QUOTE(MNet @ Jul 20 2020, 07:21 PM)

u need to understand the concept of future value of money

1.today u saved rm200pm is not same value with 2030 rm200

2.rm200 can be compounded with x% yrly and down the round its like 40 yr is not rm8000

you need to understand the example....

the RM 100 000 for 40 yrs is meant you had taken out whatever "gains" you had yearly and yet only maintain the same value of RM100 000, thus RM200 pa will be charged

if you want to take into the 'compounded effect of this RM200 with x% yrly and down the round its like 40 yr is not rm8000', then do a compounded effect calculation of the cumulative total yearly gain it gives too....

also do calculates as per GrumpyNooby's post "How much the same RM 200 worth in 2030?"

no matter what the value it is.....YES, you are RIGHT for even a "small fee 0.2% will affect ur income long term"

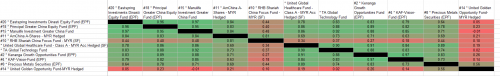

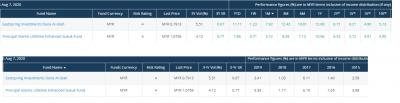

thus as per my earlier post....."i hope you did not invest in any of those "higher fees" paying active mgmt investment options....." if you really mind about the fees involved

even ETF has some % of fees involved......this small fees will effect your income in the long run too ....thus what you mentioned is RIGHT, for fees will effect your income in the long run (no matter how small it is)

QUOTE(MNet @ Jul 20 2020, 01:44 PM)

u need to read more book on

how small fee 0.2%

will affect ur income long termthis is just price less .....

This post has been edited by yklooi: Jul 20 2020, 07:47 PM

This post has been edited by yklooi: Jul 20 2020, 07:47 PM

Jul 12 2020, 06:48 PM

Jul 12 2020, 06:48 PM

Quote

Quote

0.0760sec

0.0760sec

1.07

1.07

7 queries

7 queries

GZIP Disabled

GZIP Disabled