Outline ·

[ Standard ] ·

Linear+

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

Zegoon681111

|

Dec 1 2020, 10:10 PM Dec 1 2020, 10:10 PM

|

|

QUOTE(CSW1990 @ Dec 1 2020, 05:39 PM) Green good time to top up? All my UT are in green but Gold still in shit .. I have 3% gold mining equity in my portfolio which bought in July. -22% now. Are you holding precious metal for the -22%? |

|

|

|

|

|

GrumpyNooby

|

Dec 1 2020, 10:36 PM Dec 1 2020, 10:36 PM

|

|

-deleted-

This post has been edited by GrumpyNooby: Jan 7 2021, 11:03 AM

|

|

|

|

|

|

CSW1990

|

Dec 1 2020, 10:56 PM Dec 1 2020, 10:56 PM

|

|

QUOTE(Zegoon681111 @ Dec 1 2020, 10:10 PM) Are you holding precious metal for the -22%? Rhb gold general fund & precious metal securities |

|

|

|

|

|

whirlwind

|

Dec 2 2020, 10:30 AM Dec 2 2020, 10:30 AM

|

|

How come my eastspring small cap at negative yesterday when the small cap index moving up? 🤔

And my smallest allocation Hong Leong Dana Makmur went up almost 4% yesterday 😅

|

|

|

|

|

|

WhitE LighteR

|

Dec 2 2020, 11:46 AM Dec 2 2020, 11:46 AM

|

|

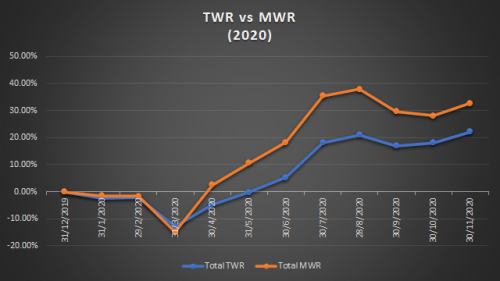

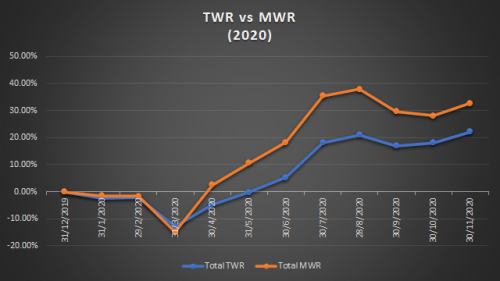

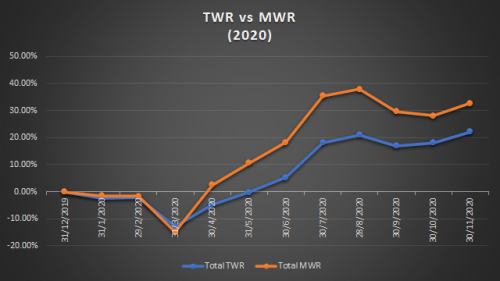

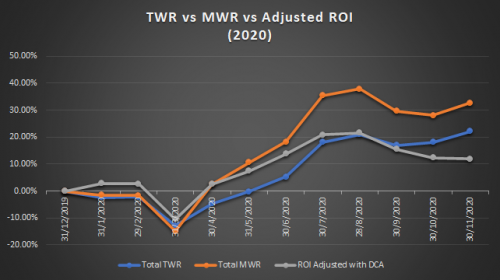

Nov tally is in for me.  TWR added 3.93 % MoM MWR added 4.70 % MoM Profit added 26.95 % MoM This post has been edited by WhitE LighteR: Dec 2 2020, 02:28 PM |

|

|

|

|

|

SUSyklooi

|

Dec 2 2020, 12:28 PM Dec 2 2020, 12:28 PM

|

|

QUOTE(WhitE LighteR @ Dec 2 2020, 11:46 AM) Nov tally is it for me.  TWR added 3.93 % MWR added 4.70 % Profit added 26.95 %     your portfolio's YTD is almost +27%  This post has been edited by yklooi: Dec 2 2020, 12:28 PM This post has been edited by yklooi: Dec 2 2020, 12:28 PM |

|

|

|

|

|

WhitE LighteR

|

Dec 2 2020, 01:27 PM Dec 2 2020, 01:27 PM

|

|

QUOTE(yklooi @ Dec 2 2020, 12:28 PM)  no la. Profit MoM increase by ~27%, not ROI  If ROI i happy d lo. Because of the effect of montly DCA, I find it difficult to find a metric tht can properly quantify into a universal value. I end up resorted to tracking using TWR and MWR I think thats why your portfolio ROI always show it remain stagnant whole year. I think is because u DCA at about the same rate as your profit return. |

|

|

|

|

|

MUM

|

Dec 2 2020, 01:34 PM Dec 2 2020, 01:34 PM

|

|

deleted

This post has been edited by MUM: Dec 2 2020, 01:36 PM

|

|

|

|

|

|

memorylane

|

Dec 2 2020, 01:58 PM Dec 2 2020, 01:58 PM

|

Getting Started

|

QUOTE(yklooi @ Dec 1 2020, 05:35 PM) just for shiok sendiri... MoM DIY port +2.25% FSM Managed Port +5.8% looks like my DIY port YTD just better than SSPN ...still got 30 days to go looks very very not likely to beat EPF.... FSM managed portfolio gave me very good results also... i started on Jan 2020 with RM20k before Covid dip..., and performing DCA constantly... somehow managed portfolio can achieve 20% return up to now... my diy portfolio only achieve about 6%... FSM choose fund skill better than me plus the portfolio more stable compare to my diy one... no regret paying 0.5% management fee per year for managed portfolio... |

