QUOTE(AnasM @ Aug 24 2020, 10:51 AM)

Mind sharing which reits ut fund having that n any idea how many % of that 5G tower reits is being held by that ut fund?FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

|

Aug 24 2020, 12:02 PM Aug 24 2020, 12:02 PM

Return to original view | IPv6 | Post

#921

|

Senior Member

8,188 posts Joined: Apr 2013 |

|

|

|

|

|

|

Aug 24 2020, 04:51 PM Aug 24 2020, 04:51 PM

Return to original view | Post

#922

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(majorarmstrong @ Aug 24 2020, 04:45 PM) thanks,any idea why this 5G American Tower is special? if one has 10% of this Reits UT invested in a portfolio, then this UT has only 10% in this American tower... then the UT port only has 1% in this American Tower. if this American Tower stock goes up by 10%,...the UT port goes up by 0.1% ROI |

|

|

Aug 25 2020, 04:50 PM Aug 25 2020, 04:50 PM

Return to original view | Post

#923

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(majorarmstrong @ Aug 25 2020, 11:44 AM) i think, if your DIY KWSP investment is related to UT funds,then you can try use this existing "Pinned" lyn thread Fund Investment Corner v3, Funds101 https://forum.lowyat.net/topic/2601692/+2900 as this current thread is more on UT funds investment on FSM platform |

|

|

Aug 31 2020, 11:00 AM Aug 31 2020, 11:00 AM

Return to original view | Post

#924

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(2387581 @ Aug 31 2020, 10:31 AM) Just searching the forum for "RHB". From my own experience, I bought this fund lump sum since August 2016, never top up since then. Currently the return is 11.51%, means annualised 2.71%, even worse than putting in FD. If you look at the performance chart, it reached a high before the 18 March crash, but unable to recoup the losses. Wanted to sell all but can't find a better place to deploy the money. And heck RM25 switching fee! if you had been following this thread, i believes many did not stick to "past" hero or heroine for sentimental purposes when it is money involved.another example is the KGF or Reits funds so if you had been having good returns with that RHB for some years, and then when it performance deteriorated for a the last few years and yet you still held on to it,...then it was your choice (same with those that had put money in FD instead of that RHB during those past good ROI years) |

|

|

Aug 31 2020, 11:42 AM Aug 31 2020, 11:42 AM

Return to original view | Post

#925

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(2387581 @ Aug 31 2020, 11:23 AM) No. I'm in the process of tuning my portfolio after neglecting it for a while, if you are long timer here, I was active here a few years ago, then quiet and then now lurking here again. sell off that fund then no need to pay switching fees of RM25K...so that the wound would be be no more as it had been cut off (amputated). is this action actionable?I was planning to redeploy the money from that fund elsewhere, when there are fellow forummers mentioned the fund I tried to offer my painful experience with them in hope that less people had to learn it the hard and expensive way. I'd appreciate if others offer actionable replies instead of sprinking salt on my wounds! i can only think of 3 actionable items, continue to hold,,,,,not fees incured switch to other RHB fund.... RM25 will be incured sell it off This post has been edited by yklooi: Aug 31 2020, 11:44 AM |

|

|

Sep 4 2020, 12:17 PM Sep 4 2020, 12:17 PM

Return to original view | Post

#926

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(MUM @ Sep 4 2020, 11:47 AM) if he wins, will the market still goes up? based on past performances....just like many had been investing based on past performances....(the mkts had been up since he is the there) if he loses, will the market die down? (many businesses will be happy if there is possible chance of direction between US/China) what do you think? if based on past performance,... the market had been up since he won the last time if he wins again this time,...mkts will continue to goes up (based on past performances and the past reasons of it going up,....even with trade tensions with China) if he losses, ...... then markets will still goes up as per some points in below post...... reduction of tension, easier to do business, less countries/companies kena sanctions/blacklist, etc, etc QUOTE(xcxa23 @ Sep 4 2020, 12:06 PM) |

|

|

|

|

|

Sep 8 2020, 10:53 AM Sep 8 2020, 10:53 AM

Return to original view | Post

#927

|

Senior Member

8,188 posts Joined: Apr 2013 |

|

|

|

Sep 8 2020, 11:10 AM Sep 8 2020, 11:10 AM

Return to original view | Post

#928

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(mystycque @ Sep 8 2020, 11:01 AM) top up all la..all fund drop now.top up how much money you have la..i put all my money here and monitor eery day just hope that, the as much money as you have is the amount that has significant impact to the current ROI of your portfolio. This post has been edited by yklooi: Sep 8 2020, 11:13 AM |

|

|

Sep 11 2020, 09:46 AM Sep 11 2020, 09:46 AM

Return to original view | Post

#929

|

Senior Member

8,188 posts Joined: Apr 2013 |

|

|

|

Sep 12 2020, 11:45 AM Sep 12 2020, 11:45 AM

Return to original view | Post

#930

|

Senior Member

8,188 posts Joined: Apr 2013 |

|

|

|

Sep 12 2020, 11:51 AM Sep 12 2020, 11:51 AM

Return to original view | Post

#931

|

Senior Member

8,188 posts Joined: Apr 2013 |

|

|

|

Oct 1 2020, 07:36 PM Oct 1 2020, 07:36 PM

Return to original view | IPv6 | Post

#932

|

Senior Member

8,188 posts Joined: Apr 2013 |

MoM for my DIY port is abt -0.6% MoM for moderately aggressive Managed Port abt -4.6% MoM for my spouse PM portfolio is abt -6.8% different composition & risk level so cannot judge This post has been edited by yklooi: Oct 1 2020, 07:39 PM Attached thumbnail(s)

