD/MYR forex returns

Most of their returns are still from the initial inception bullruns and lucky successful reoptimizations, on the flip side, anyone who's been here from late 2020 onwards would still be looking at a sea of red for god knows when to come, so I wouldn't be surprised if tension runs high.

Ultimately, fund performance within a 2-3 year window are far from a useful judge of a portfolio performance - seeing that the average investor here probably has a horizon of 20-30 years.

My take is always judge Stashaway for everything surrounding it except their performance - is their fees good? Is their investing philosophy sound and aligned to your interest? Would the alternative to Stashaway (to you) is just not investing at all?

When I evaluated it for 2 years, I've found Stashaway incompatible with me - I love how easy it is to set up a reoccuring deposit and forget about it - the truly "Stashaway" nature of investing. It's great that to some people that would have just let their currency rot in their back for 0.25% interest, Stashaway is incredibly straight forward and encourages "set it up and forget".

But, I dislike their reoptimization and stock-pickiness nature, their crazy KWEB sector tilting saga (which was not indicated to me that this is going to be a thing before I started their portfolio), their slow deposit to investing period, the MYR->USD conversion process, their almost misleading fee structure, their app changes and fuzzing of words and numbers during bearish times, the messy MYR/USD return values, and fortunately for myself, I have access to alternative ways to invest in a fashion that's more aligned to what I have in mind.

But above all else, I do not judge them for their returns in a 2 year period out of my next 30 - that's just plain silly, in my opinion.

This post has been edited by Hoshiyuu: Mar 19 2023, 09:07 AM

|

|

|

|

|

Mar 8 2023, 04:13 PM

Mar 8 2023, 04:13 PM

Quote

Quote

0.0545sec

0.0545sec

0.71

0.71

6 queries

6 queries

GZIP Disabled

GZIP Disabled