QUOTE(Phoenix_KL @ Jul 27 2025, 11:01 AM)

A sharp drop that tells it all

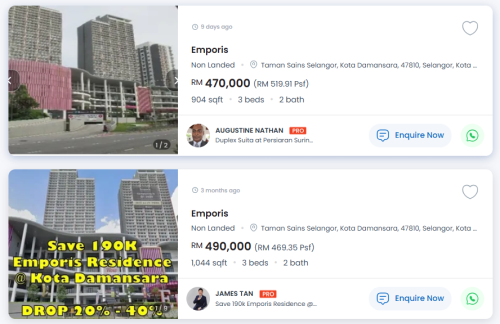

To illustrate the gravity of this issue, consider a mixed development in Kota Damansara. Launched in 2016 with an average pricing of RM750 per sq ft (psf), units in this development are now reselling for as low as RM268 psf since their handover in 2020. This represents a staggering plunge of up to 64% in value in one of the Klang Valley’s more prominent and desirable addresses.

How does such a dramatic devaluation occur? The answer lies behind the scenes, obscured by a web of undisclosed rebates, inflated loan approvals and pricing tactics designed to mask the real transaction value. Alarmingly, this is not an isolated incident. This deceptive pattern is increasingly spreading across the broader Malaysian property market, turning a blind eye to genuine market fundamentals.

What initially began as seemingly well-intentioned tools to enhance affordability such as rebates, cashbacks and zero-entry packages have gradually mutated into a pervasive mechanism that profoundly distorts the market. The playbook for this distortion is alarmingly simple yet highly effective:

https://www.starproperty.my/news/malaysia-s...-up-call/132580

To illustrate the gravity of this issue, consider a mixed development in Kota Damansara. Launched in 2016 with an average pricing of RM750 per sq ft (psf), units in this development are now reselling for as low as RM268 psf since their handover in 2020. This represents a staggering plunge of up to 64% in value in one of the Klang Valley’s more prominent and desirable addresses.

How does such a dramatic devaluation occur? The answer lies behind the scenes, obscured by a web of undisclosed rebates, inflated loan approvals and pricing tactics designed to mask the real transaction value. Alarmingly, this is not an isolated incident. This deceptive pattern is increasingly spreading across the broader Malaysian property market, turning a blind eye to genuine market fundamentals.

What initially began as seemingly well-intentioned tools to enhance affordability such as rebates, cashbacks and zero-entry packages have gradually mutated into a pervasive mechanism that profoundly distorts the market. The playbook for this distortion is alarmingly simple yet highly effective:

https://www.starproperty.my/news/malaysia-s...-up-call/132580

Jul 28 2025, 09:26 AM

Jul 28 2025, 09:26 AM

Quote

Quote

0.0240sec

0.0240sec

0.47

0.47

6 queries

6 queries

GZIP Disabled

GZIP Disabled