encikbuta liked this post

|

|

|

Oct 2 2020, 07:48 PM Oct 2 2020, 07:48 PM

Return to original view | IPv6 | Post

#933

|

Senior Member

8,188 posts Joined: Apr 2013 |

|

|

|

|

|

|

Oct 12 2020, 11:14 PM Oct 12 2020, 11:14 PM

Return to original view | IPv6 | Post

#934

|

Senior Member

8,188 posts Joined: Apr 2013 |

|

|

|

Oct 13 2020, 12:01 AM Oct 13 2020, 12:01 AM

Return to original view | IPv6 | Post

#935

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(datolee32 @ Oct 12 2020, 11:22 PM) Pre-Retirement Withdrawal for General Purposes can be made, in part or in full, from Sub-Account B, which holds 30% of a member’s PRS savings. Such withdrawals are allowed one year after the date of enrolment, once per calendar year and are subjected to an 8% tax penalty on the withdrawn amount. https://www.ppa.my/prs-and-you/prs-faq/ QUOTE(MUM @ Oct 12 2020, 11:24 PM) 30% of what you had invested can be withdrawn subjected to i think 8% tax looks like they had added some new additional withdrawal scenarios the remaining 70% have to wait till retirement https://www.ppa.my/prs-and-you/prs-faq/ Attached thumbnail(s)

datolee32 liked this post

|

|

|

Oct 13 2020, 07:29 PM Oct 13 2020, 07:29 PM

Return to original view | IPv6 | Post

#936

|

Senior Member

8,188 posts Joined: Apr 2013 |

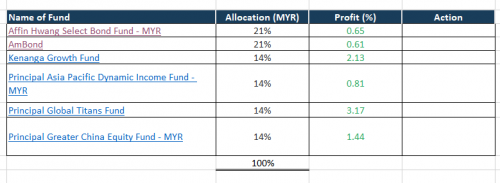

QUOTE(viktorherald @ Oct 13 2020, 05:48 PM)  My current allocation, i did contact with their advisor and this is the fund that he recommend to me. I consider my self a moderately risk person i did read the individual funds, but lets just say.. i didnt put too much thinking to it i just feel that this is quite diverse in regionality, previously some fund dip into reds and now had all recovered Anyone have good insights to offer? just that past few months,....there had been forummers |

|

|

Oct 16 2020, 11:00 PM Oct 16 2020, 11:00 PM

Return to original view | IPv6 | Post

#937

|

Senior Member

8,188 posts Joined: Apr 2013 |

The US pharmaceutical giant Pfizer expects to file for emergency use authorisation for its Covid-19 vaccine in late November, around two weeks after the Nov 3 US presidential election, it said on Friday.

The announcement means the United States could have two vaccines ready by the end of the year, with the Massachussetts biotech firm Moderna aiming for Nov 25 to seek authorisation. Bourla said the Pfizer trial, involving 30,000 participants, might produce results on the vaccine's efficacy within the next two weeks. "I've said before, we are operating at the speed of science. This means we may know whether or not our vaccine is effective by the end of October," he said. https://www.bangkokpost.com/world/2003415/p...ion-in-november This post has been edited by yklooi: Oct 16 2020, 11:02 PM |

|

|

Oct 21 2020, 10:53 AM Oct 21 2020, 10:53 AM

Return to original view | IPv6 | Post

#938

|

Senior Member

8,188 posts Joined: Apr 2013 |

|

|

|

Oct 25 2020, 12:04 PM Oct 25 2020, 12:04 PM

Return to original view | IPv6 | Post

#939

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(tadashi987 @ Oct 25 2020, 11:41 AM) I think u meant geographical risk, yes, it is riskier than as it is country specified. If you defined volatility as that, then why do you mentioned that rhb emerging mkt bond (MYR) is too volatile for you compare to this China bond fund (MYR)?but volatility is purely defined by NAV movement? as the 3-Yr Annualised Volatility (%) and 3-Yr Sharpe Ratio only based on NAV movement, doesn't factor in geographical risk. usually the latter matter for me more. where did you get the numbers (in MYR) to compare? This post has been edited by yklooi: Oct 25 2020, 12:25 PM |

|

|

Oct 25 2020, 10:21 PM Oct 25 2020, 10:21 PM

Return to original view | IPv6 | Post

#940

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(tadashi987 @ Oct 24 2020, 10:40 PM) thanks for telling about this fund.currently i am at 50% Nomura.... maybe , just maybe will shift about 10% to this beginning of new year (new year new positioning ha-ha) 50% in Nomura maybe abit too concentrated? i will keep observing this China bond for 2 months then see how.... thanks for telling.... but will China devalue it RMB again?? |

| Change to: |  0.0683sec 0.0683sec

0.73 0.73

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 8th December 2025 - 06:01 PM |