Outline ·

[ Standard ] ·

Linear+

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

datolee32

|

Nov 5 2020, 09:51 PM Nov 5 2020, 09:51 PM

|

|

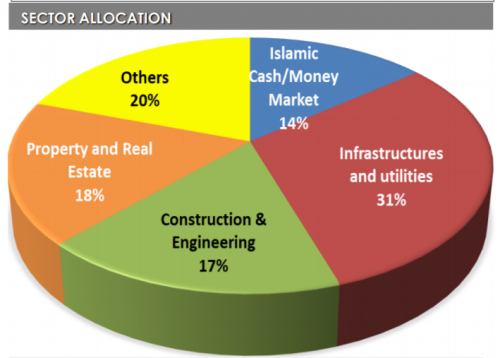

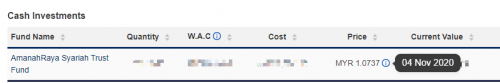

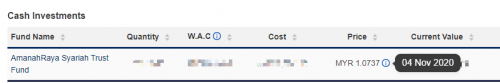

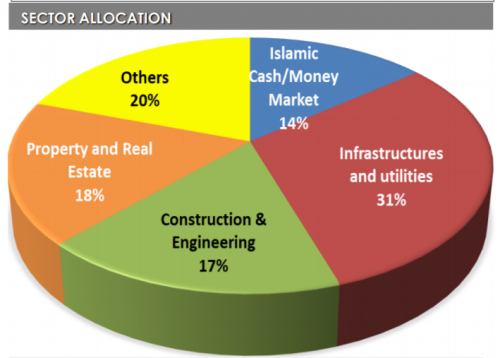

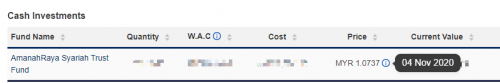

QUOTE(GrumpyNooby @ Nov 5 2020, 09:46 PM) Amanah Syariah Unit Trust Fund doesn't invest into equity market (share market). If you want to understand why it drops, you should investigate the local bond market movement. I see, thank you very much. Is following market allocation refer to the bond market?  |

|

|

|

|

|

GrumpyNooby

|

Nov 5 2020, 09:55 PM Nov 5 2020, 09:55 PM

|

|

-deleted-

This post has been edited by GrumpyNooby: Jan 7 2021, 11:36 AM

|

|

|

|

|

|

tadashi987

|

Nov 5 2020, 11:06 PM Nov 5 2020, 11:06 PM

|

|

QUOTE(datolee32 @ Nov 5 2020, 09:44 PM) Hi, sorry newbie here, would like to ask why Amanah Syariah Unit Trust Fund drop although our share market is good today? let alone bond fund has no direct relationship to share market, unit trust NAV doesn't reflect their price as of today's market u might want to aware that unit trust NAV latest is as of yesterday  |

|

|

|

|

|

datolee32

|

Nov 6 2020, 12:32 AM Nov 6 2020, 12:32 AM

|

|

Thank you very much for the reply  QUOTE(GrumpyNooby @ Nov 5 2020, 09:55 PM) The fund itself is investing into commercial bond papers: Investment a minimum of 70% of the Fund’s Net Asset value The Fund will invest a minimum of 70% of the Fund’s NAV in Ringgit and foreign currency sukuk rated at least ‘A’ or ‘P2’ by RAM or its MARC equivalent rating or A- by S&P, or its Moody's and Fitch equivalent rating. Top 5 Holdings: Tropicana Corporation Berhad WCT Holdings Berhad Lebuhraya DUKE Fasa 3 Sdn Berhad MBSB Bank Berhad Cypark Ref Sdn Berhad https://www.fsmone.com.my/admin/buy/factshe...eetMYARFSTF.pdfI'm not sure where you can track these commercial debt papers easily . QUOTE(tadashi987 @ Nov 5 2020, 11:06 PM) let alone bond fund has no direct relationship to share market, unit trust NAV doesn't reflect their price as of today's market u might want to aware that unit trust NAV latest is as of yesterday  |

|

|

|

|

|

GrumpyNooby

|

Nov 6 2020, 06:49 AM Nov 6 2020, 06:49 AM

|

|

-deleted-

This post has been edited by GrumpyNooby: Jan 7 2021, 11:36 AM

|

|

|

|

|

|

encikbuta

|

Nov 6 2020, 09:47 AM Nov 6 2020, 09:47 AM

|

Getting Started

|

QUOTE(GrumpyNooby @ Nov 5 2020, 09:55 PM) The fund itself is investing into commercial bond papers: Investment a minimum of 70% of the Fund’s Net Asset value The Fund will invest a minimum of 70% of the Fund’s NAV in Ringgit and foreign currency sukuk rated at least ‘A’ or ‘P2’ by RAM or its MARC equivalent rating or A- by S&P, or its Moody's and Fitch equivalent rating. Top 5 Holdings: Tropicana Corporation Berhad WCT Holdings Berhad Lebuhraya DUKE Fasa 3 Sdn Berhad MBSB Bank Berhad Cypark Ref Sdn Berhad https://www.fsmone.com.my/admin/buy/factshe...eetMYARFSTF.pdfI'm not sure where you can track these commercial debt papers easily . my AmBond also doing crappy these few days. I find that it closely tracks the All Bond Index in BPAM site below: Bond Pricing Agency Malaysialook for the daily updated "Refinitiv BPAM: All Bond Index" graph somewhere before the halfway mark of the website. good news is, looks like it will go up a little on the next pricing update. |

