QUOTE(CSW1990 @ Nov 20 2020, 04:55 PM)

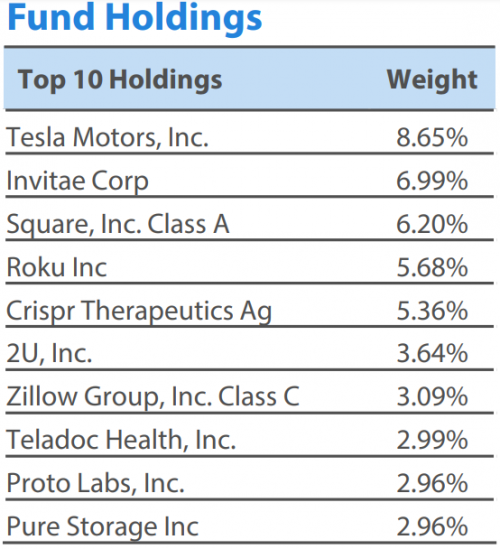

This rhb global AI fund got 7.7% Tesla, looks like many UT investor will buy in this fund before Tesla going into S&P 500 on 21/12?

Any other UT fund at FSM holding Tesla stock?

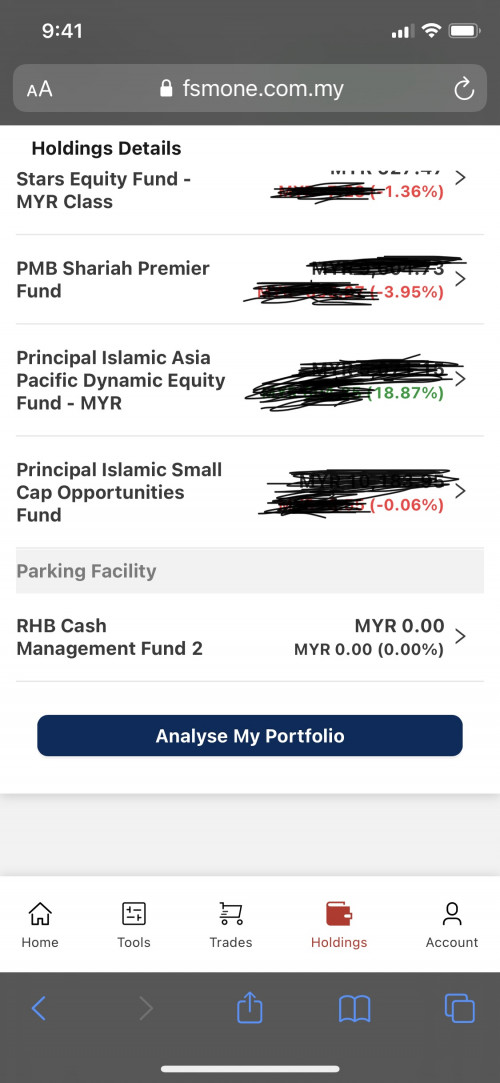

i did not actually focused on Tesla....Any other UT fund at FSM holding Tesla stock?

that stock alone had jumped alot .....

with that % of composition in that UT fund and with the % of allocation of that fund IF in my portfolio

that stock alone will have little impact to my overall portfolio even if it were to jump again now.

if 10% of that fund is in my port

if 10% of Tesla is in that fund

if Tesla were to jump again by 30%

the NAV of that fund will increase by 3% and my portfolio will increase by 0.3%

Nov 20 2020, 05:06 PM

Nov 20 2020, 05:06 PM

Quote

Quote

0.0713sec

0.0713sec

0.38

0.38

7 queries

7 queries

GZIP Disabled

GZIP Disabled