Continue from;

https://forum.lowyat.net/topic/3680981/+2560

KV property is on down trend for the last seven consecutive quarters.

Multiple Signs of Malaysia Property Bubble V20

Multiple Signs of Malaysia Property Bubble V20

|

|

Dec 23 2016, 04:32 PM, updated 3w ago Dec 23 2016, 04:32 PM, updated 3w ago

Return to original view | Post

#1

|

All Stars

21,458 posts Joined: Jul 2012 |

Continue from;

https://forum.lowyat.net/topic/3680981/+2560 KV property is on down trend for the last seven consecutive quarters. |

|

|

|

|

|

Dec 23 2016, 04:38 PM Dec 23 2016, 04:38 PM

Return to original view | Post

#2

|

All Stars

21,458 posts Joined: Jul 2012 |

Recently, it seems;

- On some vped units; bank valuation is at about 90% of developer SNP price. - At some banks, NPL on residential property has jumped by double digits %. - Some banks are not providing end finance to certain developers projects. If market sentiment doesn't improve, expect the above to persists. This post has been edited by icemanfx: Dec 23 2016, 04:41 PM |

|

|

Dec 23 2016, 11:57 PM Dec 23 2016, 11:57 PM

Return to original view | IPv6 | Post

#3

|

All Stars

21,458 posts Joined: Jul 2012 |

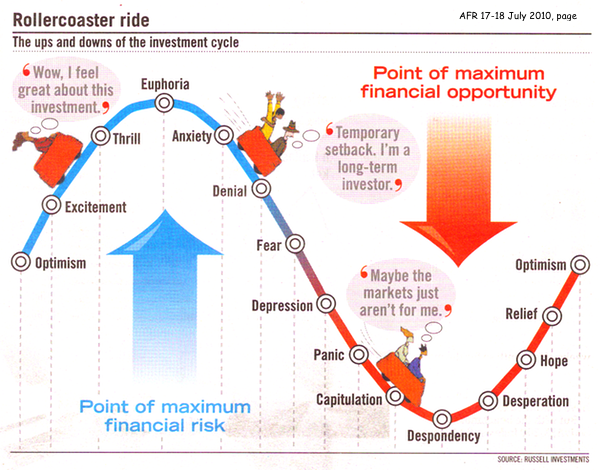

KV property is at early stage of down trend, many are in denial. This post has been edited by icemanfx: Dec 24 2016, 12:04 AM |

|

|

Dec 24 2016, 10:55 AM Dec 24 2016, 10:55 AM

Return to original view | IPv6 | Post

#4

|

All Stars

21,458 posts Joined: Jul 2012 |

|

|

|

Dec 25 2016, 06:57 PM Dec 25 2016, 06:57 PM

Return to original view | Post

#5

|

All Stars

21,458 posts Joined: Jul 2012 |

QUOTE(goks @ Dec 25 2016, 05:19 PM) If u r a yield investor, see which one makes investment sense, new is nice but u may get 3% yield, old maybe u can get 7-8% then why worry? If one knows where to look, could find dead chicken even during property bullrun. Bravo!I have not bought a new property in the last 7 years, but I have purchased 4 properties, all on auction and 30-40% under prevailing market rate. I like new properties but I am not emotional, I only buy when I can get minimum 7% yield. So put ur emotions aside and make a business decision. Many think new properties will have tremendous capital gain, not always true except 1st buyer but tha too no one does a nett investment calculation after all the interest u have paid during construction if the capital gain is great or not. QUOTE(goks @ Dec 25 2016, 10:59 PM) It's always a calculated risk. My margin of loan is only 70% so 10% down isn't an issue. If I can be blunt, if u can't afford 10% of purchase price you should not be buying a property. This is the bull shit developers now created by illegal discounts which by law is illegal but no enforcement. I saved like hell 16 years back to buy my first property, 2 years saving, no car, then BY luck I got a decent relocation bonus from company, then I dumped 10% into a house. Today young Turks want everything fast and easy. This post has been edited by icemanfx: Dec 25 2016, 11:14 PMMaintenance is almost always paid by bank for all outstanding. I have not seen cases where buyer pays. Repairs - again no different then buying a sub sale. Any property u buy u will spend money to dget it up to ur taste, even new one. Vacant possession - can be an issue, keep 5k as contingency if u need to get court order. A good auction agent is key, don't ever trust normal real estate agents who only do auction part time as they only want to rip u off some commission , i work only with full time auction agents like auction list or Lelong tips. They help me sort out allot of issues and th y do this day in and out. Finally auction u can gain allot but it's also not something for people who are cash strapped. Example I may end up buying touts and syndicates out or give my agent some money to sort matters out, on average each auction cost me 5-8k of the addition cost but that gives me peace of mind. Property is a life long, illiquid, hard commitments. Many young Malaysians in general dive into it without and exit plan or holding plan. |

