QUOTE(polarzbearz @ Nov 1 2020, 02:46 AM)

ya-lar,...existing EXCEL's macro interface cannot access it to get the NAVs idyllrain, can you help us here again?

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

|

Nov 1 2020, 09:12 AM Nov 1 2020, 09:12 AM

Return to original view | IPv6 | Post

#941

|

Senior Member

8,188 posts Joined: Apr 2013 |

|

|

|

|

|

|

Nov 1 2020, 05:41 PM Nov 1 2020, 05:41 PM

Return to original view | IPv6 | Post

#942

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(idyllrain @ Nov 1 2020, 04:55 PM) idyllrain, 23 months ago, you managed to help amend the macro inside my file,can you amend it again for me so that it will get the NAV from FSM as they have changed the interface again? thanks Attached File(s)  Auto_Nav_update_for_Idyllrain_Nov_2020_to_change.zip ( 29.14k )

Number of downloads: 9

Auto_Nav_update_for_Idyllrain_Nov_2020_to_change.zip ( 29.14k )

Number of downloads: 9 |

|

|

Nov 1 2020, 05:51 PM Nov 1 2020, 05:51 PM

Return to original view | IPv6 | Post

#943

|

Senior Member

8,188 posts Joined: Apr 2013 |

|

|

|

Nov 3 2020, 10:53 AM Nov 3 2020, 10:53 AM

Return to original view | IPv6 | Post

#944

|

Senior Member

8,188 posts Joined: Apr 2013 |

|

|

|

Nov 3 2020, 11:21 AM Nov 3 2020, 11:21 AM

Return to original view | IPv6 | Post

#945

|

Senior Member

8,188 posts Joined: Apr 2013 |

just for shiok sendiri.... while MoM my DIY port dropped abt 0.5% i think my FSM MP-Moderately Aggressive rises abt 3.5% Attached thumbnail(s)

WhitE LighteR and whirlwind liked this post

|

|

|

Nov 5 2020, 06:34 PM Nov 5 2020, 06:34 PM

Return to original view | IPv6 | Post

#946

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(whirlwind @ Nov 5 2020, 06:03 PM) encikbuta liked this post

|

|

|

|

|

|

Nov 7 2020, 08:12 AM Nov 7 2020, 08:12 AM

Return to original view | IPv6 | Post

#947

|

Senior Member

8,188 posts Joined: Apr 2013 |

|

|

|

Nov 7 2020, 11:58 PM Nov 7 2020, 11:58 PM

Return to original view | IPv6 | Post

#948

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(whirlwind @ Nov 7 2020, 10:18 PM) Affin Hwang AIIMAN Asia (Ex Japan) Growth Fund Affin Hwang Select Asia (Ex Japan) Opportunity Fund Affin Hwang Select Asia Pacific (Ex Japan) Dividend Fund I plan to go for dividend fund because it has a slight higher percentage on healthcare compare the others. What do you all think? with a different of just 1.3% allocation between these funds..... if you have RM10 000 invested in, you will have extra 1.3% or extra RM130 allocated in Healthcare sector if the healthcare sector were to rise 100% .....while the others remains the same your extra profit is just RM130 of your RM10 000 invested if you want healthcare from Affinhwang...try Affin Hwang World Series - Global Healthscience Fund - MYR or Affin Hwang World Series - Global Healthscience Fund - MYR Hedged This post has been edited by yklooi: Nov 8 2020, 12:02 AM Attached thumbnail(s)

|

|

|

Nov 8 2020, 10:51 AM Nov 8 2020, 10:51 AM

Return to original view | IPv6 | Post

#949

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(whirlwind @ Nov 8 2020, 12:30 AM) following up from my previous posting,i think there will be more "bang" for a RM 1000 cash purchase on United Global Healthcare Fund - Class A - MYR Acc than a RM10 000 EPF buy of any of that 3 funds you mentioned if you want to go heavier into Healthcare sector at just 4.5% of the RM10 000 invested with EPF, in Affin Hwang Select Asia Pacific (Ex Japan) Dividend Fund - MYR, you will just get involves with Healthcare by just RM450 but if just invest RM1 000 into this United Global Healthcare Fund - Class A - MYR Acc you will get yourself involved into Healthcare by a larger margin. just my Sunday morning thought. Attached thumbnail(s)

whirlwind liked this post

|

|

|

Nov 9 2020, 10:37 PM Nov 9 2020, 10:37 PM

Return to original view | IPv6 | Post

#950

|

Senior Member

8,188 posts Joined: Apr 2013 |

|

|

|

Nov 9 2020, 10:44 PM Nov 9 2020, 10:44 PM

Return to original view | IPv6 | Post

#951

|

Senior Member

8,188 posts Joined: Apr 2013 |

US mkts rallying big now...

DJ + 4.8% SP + 3.45% looks like, hope it is true like previously....rallied for some time after trump was announced.... someone need to collect back the election contribution/sponsor money |

|

|

Nov 11 2020, 10:32 AM Nov 11 2020, 10:32 AM

Return to original view | IPv6 | Post

#952

|

Senior Member

8,188 posts Joined: Apr 2013 |

time to get back into Global Equities? Maybe bits by bits?

