Outline ·

[ Standard ] ·

Linear+

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

whirlwind

|

Dec 1 2020, 03:25 AM Dec 1 2020, 03:25 AM

|

|

Public Bank falls most in 12 years as banking stocks hit by MSCI review https://www.theedgemarkets.com/article/publ...hit-msci-reviewWhat’s rebalancing? Sounds like a temporary bad news right? DCA? |

|

|

|

|

|

GrumpyNooby

|

Dec 1 2020, 01:05 PM Dec 1 2020, 01:05 PM

|

|

-deleted-

This post has been edited by GrumpyNooby: Jan 7 2021, 11:02 AM

|

|

|

|

|

|

ericlaiys

|

Dec 1 2020, 01:08 PM Dec 1 2020, 01:08 PM

|

|

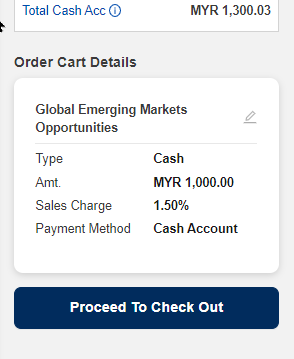

QUOTE(GrumpyNooby @ Dec 1 2020, 01:05 PM) FSM Fund Choice: Global Emerging Markets Opportunities [December 2020] Takeaway TakeawayAll in all, we opine that against the current backdrop of brewing factors, emerging markets could receive notable attention from market participants in the years ahead. Weaker Dollar, rising risk-on sentiment and the increase in global aggregate demand is likely to give a leg up to emerging market equities going ahead. Given such tailwinds behind EM equities, earnings going ahead are likely to be revised upwards. For investors that are interested to ride on the growth opportunities provided by EM equities, they can consider investing in Global Emerging Markets Opportunities. Article link: https://www.fsmone.com.my/funds/research/ar...Insurance=false0.8% Sales Charge on Global Emerging Market Opportunities Campaign link: https://www.fsmone.com.my/funds/research/ar...Insurance=falseFund link: https://www.fsmone.com.my/funds/tools/facts...t?fund=MYAMGEMO Juts bought it...lol |

|

|

|

|

|

dopp

|

Dec 1 2020, 01:57 PM Dec 1 2020, 01:57 PM

|

|

'0.8% Sales Charge on Global Emerging Market Opportunities" promotion over?  |

|

|

|

|

|

GrumpyNooby

|

Dec 1 2020, 02:01 PM Dec 1 2020, 02:01 PM

|

|

-deleted-

This post has been edited by GrumpyNooby: Jan 7 2021, 11:02 AM

|

|

|

|

|

|

dopp

|

Dec 1 2020, 02:02 PM Dec 1 2020, 02:02 PM

|

|

click Transact and see..

|

|

|

|

|

|

GrumpyNooby

|

Dec 1 2020, 02:03 PM Dec 1 2020, 02:03 PM

|

|

-deleted-

This post has been edited by GrumpyNooby: Jan 7 2021, 11:03 AM

|

|

|

|

|

|

dopp

|

Dec 1 2020, 02:03 PM Dec 1 2020, 02:03 PM

|

|

|

|

|

|

|

|

GrumpyNooby

|

Dec 1 2020, 02:05 PM Dec 1 2020, 02:05 PM

|

|

-deleted-

This post has been edited by GrumpyNooby: Jan 7 2021, 11:03 AM

|

|

|

|

|

|

dopp

|

Dec 1 2020, 02:09 PM Dec 1 2020, 02:09 PM

|

|

ahh, u need to add to cart and Proceed.

|

|

|

|

|

|

whirlwind

|

Dec 1 2020, 05:15 PM Dec 1 2020, 05:15 PM

|

|

Everywhere looks green! 🤞

|

|

|

|

|

|

SUSyklooi

|

Dec 1 2020, 05:35 PM Dec 1 2020, 05:35 PM

|

|

just for shiok sendiri... MoM DIY port +2.25% FSM Managed Port +5.8% looks like my DIY port YTD just better than SSPN ...still got 30 days to go looks very very not likely to beat EPF.... This post has been edited by yklooi: Dec 1 2020, 05:38 PM Attached thumbnail(s)

|

|

|

|

|

|

CSW1990

|

Dec 1 2020, 05:39 PM Dec 1 2020, 05:39 PM

|

|

QUOTE(whirlwind @ Dec 1 2020, 05:15 PM) Everywhere looks green! 🤞 Green good time to top up? All my UT are in green but Gold still in shit .. I have 3% gold mining equity in my portfolio which bought in July. -22% now. |

|

|

|

|

|

whirlwind

|

Dec 1 2020, 05:57 PM Dec 1 2020, 05:57 PM

|

|

QUOTE(CSW1990 @ Dec 1 2020, 05:39 PM) Green good time to top up? All my UT are in green but Gold still in shit .. I have 3% gold mining equity in my portfolio which bought in July. -22% now. Not sure about top up Better ask the sifus in here especially when it’s the last month of the year If your portfolio is around 100k, basically you are losing 660. That’s a lot |

|

|

|

|

|

ericlaiys

|

Dec 1 2020, 06:52 PM Dec 1 2020, 06:52 PM

|

|

QUOTE(GrumpyNooby @ Dec 1 2020, 02:03 PM) ericlaiys just bought. What is the sales charge? 0.8. Initial show 1.5. Then before u click end. it will show final interest is 0.8% . been doing like this few times (from referal) |

|

|

|

|

|

WhitE LighteR

|

Dec 1 2020, 07:12 PM Dec 1 2020, 07:12 PM

|

|

QUOTE(yklooi @ Dec 1 2020, 05:35 PM) just for shiok sendiri... MoM DIY port +2.25% FSM Managed Port +5.8% looks like my DIY port YTD just better than SSPN ...still got 30 days to go looks very very not likely to beat EPF.... if continuous DCA into your portfolio at about the same rate as your return, i believe the ROI value will remain stagnant right ?  |

|

|

|

|

|

YoungMan

|

Dec 1 2020, 08:14 PM Dec 1 2020, 08:14 PM

|

|

Any malaysia region fund which hold health/pharmaceutical stock? Think that when when vaccine is confirm available this sector will jump. I could be wrong.

|

|

|

|

|

|

WhitE LighteR

|

Dec 1 2020, 08:24 PM Dec 1 2020, 08:24 PM

|

|

QUOTE(YoungMan @ Dec 1 2020, 08:14 PM) Any malaysia region fund which hold health/pharmaceutical stock? Think that when when vaccine is confirm available this sector will jump. I could be wrong. U kinda slow to the party... |

|

|

|

|

|

GrumpyNooby

|

Dec 1 2020, 08:24 PM Dec 1 2020, 08:24 PM

|

|

-deleted-

This post has been edited by GrumpyNooby: Jan 7 2021, 11:03 AM

|

|

|

|

|

|

YoungMan

|

Dec 1 2020, 09:04 PM Dec 1 2020, 09:04 PM

|

|

QUOTE(WhitE LighteR @ Dec 1 2020, 09:24 PM) U kinda slow to the party... QUOTE(GrumpyNooby @ Dec 1 2020, 09:24 PM) Can collect Top Glove now.  Agree... very late to the party. But I'm not thinking to buy into stocks nor enter any global healthcare fund. Just trying to see if there any fund which hold on to local pharmaceutical business example Pharmaniaga. |

|

|

|

|

Dec 1 2020, 03:25 AM

Dec 1 2020, 03:25 AM

Quote

Quote

0.0381sec

0.0381sec

0.39

0.39

6 queries

6 queries

GZIP Disabled

GZIP Disabled