|

|

Dec 26 2016, 02:53 PM Dec 26 2016, 02:53 PM

Return to original view | Post

#6

|

All Stars

21,458 posts Joined: Jul 2012 |

|

|

|

|

|

|

Dec 31 2016, 12:31 PM Dec 31 2016, 12:31 PM

Return to original view | Post

#7

|

All Stars

21,458 posts Joined: Jul 2012 |

Invest in u.s stocks a few years ago could be a better option than kV property even without considering depreciating rm. |

|

|

Jan 3 2017, 06:13 PM Jan 3 2017, 06:13 PM

Return to original view | Post

#8

|

All Stars

21,458 posts Joined: Jul 2012 |

QUOTE(TOMEI-R @ Jan 3 2017, 04:00 PM) How are the 'crooks' going to catch themselves? You already know who are the biggest 'crooks' in siphoning big sums of money out of the country. Expect banks to tighten lending with rising npl. Those hoping for quick flip is in for the long haul.buying domestic assets could never hedge against forex loss. Like mentioned, its just another better way of parking one's money other than saving it in the bank. You are right on the High NPL rates. This I confirmed with my bankers. Not only NPL high on residential loans, car loans, personal loans and credit cards are also recording high NPLs. This post has been edited by icemanfx: Jan 3 2017, 06:15 PM |

|

|

Jan 5 2017, 03:31 AM Jan 5 2017, 03:31 AM

Return to original view | Post

#9

|

All Stars

21,458 posts Joined: Jul 2012 |

QUOTE(cocbum4 @ Jan 3 2017, 06:48 PM) Sure us market is doing good Instead of individual stock, one could choose etf and brk.b.Ayam more worry if us not doing good Ayam may get lesser return but at much lower risk (currency risk?), less mistakes to be made (not all us stock make money) and less leveraged risk, long term wise property is a BBB UUU and easily outperform U.S. market. Nothing can stop it. Keep waiting for the bubble. On forex, rm already depreciated by over 30% in one year and likely to depreciates further. Most bought property on leverage. Profit as well as losses is magnified by leverage. Unless market sentiment changed, kV property is on downtrend. With oversupply and bank tightening residential loan, kV property is unlikely to uuu anytime soon. This post has been edited by icemanfx: Jan 5 2017, 03:37 AM |

|

|

Jan 5 2017, 11:29 PM Jan 5 2017, 11:29 PM

Return to original view | IPv6 | Post

#10

|

All Stars

21,458 posts Joined: Jul 2012 |

QUOTE(cocbum4 @ Jan 5 2017, 11:16 PM) House do not exposed to any of the risk. Every investment carry certain risks.And Ayam is getting guaranteed 10-15% income every year? Why do Ayam need to worry about the risk? If kv property could guaranteed 10-15% income every year, funds manager like Blackrock and every obasans would have invested, developers need not spend millions of RM on advertisement. |

