Outline ·

[ Standard ] ·

Linear+

Ultimate Discussion of ASNB (47457-V)发 8ight 发, Wholly owned subsidary of PNB (38218-X)

|

raptar_eric

|

Nov 15 2017, 02:35 PM Nov 15 2017, 02:35 PM

|

|

There is no one to be blamed if such sheet happen, we can only blame ourselves for being borned here, and also for our gomen for all the political nonsense causing the economic downfall...

PNB, to me, is almost like a failsafe investment (to me lah). Good returns with flexibility for fixed price funds. Personally, i have asked before some of my bumi friends that are involved in politics and have some strings, whether where should i dump my funds, they told me amanah saham...

This is the only reason i switched all my funds from FD to ASx. There are more than meets the eye, its not just simple “UT” that most regular ppl take it as.

ASx is just a portion of PNB, and in the big picture, in order for PNB to be affected, at that point of time, most of us will be doomed, more things to worry bout than our funds in ASx.

Anyway just my humble 2 cents n opinion. I apologize in advanced if any of my thoughts offended anyone in any way.. just sharing what I have in mind and my understanding

This post has been edited by raptar_eric: Nov 15 2017, 02:39 PM

|

|

|

|

|

|

raptar_eric

|

Nov 15 2017, 02:42 PM Nov 15 2017, 02:42 PM

|

|

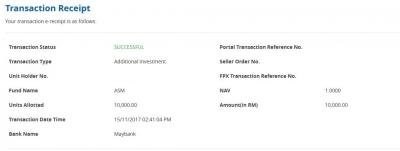

first try and manage to grab 10k.. hmm so much withdrawals happening?

|

|

|

|

|

|

ikanbilis

|

Nov 15 2017, 02:46 PM Nov 15 2017, 02:46 PM

|

|

QUOTE(nexona88 @ Nov 15 2017, 02:15 PM) I know PIDM only covers certain amount in CASA, FD etc. What I'm trying to say is, all the banks account in Malaysia.. PIDM cannot pay each of the account.. U know got how much account by individual in Malaysia? PIDM have the actual financial strength to pay?? Same with PNB too.. Suddenly everyone withdraws in 1 day? Can they pay on the spot? 80bil 😈 Just saying only  So PIDM is just for making people feel safe only.. Real shit happen.. Then we knows later... If all banks in malaysia fail, then really mati lah. What i mean is if one bank like affin fail, pidm can come to rescue for all deposits up to 250k per account. |

|

|

|

|

|

Nom-el

|

Nov 15 2017, 03:00 PM Nov 15 2017, 03:00 PM

|

|

QUOTE(kpfun @ Nov 15 2017, 09:18 AM) PIDM is a setup of MOF under Parliament supervision. It is for protecting small investors from losing all their saving. I think, all the fixed price ASNx fit the profile. Being one of ASNx holders, I'm totally ok for ASNB to spare partly investing return for PIDM premium. Alternatively, why not allow us to buy the PIDM premium as an option, such as 0.1% of the insured sum. PIDM only protects bank deposits & insurance. All investments are not covered by PIDM. Even GIA & money market funds are not covered by PIDM. QUOTE(ikanbilis @ Nov 15 2017, 02:46 PM) If all banks in malaysia fail, then really mati lah. What i mean is if one bank like affin fail, pidm can come to rescue for all deposits up to 250k per account. Perhaps people who are afraid of PIDM not having enough money to cover all depositors' money in a bank should put their money in the smaller banks like Affin. If the bank is small, maybe PIDM can pay back all the depositors. If the bank is big like Maybank, then it would be hard for PIDM to pay back every depositor. It would be really interesting if people start to do that. Hahaha.  |

|

|

|

|

|

nexona88

|

Nov 15 2017, 03:35 PM Nov 15 2017, 03:35 PM

|

|

QUOTE(ikanbilis @ Nov 15 2017, 02:46 PM) If all banks in malaysia fail, then really mati lah. What i mean is if one bank like affin fail, pidm can come to rescue for all deposits up to 250k per account. Hmm affin bank huh... For one, if not mistaken.. Its have one of the highest rate for CASA.. But too bad not much branch & ATM.. Their online banking also feels like so so only p Okay lor.. We end this right now.. PIDM or not.. Its one of the factors for people... For me its just shyok sendiri only.. No real impact... As long u feel okay. Just proceed as usual...  |

|

|

|

|

|

ikanbilis

|

Nov 15 2017, 03:44 PM Nov 15 2017, 03:44 PM

|

|

QUOTE(nexona88 @ Nov 15 2017, 03:35 PM) Hmm affin bank huh... For one, if not mistaken.. Its have one of the highest rate for CASA.. But too bad not much branch & ATM.. Their online banking also feels like so so only p Okay lor.. We end this right now.. PIDM or not.. Its one of the factors for people... For me its just shyok sendiri only.. No real impact... As long u feel okay. Just proceed as usual...  Exactly....this is the ASNB tered anyway. For those who seek pidm coverage for whatever asnb products including ASx, this is just wishful thinking. But if they want to win in debating, let them win lor. LOL  |

|

|

|

|

|

nexona88

|

Nov 15 2017, 03:49 PM Nov 15 2017, 03:49 PM

|

|

QUOTE(ikanbilis @ Nov 15 2017, 03:44 PM) Exactly....this is the ASNB tered anyway. For those who seek pidm coverage for whatever asnb products including ASx, this is just wishful thinking. But if they want to win in debating, let them win lor. LOL  Hahahaha.. Spot on.. For now.. ASx IS NOT PIDM COVERED 😂😂 Including Fixed Price Funds.. End of story... This post has been edited by nexona88: Nov 15 2017, 03:50 PM |

