QUOTE(ladytarot99 @ Feb 10 2020, 02:08 PM)

I’m 29yo, better not saying how much my saving because I’m daddy mommy kasi, hubby inlaw kasi...

But I think I should share how much My hubby earned till he is 30 years old. Although his parents very loaded, but he is 100% self made yo

1999 = Graduated from UK, straight got his first job.

1999= Salary RM5k/month not include allowances (OnG offshore) ——— RM 50k saving

2000= Salary RM5900/month (OnG offshore) ——-RM 91K saving

2001 = Salary RM7100/month (OnGoffshore)——-RM150K saving

2002 = Salary RM8500/month (OnGoffshore)———RM210K saving

2003 = Salary RM11K/month (offshore)——— RM440k saving

2004 = salary RM16k/month(offshore)——— RM570K saving (30 YO)

In 2005 he left offshore job... collie based in office while starting his own company at the same time..

2006 his first 2 companies running

2007 he got his master degree and mba for free while still working as collie and running his own company at the same time...

2009 still working as collie and runs RM30millions nett worth private companies of his own..

2010-2011 he accomplished his PhD target, resign from his position an 100% focus on his companies

-

-

-

-

-

-

2020 ——— we’re not finish yet..

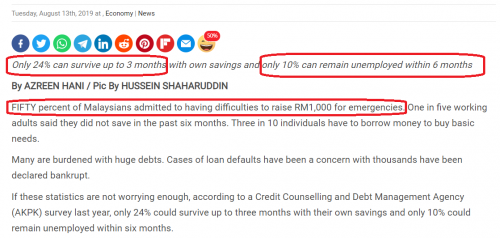

I’m not trying to brag.. I just want to tell others.. Nothing’s impossible... unfortunately you have to set up your goal and do all of your best to get it... money is not an issue, but your mental is.. its important to be mentally prepared rather than financially prepared... if you are not mentally prepared, no matter how much money in your hands it would be gone in many ways, but if you are mentally prepared and have a big goal in life, no matter how little money you got, you’ll be able to take the maximum advantage out of it..

Here's mine:

2006, finish SPM. With average results. Spent time in cyber and chasing tail..

2007, college. Dropped out. Run a cyber cafe business. became a really skilled CS player.

2008, college again. This time doing my own course, with my own funds.

2009-2013; engineering degree. but mostly, just wasting more time whilst earning minimum wage jobs and paying for my own education/life.

2013; first proper job in my chosen field. first job, earning 5k rm/month. Spent some good times chasing tail & partying hard.

2014: jumped jobs. salary 8.5k/month. spent more time chasing tail & drinking with mates. Hit some big shot bros up in HK, Macau, Shanghai, & BkK .. party like it's the end of the world.

2015: salary 12k/month woops, my partying lifestyle finally caught up with me.. i knocked up my girlfriend of 12 months. lmaooo. We promptly get married and quickly start a family life.

2016-2018: kid no.1.. party days are over, and suddenly have so much money saved up. So put downpayment & acquired property no.1 in 2016, in 2017, bought investment prop no.2.

2019: 20k/month. kid no.2, my baby princess.. I bought a couple more property. 2.1mil in debt and counting. life is all good. We moved to live closer to the seaside. I spend my weekends on a chartered yatch, fishing with my 4 year old son or we go mountain biking in the jungle.. Now planning to get a boat of my own in 2020 and park it in a marina.

32 this year, my ex-model wife is 26, she's still getting gigs despite being a mom of 2 kids.. 2 great kids.

I'm in a heck of alot of debt, but have a good paying and pretty stable career.

Plenty more of life to live.

point is, there's really no need to stress about getting 'further' ahead in life.

Even a mad party animal like me, who shot-gunned a wedding, is doing okay.. Just go with the flow.. No need to plan meticulously..

This post has been edited by Liamness: Feb 10 2020, 04:21 PM

Jan 28 2019, 04:36 PM, updated 7y ago

Jan 28 2019, 04:36 PM, updated 7y ago

Quote

Quote

0.0806sec

0.0806sec

0.82

0.82

5 queries

5 queries

GZIP Disabled

GZIP Disabled