|

|

|

|

|

GrumpyNooby

|

Nov 6 2020, 09:50 AM Nov 6 2020, 09:50 AM

|

|

-deleted-

This post has been edited by GrumpyNooby: Jan 7 2021, 11:36 AM

|

|

|

|

|

|

biastee

|

Nov 6 2020, 02:31 PM Nov 6 2020, 02:31 PM

|

Getting Started

|

QUOTE(IdiotGuY88 @ Nov 1 2020, 03:31 PM) the new website i dont like the watchlist page, i prefer old watchlist UI, can compare performance to see, 1week, 1mth, 3mth, 6mth that kind of info If the missing 1W, 1M, 3M, & 6M, etc data negatively affects you, try dropping your CS an email. If enough of us make noise, they will be compelled to address our grievances. My CS replied that they will make some changes on the watchlist module by next week. |

|

|

|

|

|

WhitE LighteR

|

Nov 6 2020, 03:05 PM Nov 6 2020, 03:05 PM

|

|

I hope they fix the charting tool also. Its broken more worst than previous one. the 200 day sma u need to uncheck to get the 200 day line. so weird. haha. n each time i change fund i need to check n uncheck one of the boxes to get the lines to display. else all wont show up.

|

|

|

|

|

|

encikbuta

|

Nov 6 2020, 04:09 PM Nov 6 2020, 04:09 PM

|

Getting Started

|

i just want to check if it's my own PC setting problem or it's the FSM website problem. on my chrome PC browser, every time i snap my window to the left or right, the below will come up. you guys encountering the same thing? Attached thumbnail(s)

|

|

|

|

|

|

GrumpyNooby

|

Nov 6 2020, 04:10 PM Nov 6 2020, 04:10 PM

|

|

-deleted-

This post has been edited by GrumpyNooby: Jan 7 2021, 11:36 AM

|

|

|

|

|

|

whirlwind

|

Nov 6 2020, 05:20 PM Nov 6 2020, 05:20 PM

|

|

Is it too late for me to switch my affin hwang select asia pacific (ex japan) balanced fund to affin hwang select asia (ex japan) dividend fund now?

|

|

|

|

|

|

GrumpyNooby

|

Nov 6 2020, 05:29 PM Nov 6 2020, 05:29 PM

|

|

-deleted-

This post has been edited by GrumpyNooby: Jan 7 2021, 11:36 AM

|

|

|

|

|

|

whirlwind

|

Nov 6 2020, 05:37 PM Nov 6 2020, 05:37 PM

|

|

QUOTE(GrumpyNooby @ Nov 6 2020, 05:29 PM) Just my humble but worthless inputs, both funds are almost similar and should be classified under moderate risk type between 4 to 6 on the scale of 1 to 10. Why is it similar? One is balanced and one is pure equity. I’m gonna assume market for Asia/China will be good and continue to climb up especially when Biden win the election. By Switching to pure equity I’ll gain more profit right? |

|

|

|

|

|

GrumpyNooby

|

Nov 6 2020, 05:38 PM Nov 6 2020, 05:38 PM

|

|

-deleted-

This post has been edited by GrumpyNooby: Jan 7 2021, 11:37 AM

|

|

|

|

|

|

whirlwind

|

Nov 6 2020, 05:39 PM Nov 6 2020, 05:39 PM

|

|

QUOTE(GrumpyNooby @ Nov 6 2020, 05:38 PM) Ignore it. I didn't study the FFS. But do you think it’s too late for me to switch? Market has been continuously green this few days |

|

|

|

|

|

GrumpyNooby

|

Nov 6 2020, 05:42 PM Nov 6 2020, 05:42 PM

|

|

-deleted-

This post has been edited by GrumpyNooby: Jan 7 2021, 11:28 AM

|

|

|

|

|

|

whirlwind

|

Nov 6 2020, 06:11 PM Nov 6 2020, 06:11 PM

|

|

QUOTE(GrumpyNooby @ Nov 6 2020, 05:42 PM) If I can predict the wave so accurate, I'll be the next Buffett. It depends on investment horizon. If you foresee that there'll be an upside from now, you can switch. If I were you who want to focus purely equity, I'll switch into more aggressive fund which Affin Hwang Asia ex Japan Select Opportunity fund. Noted Would like to avoid the mistake I did switching out my Principal Global Titan Fund before the election. Now it’s doing so well. This post has been edited by whirlwind: Nov 6 2020, 06:12 PM |

|

|

|

|

|

WhitE LighteR

|

Nov 6 2020, 06:21 PM Nov 6 2020, 06:21 PM

|

|

QUOTE(whirlwind @ Nov 6 2020, 06:11 PM) Noted Would like to avoid the mistake I did switching out my Principal Global Titan Fund before the election. Now it’s doing so well. many factor can influence a portfolio performance. not switching in and out is probably a good one. think how your portfolio perform as a whole rather than looking at each individual fund performance only. an all weather portfolio. i like to diversify my fsm portfolio to multiple region n at least some in gold. This post has been edited by WhitE LighteR: Nov 6 2020, 06:22 PM |

|

|

|

|

|

whirlwind

|

Nov 6 2020, 06:33 PM Nov 6 2020, 06:33 PM

|

|

QUOTE(WhitE LighteR @ Nov 6 2020, 06:21 PM) many factor can influence a portfolio performance. not switching in and out is probably a good one. think how your portfolio perform as a whole rather than looking at each individual fund performance only. an all weather portfolio. i like to diversify my fsm portfolio to multiple region n at least some in gold. Noted My current constraint would be I’m investing using epf Limited funds to choose from Im actually looking for a fund focusing on health care in the epf fund list This post has been edited by whirlwind: Nov 6 2020, 06:33 PM |

|

|

|

|

Nov 5 2020, 09:51 PM

Nov 5 2020, 09:51 PM

Quote

Quote

0.0361sec

0.0361sec

0.41

0.41

6 queries

6 queries

GZIP Disabled

GZIP Disabled