|

|

|

|

|

MUM

|

Dec 2 2020, 02:03 PM Dec 2 2020, 02:03 PM

|

|

QUOTE(memorylane @ Dec 2 2020, 01:58 PM) FSM managed portfolio gave me very good results also... i started on Jan 2020 with RM20k before Covid dip..., and performing DCA constantly... somehow managed portfolio can achieve 20% return up to now... my diy portfolio only achieve about 6%... FSM choose fund skill better than me plus the portfolio more stable compare to my diy one... no regret paying 0.5% management fee per year for managed portfolio... yes,...i observed that too... but just hoped it was their "boss" actions after noting the complaints and grumbling of many forummers since last year about how badly their managed portfolio performed. hope it was their corrective actions and not just lucky placings This post has been edited by MUM: Dec 2 2020, 02:03 PM |

|

|

|

|

|

no6

|

Dec 2 2020, 02:21 PM Dec 2 2020, 02:21 PM

|

|

QUOTE(memorylane @ Dec 2 2020, 01:58 PM) FSM managed portfolio gave me very good results also... i started on Jan 2020 with RM20k before Covid dip..., and performing DCA constantly... somehow managed portfolio can achieve 20% return up to now... my diy portfolio only achieve about 6%... FSM choose fund skill better than me plus the portfolio more stable compare to my diy one... no regret paying 0.5% management fee per year for managed portfolio... is the managed portfolio under aggressive mode in order to achive 20% return ? |

|

|

|

|

|

memorylane

|

Dec 2 2020, 02:37 PM Dec 2 2020, 02:37 PM

|

Getting Started

|

QUOTE(no6 @ Dec 2 2020, 02:21 PM) is the managed portfolio under aggressive mode in order to achive 20% return ? ya conventional aggressive portfolio (not the islamic one). Of cos i have also constantly DCA during the covid period until now... i notice FSM always switch the fund at really right timing... eg: switch into the tech fund (i forgot which month), after switch the tech stock begin to jump... they perform switching and rebalancing themself, save my hassle to time the market and choose fund... most importantly i don't have to worry when certain market are down certain day, as their portfolio is really diversified.... |

|

|

|

|

|

no6

|

Dec 2 2020, 02:49 PM Dec 2 2020, 02:49 PM

|

|

QUOTE(memorylane @ Dec 2 2020, 02:37 PM) ya conventional aggressive portfolio (not the islamic one). Of cos i have also constantly DCA during the covid period until now... i notice FSM always switch the fund at really right timing... eg: switch into the tech fund (i forgot which month), after switch the tech stock begin to jump... they perform switching and rebalancing themself, save my hassle to time the market and choose fund... most importantly i don't have to worry when certain market are down certain day, as their portfolio is really diversified.... thanks for sharing. not bad at all having the managed portfolio, shall look into it. btw, the subsription fee of 1% is just one off from the initial investment amount or ? |

|

|

|

|

|

memorylane

|

Dec 2 2020, 02:57 PM Dec 2 2020, 02:57 PM

|

Getting Started

|

QUOTE(no6 @ Dec 2 2020, 02:49 PM) thanks for sharing. not bad at all having the managed portfolio, shall look into it. btw, the subsription fee of 1% is just one off from the initial investment amount or ? one off initial investment, it is lesser than initial sales charge for diy fund....then 0.5% per year for management fee for manage portfolio... my advice is start small with continuous DCA regular saving plan... no one know the bull market now can last how long... and no one can time the market precisely.... i start direct with big amount 20K on Jan 2020, when Covid march 2020 huge dip, my heart really broken.... luckily i make a decision to continue DCA... now giving 20% return... bravo for FSM selection skill also... |

|

|

|

|

|

no6

|

Dec 2 2020, 03:08 PM Dec 2 2020, 03:08 PM

|

|

QUOTE(memorylane @ Dec 2 2020, 02:57 PM) one off initial investment, it is lesser than initial sales charge for diy fund....then 0.5% per year for management fee for manage portfolio... my advice is start small with continuous DCA regular saving plan... no one know the bull market now can last how long... and no one can time the market precisely.... i start direct with big amount 20K on Jan 2020, when Covid march 2020 huge dip, my heart really broken.... luckily i make a decision to continue DCA... now giving 20% return... bravo for FSM selection skill also... valid advice  just wandering any lump sum after march dip or just dca all the way monthly/weekly |

|

|

|

|

|

memorylane

|

Dec 2 2020, 03:21 PM Dec 2 2020, 03:21 PM

|

Getting Started

|

QUOTE(no6 @ Dec 2 2020, 03:08 PM) valid advice  just wandering any lump sum after march dip or just dca all the way monthly/weekly lump sum + DCA also. I start with 20K investment in Jan 2020... as of now , total investment is 33K, Current portfolio market value is 40K... |

|

|

|

|

|

whirlwind

|

Dec 2 2020, 03:51 PM Dec 2 2020, 03:51 PM

|

|

UK approves Pfizer-BioNTech Covid-19 vaccine, first in the world https://www.theedgemarkets.com/article/uk-a...ine-first-world |

|

|

|

|

|

GrumpyNooby

|

Dec 2 2020, 07:01 PM Dec 2 2020, 07:01 PM

|

|

-deleted-

This post has been edited by GrumpyNooby: Jan 7 2021, 11:04 AM

|

|

|

|

|

|

GrumpyNooby

|

Dec 2 2020, 08:18 PM Dec 2 2020, 08:18 PM

|

|

-deleted-

This post has been edited by GrumpyNooby: Jan 7 2021, 11:04 AM

|

|

|

|

|

Dec 1 2020, 10:10 PM

Dec 1 2020, 10:10 PM

Quote

Quote

0.0522sec

0.0522sec

0.67

0.67

6 queries

6 queries

GZIP Disabled

GZIP Disabled