|

|

|

|

|

veera77

|

Nov 15 2017, 05:09 PM Nov 15 2017, 05:09 PM

|

|

there is certain level of risk in any type of investment..if not willing to face the risk...the best is keep the cash under the pillow..but make sure your house at higher elevation...as your cash may flows into flood water if your house at low level..again RISK!!! life without risk is total boring  This post has been edited by veera77: Nov 15 2017, 05:11 PM This post has been edited by veera77: Nov 15 2017, 05:11 PM |

|

|

|

|

|

Jinglexo

|

Nov 15 2017, 05:12 PM Nov 15 2017, 05:12 PM

|

Getting Started

|

QUOTE(nexona88 @ Nov 15 2017, 02:32 PM) How low we talking about?? 2.5% like in 1959?? Or 4% in 1960 😇 Below 5.5%. Because epf is bleeding |

|

|

|

|

|

MGM

|

Nov 15 2017, 05:16 PM Nov 15 2017, 05:16 PM

|

|

QUOTE(Jinglexo @ Nov 15 2017, 05:12 PM) Below 5.5%. Because epf is bleeding EPF bleeding? U mean EPF losing money? |

|

|

|

|

|

veera77

|

Nov 15 2017, 05:17 PM Nov 15 2017, 05:17 PM

|

|

as long as epf dividend above FD...recommended to keep your epf...its your retirement money!...never under-estimate the importance of retirement fund...and to ensure our dependents have immediate cash availability if unforeseen situation happen to us... QUOTE(Jinglexo @ Nov 15 2017, 05:12 PM) Below 5.5%. Because epf is bleeding |

|

|

|

|

|

nexona88

|

Nov 15 2017, 05:19 PM Nov 15 2017, 05:19 PM

|

|

QUOTE(Jinglexo @ Nov 15 2017, 05:12 PM) Below 5.5%. Because epf is bleeding Hmm EPF bleeding.... Forex losses? Wrong investment strategy?? Like FGV  Or someone "milking" the funds for personal advantage  |

|

|

|

|

|

veera77

|

Nov 15 2017, 05:23 PM Nov 15 2017, 05:23 PM

|

|

Warren Buffet famous quote...put the eggs in few baskets...

EPF, ASBN, FD, Stock, UT , Forex, REIT etc...all are readily available baskets for u...choose the basket which best fit your investment and risk appetite...

This post has been edited by veera77: Nov 15 2017, 05:23 PM

|

|

|

|

|

|

veera77

|

Nov 15 2017, 05:26 PM Nov 15 2017, 05:26 PM

|

|

FGV...bought RM5 sold RM2...who paid the lost...we all the lovable Malaysian...by reducing our last year dividend...  QUOTE(nexona88 @ Nov 15 2017, 05:19 PM) Hmm EPF bleeding.... Forex losses? Wrong investment strategy?? Like FGV  Or someone "milking" the funds for personal advantage  |

|

|

|

|

|

nexona88

|

Nov 15 2017, 05:32 PM Nov 15 2017, 05:32 PM

|

|

QUOTE(veera77 @ Nov 15 2017, 05:26 PM) FGV...bought RM5 sold RM2...who paid the lost...we all the lovable Malaysian...by reducing our last year dividend...  That & few others investment that we don't know about 😇 |

|

|

|

|

|

Jinglexo

|

Nov 15 2017, 05:33 PM Nov 15 2017, 05:33 PM

|

Getting Started

|

QUOTE(veera77 @ Nov 15 2017, 05:17 PM) as long as epf dividend above FD...recommended to keep your epf...its your retirement money!...never under-estimate the importance of retirement fund...and to ensure our dependents have immediate cash availability if unforeseen situation happen to us... Okay sir. Understand . Retirement fund for dependent. I never thought of this. |

|

|

|

|

|

Jinglexo

|

Nov 15 2017, 05:39 PM Nov 15 2017, 05:39 PM

|

Getting Started

|

QUOTE(nexona88 @ Nov 15 2017, 05:32 PM) That & few others investment that we don't know about 😇 That's why they say Pnb also a bit shaky. Even the management looks professional but actually is like a pm fund . Not public mutual fund. Hahaha |

|

|

|

|

|

dark_elvin

|

Nov 15 2017, 07:09 PM Nov 15 2017, 07:09 PM

|

Getting Started

|

QUOTE(demetry @ Nov 13 2017, 06:06 PM) today alot asm units. how much u grab? how do you know the availability of ASM units ? we must go counter to try? Or we need to waste the service charge to try on bank portal ? |

|

|

|

|

|

savvyaunty

|

Nov 15 2017, 07:49 PM Nov 15 2017, 07:49 PM

|

|

QUOTE(dark_elvin @ Nov 15 2017, 07:09 PM) how do you know the availability of ASM units ? we must go counter to try? Or we need to waste the service charge to try on bank portal ? try over counter or MyASNB. Can't exactly see the units available on MyASNB but can play tikam and keep trying with no service charge |

|

|

|

|

|

nexona88

|

Nov 15 2017, 07:57 PM Nov 15 2017, 07:57 PM

|

|

QUOTE(Jinglexo @ Nov 15 2017, 05:39 PM) That's why they say Pnb also a bit shaky. Even the management looks professional but actually is like a pm fund . Not public mutual fund. Hahaha Hehehehe... PM funds.. That's new term I learned today  PNB accounting also not so clear.. Many have said it previously... So just hit & run only since even the real NAV is not known.. |

|

|

|

|

Nov 15 2017, 02:35 PM

Nov 15 2017, 02:35 PM

Quote

Quote

0.0211sec

0.0211sec

0.60

0.60

6 queries

6 queries

GZIP Disabled

GZIP Disabled