|

|

Jan 6 2017, 12:06 AM Jan 6 2017, 12:06 AM

Return to original view | IPv6 | Post

#11

|

All Stars

21,458 posts Joined: Jul 2012 |

QUOTE(cocbum4 @ Jan 5 2017, 11:42 PM) Jew won't belip it Leverage magnified profit as well as losses.It is why Ayam become millionaire just from the income alone. Banker always call me for new house loan, ayam can keep leveraging Ayam income. It is why Ayam find no reason Ayam need to care about the risk Jew mentioned To become a millionaire from 10 to 15% income, one need to start with multi-million. |

|

|

Jan 6 2017, 12:14 AM Jan 6 2017, 12:14 AM

Return to original view | IPv6 | Post

#12

|

All Stars

21,458 posts Joined: Jul 2012 |

|

|

|

Jan 6 2017, 11:17 AM Jan 6 2017, 11:17 AM

Return to original view | Post

#13

|

All Stars

21,458 posts Joined: Jul 2012 |

QUOTE(Cabinda @ Jan 6 2017, 12:19 AM) all this while trying, and still trying.. so asking for your expertise statistics and numbers expert for advise.. hope can hit straight in between the balls.. http://publications.credit-suisse.com/task...20A1A254A3E24A5For reasons, there are less than 3% of adults in the kangkong have over us$100k net worth. To become a rm millionaire will takes more than just working smart, investing like a herd won't be one. QUOTE(cocbum4 @ Jan 6 2017, 12:21 AM) Is it very difficult to do it in u.s stock? If you have the financial strength as you claimed; you could have made more than a 150m2 condo in klcc vicinity from US stocks since US presidential election in November.Ayam didn't know it is very difficult. Bank keep giving Ayam new loan Ayam think it is very easy to do so in stock also. This post has been edited by icemanfx: Jan 6 2017, 12:04 PM |

|

|

|

|

|

Jan 6 2017, 03:37 PM Jan 6 2017, 03:37 PM

Return to original view | Post

#14

|

All Stars

21,458 posts Joined: Jul 2012 |

QUOTE(Cabinda @ Jan 6 2017, 02:57 PM) hello, i dont want listen you analyze statistics, chart, or numbers, because i dont understand.. Beside sport toto, you could buy a suit with rm2k to get a job at a investment bank or funds management in sg, hk or shanghai. If you know your stuffs and ways round, you could become the top 3% in 5 to 10 years.If i know how to work smart i dont have to ask for your advise already.. By your expert on statistics, chart and numbers, i believe you can turn my RM2k become RM20mil easily... So please help me to become millionaire.. or even one of the 3% who have US$100k networth This post has been edited by icemanfx: Jan 6 2017, 03:37 PM |

|

|

Jan 6 2017, 05:18 PM Jan 6 2017, 05:18 PM

Return to original view | Post

#15

|

All Stars

21,458 posts Joined: Jul 2012 |

QUOTE(Cabinda @ Jan 6 2017, 05:01 PM) Nowadays, doesnt require certificate ka? buy suit can get job already? I graduate in "Specialist in Property Management", SPM, can work in investment bank and funds management ka? If i apply for cleaner job maybe can lar.. work as cleaner in sg, hk or shanghai, can become top 3% in 5 to 10 years? If you are in property industry, you may has a chance to marry into developers family else accept to be a member of 97%.No other kang tau you can help me generate from RM2k to become RM20mil or even at least 3% of the US$100k networth? |

|

|

Jan 6 2017, 08:16 PM Jan 6 2017, 08:16 PM

Return to original view | Post

#16

|

All Stars

21,458 posts Joined: Jul 2012 |

QUOTE(Cabinda @ Jan 6 2017, 05:38 PM) With a SPM cert on hand, and working as cleaner i can have chancy mary into developer family? very ambitious ah.. Students are obviously in 97% members.i'm now member of 97% so thats y i seek for your advise.. but look like you're one of the 97% also.. because you pusing pusing.. no solution for me at all.. |

