QUOTE(LostAndFound @ May 26 2025, 05:32 PM)

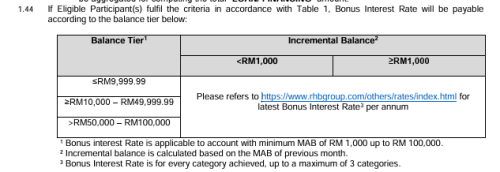

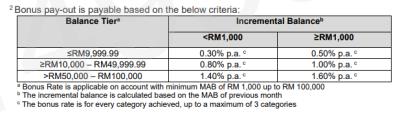

Not true, because let's say this month I have 100k MAB (didn't touch at all).

Next month my requirement is 101k. But if I did ANY transactions with that account (for e.g. using it to pay my credit card bill), that will change the MAB. So unless I'm doing the specific calculation, I will start having to keep track that on the 15th of the month I paid out 3k, salary coming in on 28th is more than that, how much exactly do I need to 'top up' in between to hit 101k. Let's say I put in a bit more to be safe, MAB come out will be 101.5k

The next month requirement is then 102.5k. If I calculated wrong? Suddenly the interest earned drops for that month AND all subsequent months. So the only way (which I'm planning to use right now actually) is to make sure the account just.... never used except for credit salary.

Whereas for UOB, if you count wrong no big deal. Can just treat it like a savings account, I schedule all my CC bill payments from the same account and don't really bother about whether I need to hit one specific number, as long as its somewhere in the 100k-200k range.

Ironically before RHB's change I used to leave exactly 100k in UOB and everything else in RHB for regular bill payment etc. Once UOB extended interest to 100k-200k range I just used that, then some time after that RHB change requirement to increasing balance, no motivation to come back.

ya, for this kind of incremental balance requirement, i will not use that acc as my normal saving acc, more like treating it as "FD", less movement then will be easier to track... more effort require for the extra 1%, anyway, this campaign only until dec25, so, i just treat it as "FD" for less than 1 year, just every month make sure to put in add 1k at 1st of the month..Next month my requirement is 101k. But if I did ANY transactions with that account (for e.g. using it to pay my credit card bill), that will change the MAB. So unless I'm doing the specific calculation, I will start having to keep track that on the 15th of the month I paid out 3k, salary coming in on 28th is more than that, how much exactly do I need to 'top up' in between to hit 101k. Let's say I put in a bit more to be safe, MAB come out will be 101.5k

The next month requirement is then 102.5k. If I calculated wrong? Suddenly the interest earned drops for that month AND all subsequent months. So the only way (which I'm planning to use right now actually) is to make sure the account just.... never used except for credit salary.

Whereas for UOB, if you count wrong no big deal. Can just treat it like a savings account, I schedule all my CC bill payments from the same account and don't really bother about whether I need to hit one specific number, as long as its somewhere in the 100k-200k range.

Ironically before RHB's change I used to leave exactly 100k in UOB and everything else in RHB for regular bill payment etc. Once UOB extended interest to 100k-200k range I just used that, then some time after that RHB change requirement to increasing balance, no motivation to come back.

May 26 2025, 05:53 PM

May 26 2025, 05:53 PM

Quote

Quote

0.0215sec

0.0215sec

0.31

0.31

6 queries

6 queries

GZIP Disabled

GZIP Disabled