Planes, dry ice, pharmacies: logistical challenges of Covid-19 vaccines PUBLISHED : 11 NOV 2020 https://www.bangkokpost.com/world/2017751/p...vid-19-vaccines |

|

|

Nov 12 2020, 01:53 PM Nov 12 2020, 01:53 PM

Return to original view | IPv6 | Post

#953

|

Senior Member

8,188 posts Joined: Apr 2013 |

|

|

|

|

|

|

Nov 14 2020, 06:05 PM Nov 14 2020, 06:05 PM

Return to original view | IPv6 | Post

#954

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(ironman16 @ Nov 14 2020, 06:03 PM) i think is lower risk......as per "By investing into a MYR-hedged class of the fund, you can lower your risk of a weakening of the EUR (the underlying investment currency) against the MYR (your original investment currency) eroding your investment returns from the European credit market." datolee32 and brokenbomb liked this post

|

|

|

Nov 17 2020, 08:37 AM Nov 17 2020, 08:37 AM

Return to original view | IPv6 | Post

#955

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(whirlwind @ Nov 17 2020, 08:24 AM) Tesla to join S&P 500, spark epic index fund trade Perhaps has impact to us funds that focused on the movement of s&p index.https://www.theedgemarkets.com/article/tesl...ndex-fund-trade Another good news for US funds? I see no impact to those us funds that either holds or does not hold tesla stocks in their portfolios WhitE LighteR and whirlwind liked this post

|

|

|

Nov 20 2020, 08:29 AM Nov 20 2020, 08:29 AM

Return to original view | IPv6 | Post

#956

|

Senior Member

8,188 posts Joined: Apr 2013 |

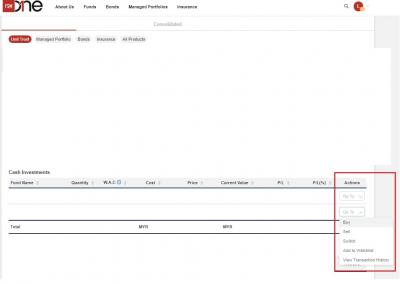

QUOTE(encikbuta @ Nov 20 2020, 07:54 AM) first time buying fund with the new system. does anyone else feel a bit insecure coz dun have the "Existing Fund" label when you select your existing funds to top up? after login, at the a/c holding page,got fear that i might add the fund with the wrong hedge or slightly different name, haha. it will shows a listing of your EXISTING funds held in details.... a the last column of it, there is "ACTIONS".......then click GO TO (light Grey in color) drop down menu should have a list of action to select...includes BUY This post has been edited by yklooi: Nov 20 2020, 08:50 AM Attached thumbnail(s)

|

|

|

Nov 20 2020, 11:08 AM Nov 20 2020, 11:08 AM

Return to original view | IPv6 | Post

#957

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(jonoave @ Nov 20 2020, 10:59 AM) I'm thinking of reducing my exposure to Asian market and selling off some of my Principal Asia Income Dynamic Fund. do you have other fund(s) in your portfolio that focused in US?Was looking at some inhouse fund, and found this. Launched last year. Any thoughts? https://www.fsmone.com.my/funds/tools/facts...c=global-search do you like US region? as this fund is seemed to be 76% in US.... |

|

|

Nov 20 2020, 12:11 PM Nov 20 2020, 12:11 PM

Return to original view | IPv6 | Post

#958

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(Mr.Beanster @ Nov 20 2020, 12:00 PM) Any US focused funds to recommend? I already have TA Global Tech focusing heavily at US Tech stocks. I was looking at Principal Global Titan but seems like the fund holds up to ~20% of US Tech Stock which I already have them in the TA Global Tech. while waiting for value added responses,..you can try check these out if you want...Attached thumbnail(s)

|

|

|

Nov 20 2020, 01:39 PM Nov 20 2020, 01:39 PM

Return to original view | IPv6 | Post

#959

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(jonoave @ Nov 20 2020, 01:34 PM) Yeah I currently have principal global titan, around 17% of my portfolio. Mind telling how many % of this millennium fund will be in Yr port if you decided to hv it?Also have TA global tech which is 8%. I'm ok with US region, just want to diversify a bit. ........... |

|

|

Nov 20 2020, 03:36 PM Nov 20 2020, 03:36 PM

Return to original view | IPv6 | Post

#960

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(jonoave @ Nov 20 2020, 03:30 PM) Hehe, probably just 5% max now that i think of it. fyi,I'll likely also put some in RHB Artificial Intelligence, 5-7%. Edit to add: Might also reduce my Principal Global Titan allocation by few percent. RHB Global Artificial Intelligence Fund is 90.7% in US and also heavy in Tech...thus maybe high corelated to your existing TA Global Tech fund https://www.fsmone.com.my/admin/buy/factshe...etMYRGSIFMH.pdf This post has been edited by yklooi: Nov 20 2020, 03:39 PM |

| Change to: |  0.0673sec 0.0673sec

0.24 0.24

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 8th December 2025 - 12:53 AM |