|

|

Jan 7 2017, 11:12 AM Jan 7 2017, 11:12 AM

Return to original view | IPv6 | Post

#17

|

All Stars

21,458 posts Joined: Jul 2012 |

QUOTE(kevyeoh @ Jan 7 2017, 11:01 AM) I believe in buying and holding long term for good location properties and then get rental income while holding long term.... is this consider uuu? Prime locations held by reits e.g. klcc, pavilion, mv, sunway pyramid, etc are unlikely to sell, won't see price drop. To use this as a benchmark is detached from the general market.For properties in good location... i don't see the price DVD... i have been stressing on this keyword = location, but usually people like to generalize and say property downtrend now... AFAIK... prime or good location area the price hardly go down... probably stay flat in bad times only.... but over long term... it is up trend.... On residential property, believe there isn't a consensus that which area or development is super prime and will immune to any price downfall. And most people purchase are not super prime. Historically, property price rise in the long term but at about inflation rate. Due to oversupply in kv, unless there is a change in market sentiment, price is likely continue to downtrend and falling behind inflation rate. This post has been edited by icemanfx: Jan 7 2017, 08:01 PM |

|

|

Jan 15 2017, 05:11 PM Jan 15 2017, 05:11 PM

Return to original view | IPv6 | Post

#18

|

All Stars

21,458 posts Joined: Jul 2012 |

QUOTE(kenlaw72 @ Jan 13 2017, 05:52 PM) hear form developer, they already get the tenants. CBJ is so vibrant that commie rental could be free for one year.they give free rental one years to potential shop tenants which open at 3rd avenue. QUOTE(Donald Trump @ Jan 13 2017, 09:23 PM) it was 100% empty after more than a year Icon city is said to be mv in the making.AT LAST 1 shop doing reno....🎉🎂 [=Donald Trump,Jan 13 2017, 10:50 PM] Soli correction.....my pucat friend say this is not shop renovating....is actually TLG MS use to store their crap😌......my bad so is still maintain 100% NOT OCCUPY for more than a year and counting QUOTE(Quang1819 @ Jan 13 2017, 11:33 PM) worked there for a year couple months back. more shops are closing down in the mall and the shoplots outside the mall as well. heard that my old working would be shifting as well lol Another uuu[=Quang1819,Jan 13 2017, 11:35 PM] but most of them are known brands like Oldtown, Subway and a few more. Those that aren't well known all closed down This post has been edited by icemanfx: Jan 15 2017, 06:11 PM |

|

|

Jan 15 2017, 06:09 PM Jan 15 2017, 06:09 PM

Return to original view | Post

#19

|

All Stars

21,458 posts Joined: Jul 2012 |

根据Lelongtips.com.my的统计数据显示,从2004年开始至今,全国有逾36万间房屋被拍卖,每月有至少2500间,即每日平均约有120间房屋被拍卖,其中又以非有地產业佔多数,如服务公寓、公寓或组屋单位。

「如今隆市也有许多新房屋发展计划,推出免头期或低头期优惠,吸引年轻人购买,但问题在于年轻人无法承担房贷,导致从去年开始隆雪拍卖屋中有约70%的屋主是80后的青年。」 http://www.orientaldaily.com.my/central/zm1206 Believe this is only the beginning and will increase with npl. This post has been edited by icemanfx: Jan 15 2017, 06:10 PM |

|

|

Jan 16 2017, 12:16 AM Jan 16 2017, 12:16 AM

Return to original view | IPv6 | Post

#20

|

All Stars

21,458 posts Joined: Jul 2012 |

QUOTE(ManutdGiggs @ Jan 15 2017, 11:49 PM) Since when tms is a reliable dev??? It seems many of uuu/bbb herd has boarded the thief boat to holland.It's quite a norm for buyers to b conned by tns. Nothin new I guess. It ll b headline if it's not a con job. Now all eyes r on sg buluh. This post has been edited by icemanfx: Jan 16 2017, 05:41 PM |

| Change to: |  0.0241sec 0.0241sec

1.26 1.26

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 24th December 2025 - 02:01 PM |